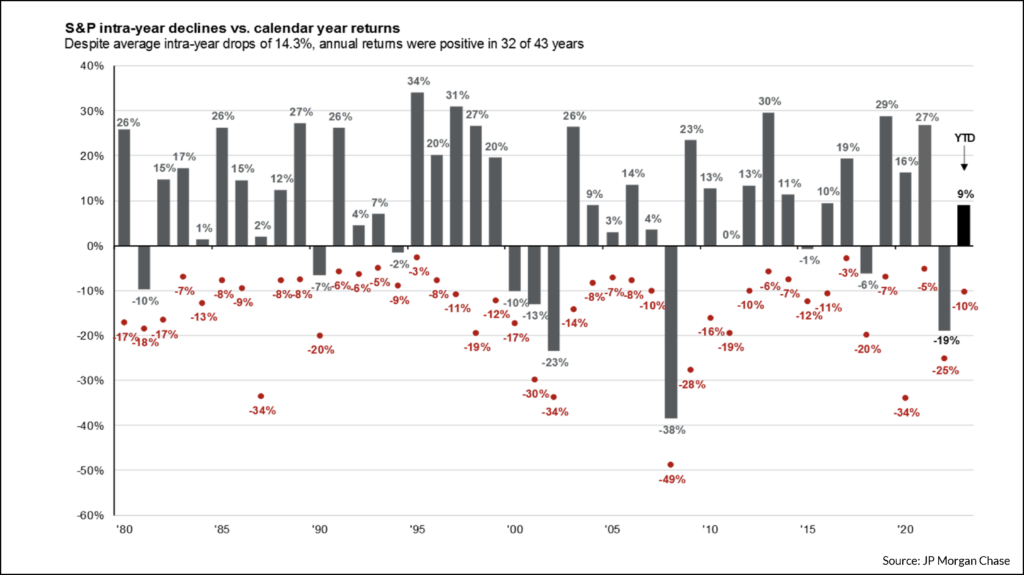

In our September article Seasonal Trends, we highlighted historical market weakness that equities typically experience in the August to October timeframe, before the average strongest periods from November to April. While never a reliable predictor of future outcomes, historic averages have certainly fit the mold this year for both the good and the bad. After peaking in July, the S&P 500 declined 9% from August to October. Sure enough, as the calendar flipped to November, markets have rallied and the S&P 500 is now up 7% for the month through November 15th. After this rollercoaster last few months, many investors can be left wondering if this is the ride they signed up for. For both the good and the bad, the answer is yes.

Since 1980, the S&P 500’s average intra-year drop is 14.3%.

- However, in 74% of those calendar years, the index finished positive.

- In each of the last 20 years, the S&P 500 has averaged over 11 days being down over 2%, while 16 of the last 20 years finished the year positive.

Although bouts of volatility to the downside naturally increase anxiety, especially after a challenging 2022, these fluctuations in any given year are more than just common – they are expected.

While reasons for these pullbacks can vary each year – anything from economic weakness, Fed or government activity or geopolitical events that increased valuations, speculative investment behavior, or varying earnings results – the more accurate reason may also seem like the simplest: pullbacks are normal. The lesson stays the same. The probability of success remains positive over longer periods, and staying invested is vital toward weathering these storms.

While this lesson is important, it doesn’t mean we need to sit idly back when opportunity emerges. In late September, our Investment Committee reviewed a tactical alert from one of the asset allocation research firms we utilize. Following our internal discussions, we broadly lowered our overall equity exposure and increased our fixed income allocations across client portfolios. We remain at these lower exposures for now, while our research still indicates some caution is warranted.

As we continue to move towards the end of the year, we are mindful that periods of opportunity often emerge following bouts of weakness. While the timing of broader asset allocation moves can never be perfect, we think a longer time horizon and an understanding of average market volatility provide the context necessary to remain vigilant whenever the next opportunities emerge.

As always, please reach out to your JNBA Advisory Team with any questions or concerns you may have.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at jnba.com/disclosure.