Our Approach

Customized strategies for you and your goals.

You and your financial opportunities are unique. The strategies used to navigate life transitions and help you arrive at your desired future should be as well.

Advice Driven by Advocacy®

A team dedicated to integrating financial life planning and investment management.

By bringing together all areas of your financial life, our team can help you create something bigger than the sum of its parts. At JNBA, we take a proactive approach to integrating financial life planning and investment management. We work together as a team and as your advocate to leverage each other’s diverse experience for the benefit of our clients. This team approach allows us to deliver custom, dynamic financial life planning and investment strategies that are driven by your values, goals, and vision for the future. Your dedicated JNBA Advisory Team also works with outside professionals, such as accountants to prepare tax returns, attorneys to draft estate planning documents, and risk management professionals to review or source insurance policies, to help ensure all aspects of your financial life are well cared for and working together to achieve your goals.

Our Financial Planning Committee, driven by a team of experienced Certified Financial Planner™ professionals, works closely with all advisors to understand changes to tax law, insurance offerings, etc. to evaluate how any changes may impact clients’ financial life plans. Your dedicated JNBA Advisory Team collaborates with our experienced Investment Committee team members to develop a portfolio to meet your needs and address your specific risk and return profile. We then customize your portfolio to help ensure it takes into consideration any potential tax consequences, charitable gifting strategies, legacy goals, comfort with market risk, investment time horizon, etc. This can also include socially responsible investing – building a portfolio in a manner that aligns with your values through our ESG (environmental, social, and corporate governance) platform offering.

Investment Process

A commitment to a higher standard.

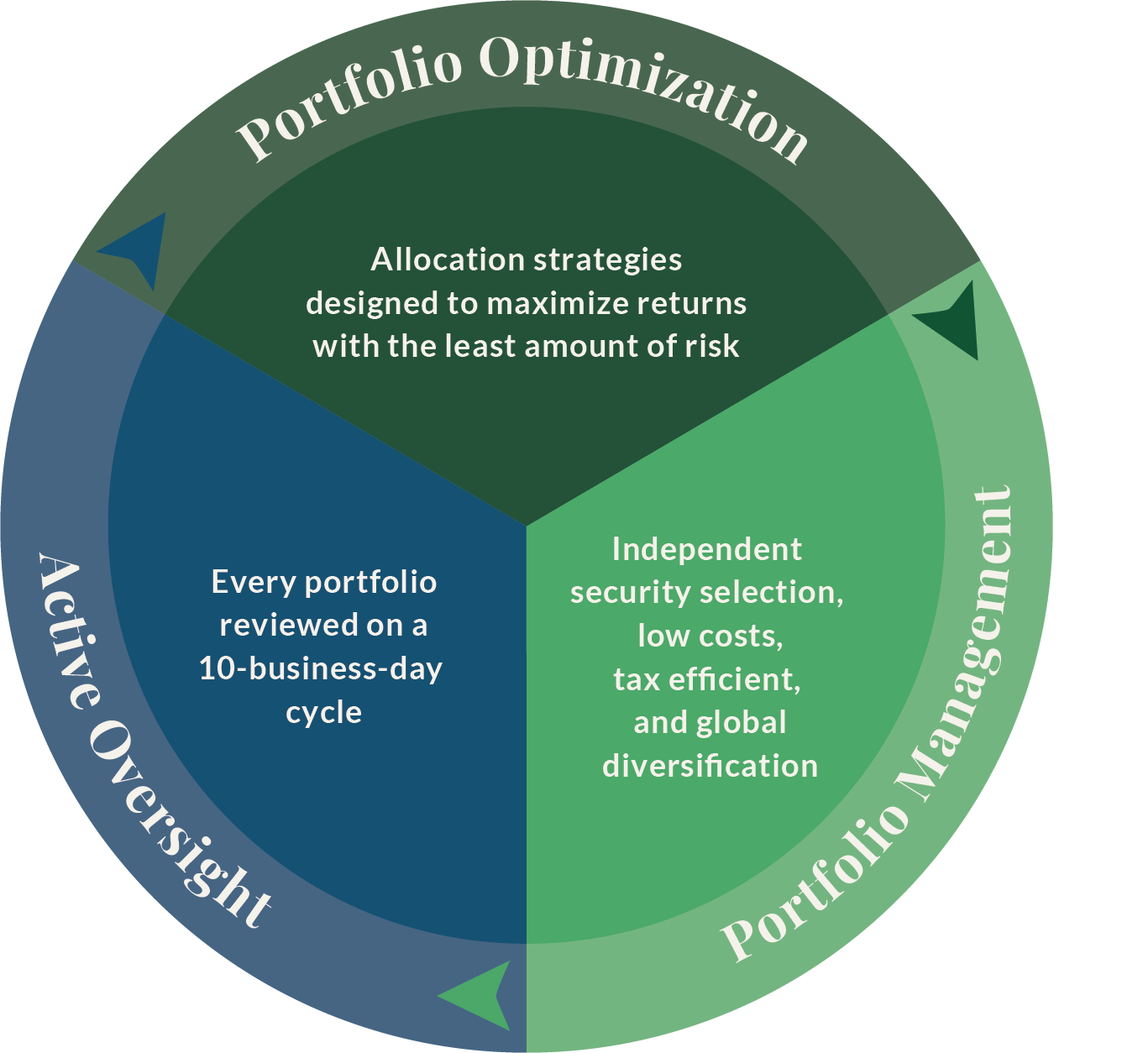

Our Investment Committee is fiercely independent through every stage of investment strategy development, implementation, and ongoing management. We don’t sell products, and – as a fiduciary – are required to always act in the best interests of our clients with every decision we make and every action we take. Driven by your financial life plan, we design and implement your portfolio to meet your needs. Our investment philosophy and processes center around three key pillars – keeping portfolios low cost, focusing on global diversification, and tax-efficient investing. Our disciplined processes include consistent research into industry trends, economic outlooks, and the latest best practices in investment management. Our team reviews all client portfolios, at minimum, every 10 business days to help ensure no opportunities are missed and that investment strategies remain in line with market movement.

Now more than ever, clients are looking to partner with a financial advocate who can help them reach their unique objectives through customization. The JNBA Investment Committee has developed a robust platform of investment solutions that allow for a tailored approach, offering clients flexibility, transparency, tax efficiencies, and other benefits on a path to achieving their financial goals. Among the many spheres of customization, we support dividend-paying portfolios, ESG integration, detailed performance reporting, executive stock compensation advice, tax optimization, and charitable gifting strategies such as Donor Advised Funds.

Our Approach to Fees

At JNBA, we operate on a non-commission, fee-only basis, not because it’s the trendy thing to do, but because it’s the right thing to do. We don’t sell proprietary investment products. We don’t collect referral fees from other professionals. And this has been our business practice for more than 45 years.

We predominately charge a fee that is based on a percentage of the assets we actively manage on your behalf to help ensure we have a financial stake in your success. We require a minimum asset level of $1,000,000 or minimum annualized fee of $10,000. This fee covers discretionary investment management and financial life planning services to help you achieve your goals. And, as your assets grow over time, the percentage we charge decreases.

Bottom line? We provide transparent, fiduciary advice that is always in your best interest. Plain and simple.