Q3 2022 Economic and Market Update

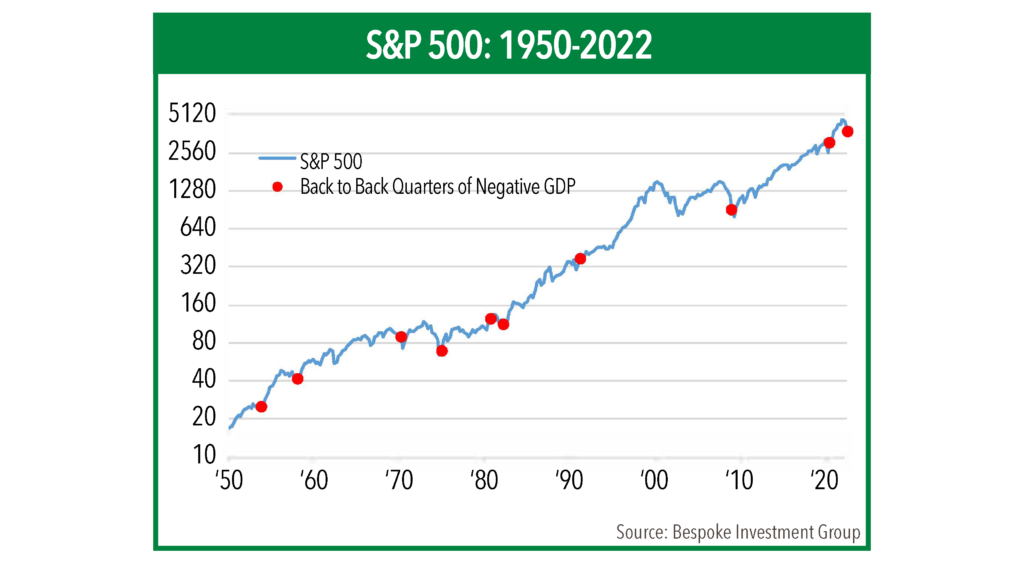

After appearing to form a bottom in mid-June, the market surged higher as investors began to anticipate a slower pace of rate hikes from the Fed as it became more likely the economy would post a second straight quarter of negative economic growth in real terms (adjusted for inflation). While the JNBA Investment Committee believes […]

Podcast: What could the economy’s mixed messages be trying to tell us?

The economy is trying to tell us something, but its messages are mixed. GDP fell in the second quarter, the second straight decline of negative real growth, which many investors have interpreted as a strong recession signal. While the National Bureau of Economic Research considers many different economic variables and hasn’t officially labeled it a […]

Midyear Market Update: How has the first half of 2022 set the stage for the rest of the year?

By nearly any measure, the first half of the year has been extremely challenging for investors, with negative returns across all asset classes. But even as the bumpy ride continues, silver linings are emerging. In our latest video, JNBA Chairman and CEO Richard S. Brown, Director of Investment Management David Webb, and Senior Advisors […]

Podcast: Some Potential Upsides to the Fed’s Recent Rate Hike

(A written transcript of the podcast is available by here.) The Fed’s interest rate hike last week was the largest in nearly 30 years and resulted in a mixed bag for investors. Fears of inflation have dampened consumer sentiment, which continues to contribute to market volatility. Despite the markets entering bear market territory, the climate […]

Market Update: Inflation, Interest Rate Hikes, and Economic Worries

After a brief reprieve from market volatility at the end of May, stocks skidded to finish lower last week after CPI figures released on Friday showed the highest level of inflation since 1981. Financial markets are expecting a 0.5% or possibly larger increase in interest rates at this week’s Fed meeting, as well as further […]

The Value of an Advisor: Portfolio Construction

At JNBA, we are big believers in the value an advisor can provide to clients. A trusted relationship can produce a rewarding experience and long-term mutual benefits for investors and their advisors and advocates. As we continue our blog series on “The Value of an Advisor,” which highlights what research states are some of the […]