In its eighth and final meeting of 2022 this week, the Federal Reserve increased rates by 50 basis points (bps). This deviates from four consecutive hikes of 75 bps thereby showing signs that moderating inflation has boosted confidence that higher interest rates are finally helping to slow global demand. In anticipation of more favorable news, financial markets have rallied over the last couple of months with gains for both global stocks and bonds respectively from their October lows.

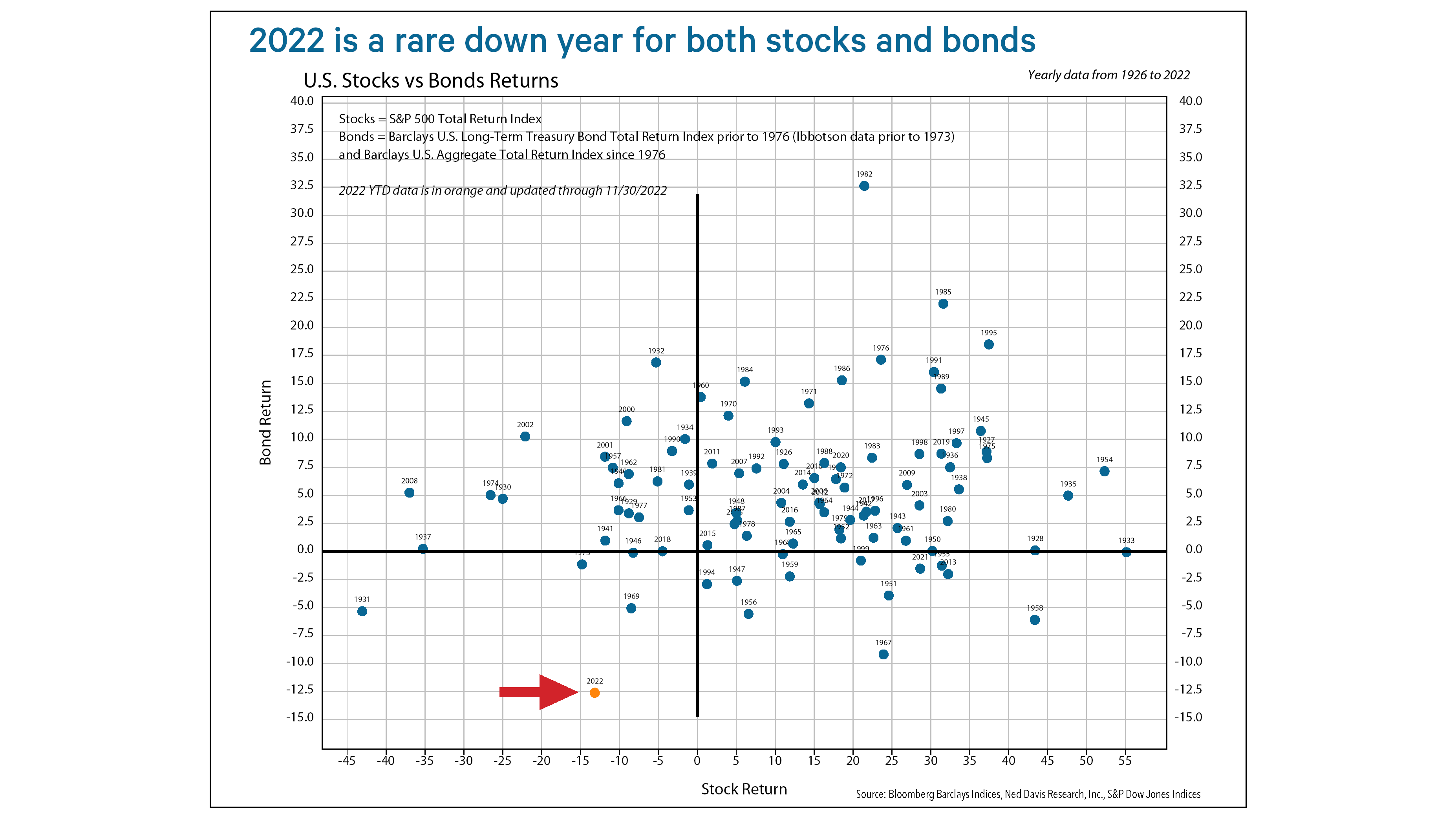

As we look to turn the corner on a tough year (see chart), and with much talk of a possible recession in 2023 dominating the news cycle, investors can’t be faulted for asking themselves, ”What has really changed?” After all, the primary ingredients driving much of this year’s volatility – Russia’s invasion of Ukraine, stubbornly high inflation, and the Fed tightening monetary policy at the fastest pace in decades, all while facing an inverted yield curve – are still present worries.

Fortunately, there are reasons for optimism. Europe appears to have enough energy to power through the winter and China’s zero-COVID policies – which have been restraining the world’s #2 economy – are falling by the wayside. In financial markets, investor pessimism reached extreme levels earlier this year, and both stock and bond prices appear to have already largely incorporated much of the possible bad news.

Furthermore, consumer sentiment could get a boost if inflation continues to fall, which seems likely given the labor market is far less frenzied and consumers are slowly depleting their excess savings – both of which should reduce demand on the margin and cool inflation further. Case in point is Wednesday’s better-than-expected consumer price inflation (CPI) report. Excluding food and energy, the CPI rose just 0.2% in the month of November (2.4% annualized), its smallest increase in 15 months, after a 0.3% reading in October – down significantly from 0.6% in September and August. That said, the JNBA Investment Committee believes the Fed will want to see core goods prices fall further and rental rates soften before easing its aggressive posture.

Improving inflation data should allow for less restrictive monetary policy, which would lower the odds of a deep, painful recession (a “hard landing”) – something we would view as a positive development that creates conditions for some cautious optimism. Why not full-throttled optimism? As we enter 2023, we still see economic risk to the downside and believe that a mild recession is the most likely base case, with an accompanying earnings recession possible.

At this juncture, we do not expect the Fed to back off too early, ultimately allowing inflation to rebound and become more permanently entrenched. Hence, investors should continue to expect another couple of rate hikes in 2023, with the potential to push the Fed Funds rate north of 5%. However, given that markets originally expected just 50 bps of hikes this year and got 425 bps instead – most of the pain is likely behind us. Even if a recession comes to pass, we feel that the possibility of market lows being retested in the first half of 2023 should not discourage investors from becoming more constructive on stocks next year as the Fed will likely pivot to cut rates in 2024 and 2025, setting the stage for renewed economic growth. With most stock rallies in bear markets unusually powerful and swift, and often occurring several months in advance of the end of a recession, we believe now is the time for investors to steel themselves for participating in the next leg up in the market. The table will likely be set once we have additional earnings revisions to the downside. On the other hand, if a recession does not come to pass and a soft landing is achieved, it would not surprise us if the market lows have already been made.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at www.jnba.com/disclosure.