Pulse Check

After a tumultuous first half of the year, markets steadied in July with the S&P 500 hovering near all-time highs while foreign equities continue to maintain strong YTD gains. Volatility also eased, with the S&P notching 25 straight sessions without a >1% move through the end of July. Uncertainty around tariff policy has decreased for […]

Video Discussion: Staying Focused in 2025’s Dynamic Market

The first half of 2025 has included significant market volatility, especially around early April. Now, as Q2 comes to an end and markets have evened out some, the JNBA Financial Advisors Investment Committee analyzes the historic ups and downs in a video discussion recorded on July 14, 2025. The conversation between JNBA Chairman and CEO […]

2025: A Look at the First Six Months

At the halfway point in the year, looking at the returns across the broader stock and bond landscape tells a solid, albeit deceptive performance story. The S&P 500 is up ~6% YTD and at all-time highs, well in line with average yearly performance, while small- and mid-cap U.S. equities have slightly lagged. International equities have […]

Markets in Flux

What changes to make? With May in the rearview mirror, most equity markets are broadly positive five months into the year; however, these figures are a bit deceptive. A weak start to the year, then a sharp April downturn before a rally throughout the last 1.5 months, created a bit more of a rollercoaster ride […]

Investment Committee Video Podcast: May 2025

Market conditions in April 2025 were notably volatile, with almost daily swings in market values following changes in policy and tariffs. The whiplash left consumers, businesses, and investors concerned about the U.S. economy’s resilience and the long-term impact on portfolios. In our latest JNBA Investment Committee video podcast, recorded on May 19, 2025, senior members […]

April Showers

As the calendar shifts towards spring, April brought a serious “shower” into the markets, with the new administration’s Liberation Day announcement on U.S. tariff policies released on April 2, 2025. The following days and weeks were a steady drizzle of shifting policies combined with confusing and often contradictory White House statements within hours of each […]

Tariff Turmoil & the Economy

Headlines are busy with the announcement of President Trump’s new package of tariffs. The administration’s aim to use tariffs to help bring manufacturing back to the U.S. and addressing what the president views as trade imbalances between the U.S. and the rest of the world is clearly impacting financial markets here in the shorter term. […]

Market volatility and core investment principles

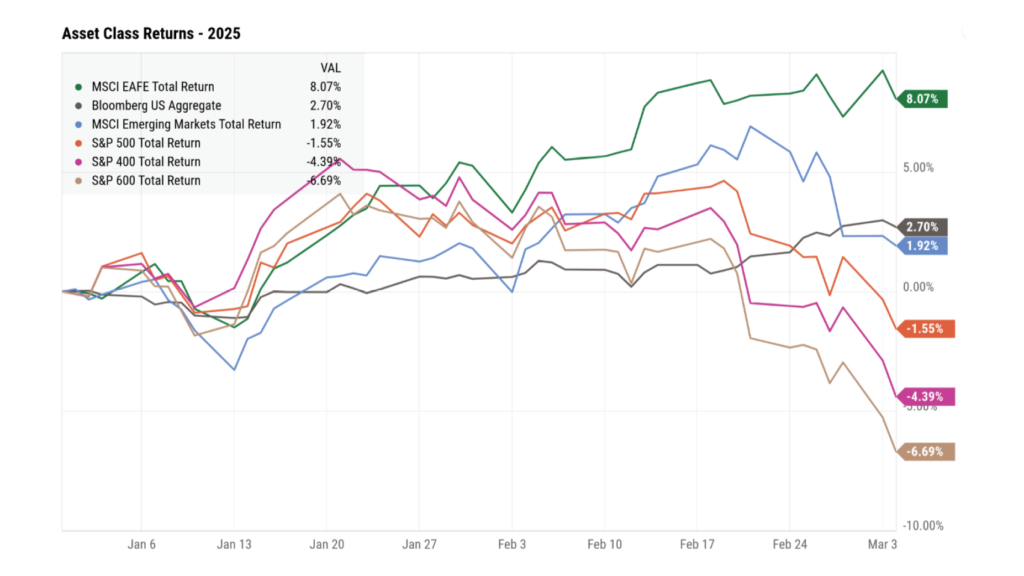

It’s been a bit of a chaotic start to the year and, as would be expected, JNBA has fielded a lot of questions about not only client portfolios, but the overall market environment in general. After a relatively strong first 6+ weeks of 2025, markets have pulled back from February highs, with the U.S. feeling […]

March 2025 Portfolio Update

2025 is off to a busy start with investors digesting updated earnings results, recent actions taken by the new administration, new economic data, and potentially new technological breakthroughs. With new tariff policies enacted by the new administration, uncertainty around the day-to-day headlines has been at renewed highs. After a strong start to the year and […]

February 2025 Portfolio Update

2025 is off to a busy start with investors digesting updated earnings results, recent actions taken by the new administration, new economic data, and potentially new technological breakthroughs. While each day has brought new headlines driving further optimism or increased concern, markets have so far digested each day into a strong start to the year […]