To listen to JNBA’s recent Market Update podcast featuring discussion and commentary from the Investment Committee, click here.

For more insights and complimentary visual charts, read below:

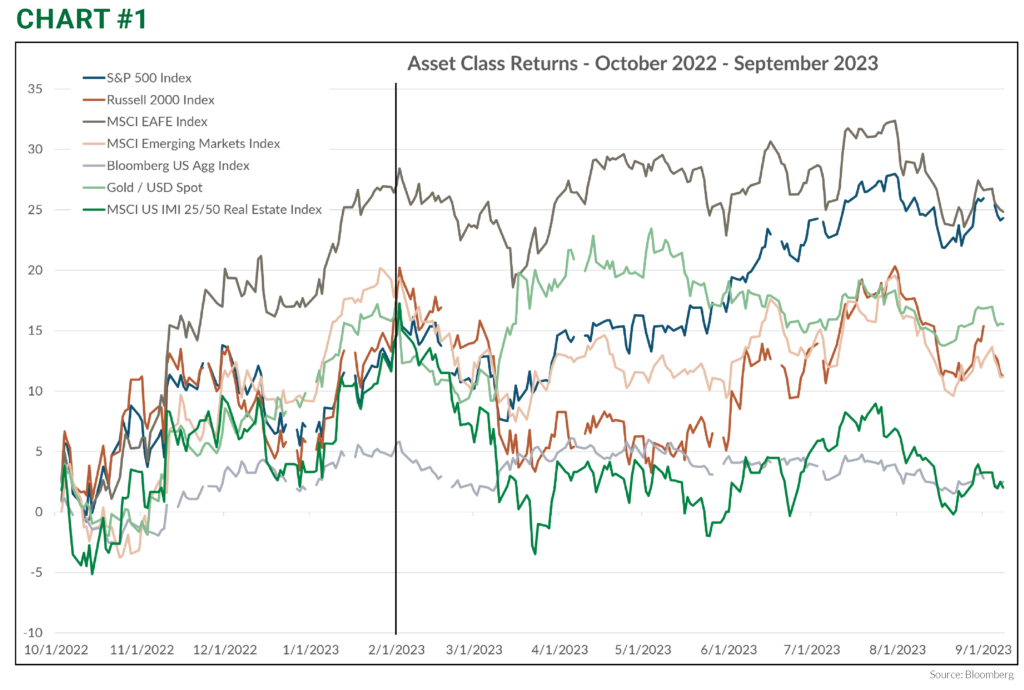

Despite a relatively strong year for the S&P 500, with YTD returns hovering north of 15%, we have seen challenges across more diversified portfolios in both equities and fixed income. While U.S. large cap, driven largely by a few select mega-cap companies, have led the overall performance for asset classes since October 2022 lows, investors have faced a rather muted environment in 2023. Since February of this year, most major asset classes have continued to trend sideways as U.S. large cap has moved modestly higher.

While such leadership from U.S. large cap isn’t unheard of, historically this hasn’t been a bad thing for markets overall. In the past, we have seen other assets play ‘catch up’ towards the broader S&P 500 versus an overall reversal. While it can be a frustrating time, we believe amidst a continued resilient economic environment combined with attractive lower valuations, other asset classes across mid- and small-cap, as well as international equities, remain poised to offer a favorable risk/return outlook.

