Over the past few months, it has been hard to turn on a TV or have a conversation without the word “recession” being brought up. In the midst of these conversations, you’d often hear phrases such as “soft landing,” “mild recession,” or “hard landing” being thrown around. While some working professionals have weathered an economic slowdown before, those newer to the workforce might be preparing for and navigating this for the first time. Unfortunately, the noise packed into the daily news and conversations can often lead to feelings of uncertainty and concern. As such, our goal is to offer clear understanding around the possibility of various recession outcomes and how best to prepare.

What is a Mild Recession vs. Severe Recession?

A recession is an economic downturn that occurs over several months or even years. The traditional definition is two negative quarters of Gross Domestic Product (GDP), signaling slower or negative economic growth.

A mild recession typically means a downturn in the economy primarily impacting employment and production. For example, falling consumer demand can prompt companies to lay off workers, which reduces household spending power, which can further weaken consumer demand.

A severe recession (or depression) is typically accompanied by a widespread increase in unemployment along with a pause in economic activity. Often in this instance, many economic indicators look downright awful and may lead you to believe the issues could persist for an extended period of time.

Recessions are usually clearly identified only after they are over. The JNBA Investment Committee feels that the fast increase in interest rates over the past year has led to tightening financial conditions that will make the next year more difficult for both businesses and consumers. While an inverted yield curve and a deterioration in leading economic indicators indicate a recession is likely, we are hopeful that falling inflation and a still healthy labor market increase the odds that a mild recession is the base case. Given that outcome, we suggest investors prepare for that eventuality.

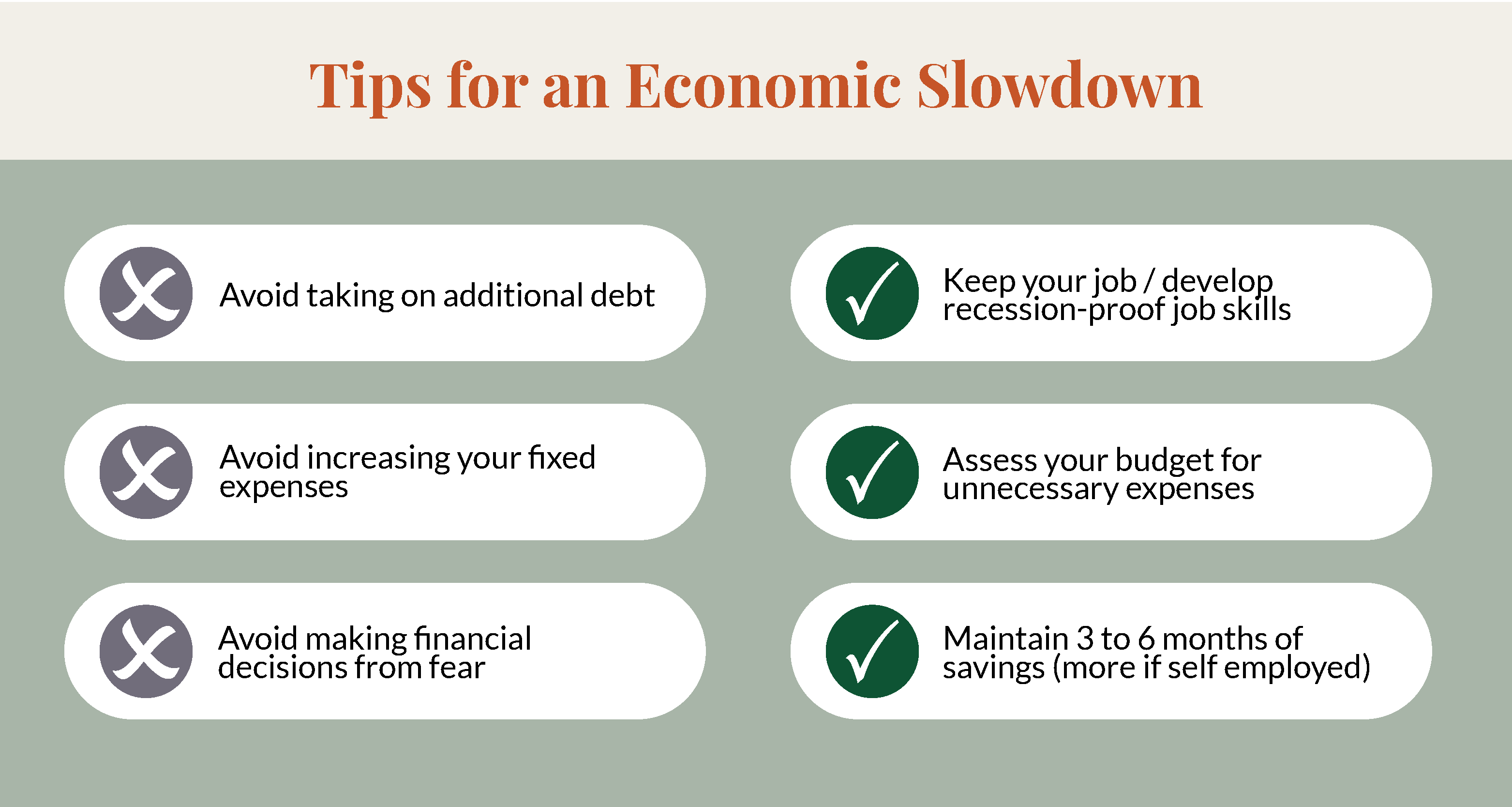

How Best to Prepare for a Recession:

- Emergency Reserve – While it is always a best practice to have an emergency reserve (3-6 months of fixed expenses), it is even more important when inflation is high and concerns around layoffs or salary cuts seems greater than before.

- Debt Repayment – If you are concerned about a change to your income or possible loss of job, understanding your outstanding debt and paying down those debts with the highest interest rates can help alleviate any financial strain should that income change come to fruition.

- Budget – Review your monthly expenses to determine what is fixed vs. variable. You might find yourself putting off a big car purchase to preserve cash in the coming months. Having a clear understanding of your expenses and what you can adjust should help alleviate potential stress.

- Investments – Now is a great time to reassess your allocation to ensure it remains in alignment with your long-term goals and potential short-term needs. Oftentimes the market will begin to recover and experience positive momentum before the recession is declared “over,” so it is important to ensure you are well positioned to participate in the recovery.

Most importantly, should you have questions about how a recession might impact you, your family, or your financial life plan, please contact your JNBA Advisory Team.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at jnba.com/disclosure