Navigating Charitable Giving

Thoughtful considerations on our podcast, “Navigating Life Transitions” When it comes to charitable giving, there are many ways – both big and small – to make a difference. So, where and how does one begin? On the latest episode of JNBA’s podcast “Navigating Life Transitions,” JNBA Advisors, Elise Huston and Nick Scheibel, share gifting strategies […]

Year-End Charitable Giving Considerations

As we approach the end of 2023 and the traditional “Giving Season,” many individuals and families are thinking about how to support the organizations and causes closest to their hearts. If charitable giving aligns with your values and remains a top priority for you or your family, we encourage you to explore various tools and […]

Navigating Your Empty Nest

Have you recently found yourself with an “empty nest?” Every fall, many parents and guardians are met with this new phase of life as children launch into young adulthood by entering college, the workforce, or pursuing other opportunities. In this month’s episode of the “Navigating Life Transitions” podcast, host Kim Insley and JNBA team members Elise Huston, Stephanie […]

Helping support your child’s financial foundation

As your children set off on their own, you likely will feel proud to realize you have saved enough for college tuition in a savings plan (knowing their desired college and location may have changed a few times this past year), or your college-aged child may have been awarded scholarships or other financial aid that […]

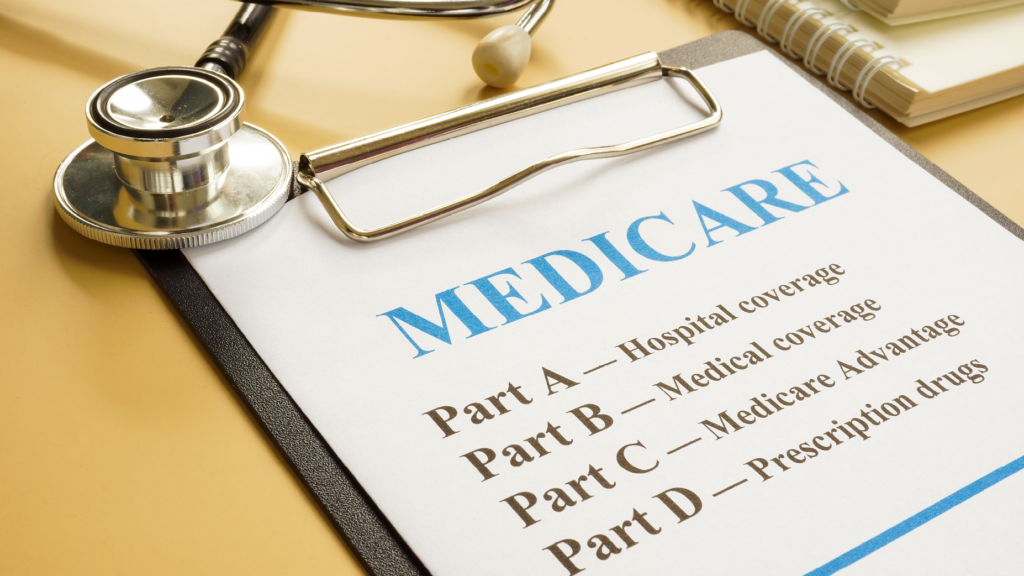

2024 Medicare Open Enrollment: December 7 Deadline

As we approach the end of the year, the annual Medicare open enrollment period begins, and it is time to review your current Medicare coverage and determine if any adjustments need to be made. Most people will only make changes due to an increase in premiums or co-pay amounts, but there may be other reasons […]

Your Investment Accounts are now custodied at Charles Schwab & Co., Inc.

Earlier this month your investment accounts managed by JNBA were moved to Schwab. JNBA’s role as your financial advisor has not changed with Schwab being the new custodian. Below are important reminders summarizing what to expect with your accounts now custodied at Schwab. ONLINE ACCOUNT ACCESS CHECKS WHAT TO EXPECT NEXT Friday, September 1: Please do not […]

Labor Day Weekend: Your TD Ameritrade accounts are moving to Charles Schwab & Co., Inc.!

Over Labor Day weekend, your investment accounts managed by JNBA that are currently held at TD Ameritrade will move to Schwab as a result of the two custodians merging. JNBA’s role as your financial advisor is not changing. With the merger, your accounts will be held at a new custodian – Schwab. With the transition only a little […]

How Do You Leave a Lasting Legacy?

Thoughtful considerations on our podcast, “Navigating Life Transitions” How do you want to be remembered? It can be hard to think about, but it’s important, as the answer is unique to each individual. This is the topic of discussion in the latest episode of “Navigating Life Transitions,” a new podcast by JNBA Financial Advisors. Each […]

College Strategies Webinar

The global COVID-19 pandemic made lasting changes to many industries, including post-secondary education. Applications for colleges and universities are up 32% since 2020, making acceptance into both private and public schools highly competitive. Additionally, over the last 30 years, tuition costs have doubled at some public universities and quadrupled at many private institutions. Parents are […]

The 101 on 529s

What is a 529 Plan? A 529 plan allows donors to invest for a beneficiary’s education in a tax-advantaged way. When saving into a 529 plan, contributions may be eligible as tax deductions. Any growth or accumulations within the 529 plan is tax-deferred. Additionally, funds can be withdrawn from a 529 tax-free if utilized for […]