Q3 Market Update: The Fed and the Economy’s Impact on Fixed Income

The last three years across markets have brought about dramatic changes as the effects of the pandemic resulted in historic shifts in fiscal and monetary policy, inflation, employment trends, and overall consumer spending and savings habits. One of the largest impacts from these disruptions was the strong increase in inflation we saw at the beginning […]

Q3 Market Podcast: Seasonal Trends

This week, the Federal Reserve left interest rates unchanged, which has many hopeful for an economic “soft landing.” Is this possible amongst the recent weaknesses we’ve seen in the last few months? JNBA President Kim Brown sits down with Mark Rosenkranz and John Foster, both members of JNBA’s Investment Committee, to discuss this and more in our […]

Seasonal Trends

To listen to JNBA’s recent Market Update podcast featuring discussion and commentary from the Investment Committee, click here. For more insights and complimentary visual charts, read below: Despite a relatively strong year for the S&P 500, with YTD returns hovering north of 15%, we have seen challenges across more diversified portfolios in both equities and […]

Market Update: Dog Days of Summer

After a challenging 2022, YTD performance up 20% in the S&P 500 through July has been a welcomed reprieve, despite the pullback and volatility we have been experiencing in August. Within this strong performance backdrop, there have been constant concerns around Fed interest rate hikes, banking sector turmoil, debt ceiling debates, and a potential recession […]

Investment Committee Video Discussion: Where is the recession everyone has been talking about?

Over the last year, economic headlines have been bleak. From the national debt ceiling debate to fears of a potential banking crisis, we’ve watched interest rates go up right alongside talks of an economic downturn. But as we turn the corner into the second half of 2023, Americans have been left to wonder, “Where is […]

Market Update: Lay of the Land

With the U.S. Congress passing legislation to lift the government’s debt ceiling this week, it appears a large overhang to recent months has been removed, and the markets have already been focusing on other things. The continued area of attention is the familiar debate on future rate hikes. Pundits have been talking about a “pause” […]

Q2 Market Podcast: Feeling Comfortably Uncomfortable

From turmoil with regional banks to bonds and treasury bills providing higher-yield competition for stocks, one way to describe how many investors are feeling right now is “comfortably uncomfortable.” Negative investor sentiment as we started 2023 set the bar relatively low, and both stocks and bonds are performing better than expected. But market volatility continues. […]

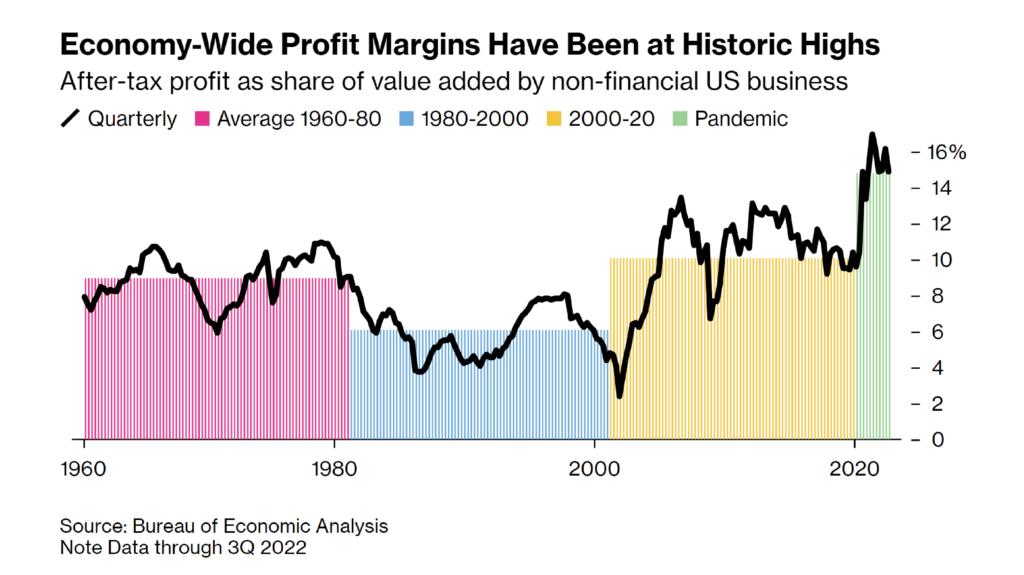

Market Update: The Big Picture

Over the last several years, the average investor has faced a historic wave of new factors to consider. The onset of the pandemic created constant ripples to monitor, from new case numbers, to mortality rates, quarantine lengths, government stimulus, vaccine developments and rates, consumer activity, wage growth, unemployment, inflation, Fed activity… the list goes on. […]

Market Update: Bank Failures in a Different Environment from 2008

Markets have been incredibly volatile recently with the Federal Reserve stepping in to protect both insured and uninsured depositors of Silicon Valley Bank and Signature Bank last weekend. With a duty to safeguard the stability of the banking system, the Fed took action to ensure depositors are made whole under the Federal Deposit Insurance Corporation […]

Q1 2023 Economic and Market Update

With stocks and bonds sputtering on the heels of a January that saw many financial assets claw back a large chunk of their 2022 losses, investors are starting to wonder about the speed with which inflation will subside and how Fed policy might alter the trajectory of economic growth. In recent weeks, investors have recalibrated […]