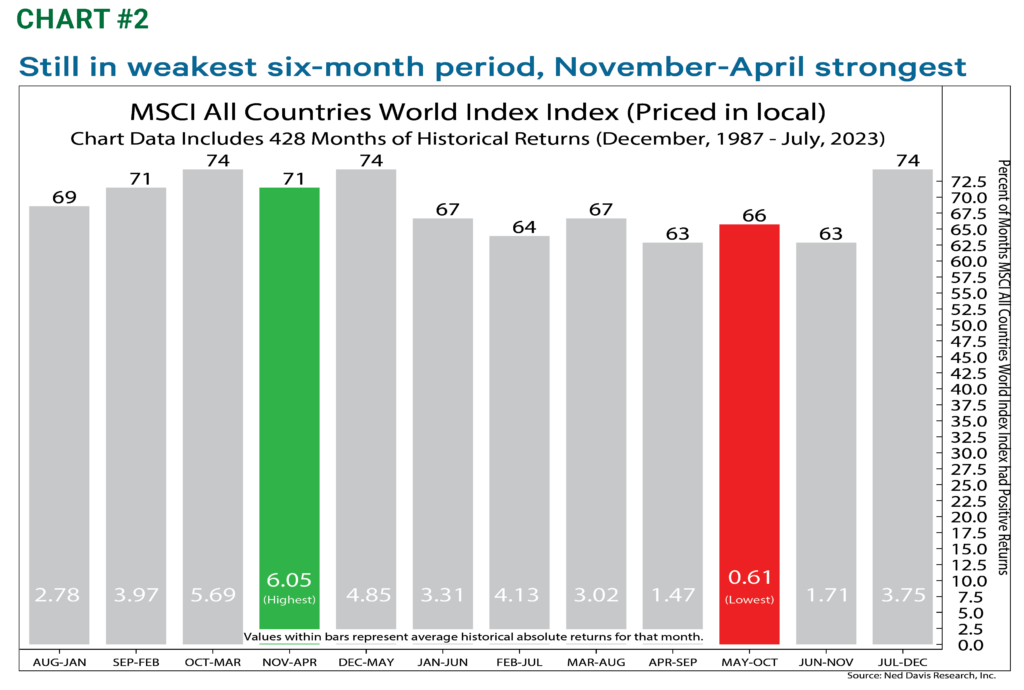

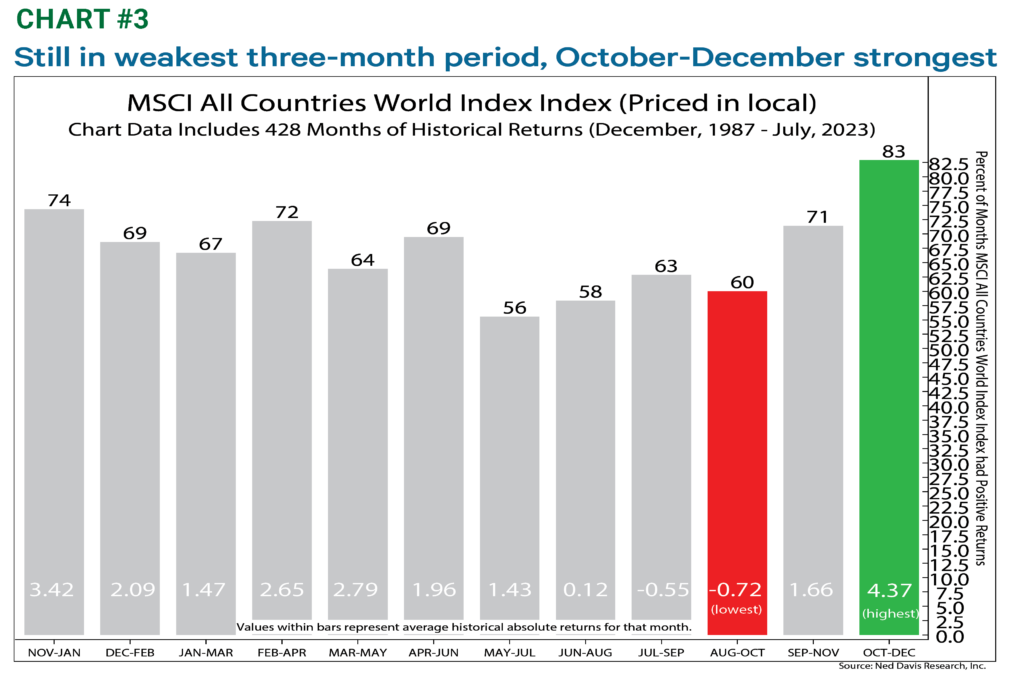

Despite this optimism, the JNBA Investment Committee remains cognizant that the current period is historically one of the softest for equities. As shown in the following two charts, May through October has been the weakest six-month period for global equities, while November through April has been the strongest. Similarly, three-month trends paint a like picture, with the weakest stretch aligning with our current August through October timeframe before seasonal strength typically appears October through December.

While the past can never be fully relied upon for the future, we believe continued strength in unemployment, corporate earnings, and inflation trends provide a solid foundation for potential improved performance entering 2024.

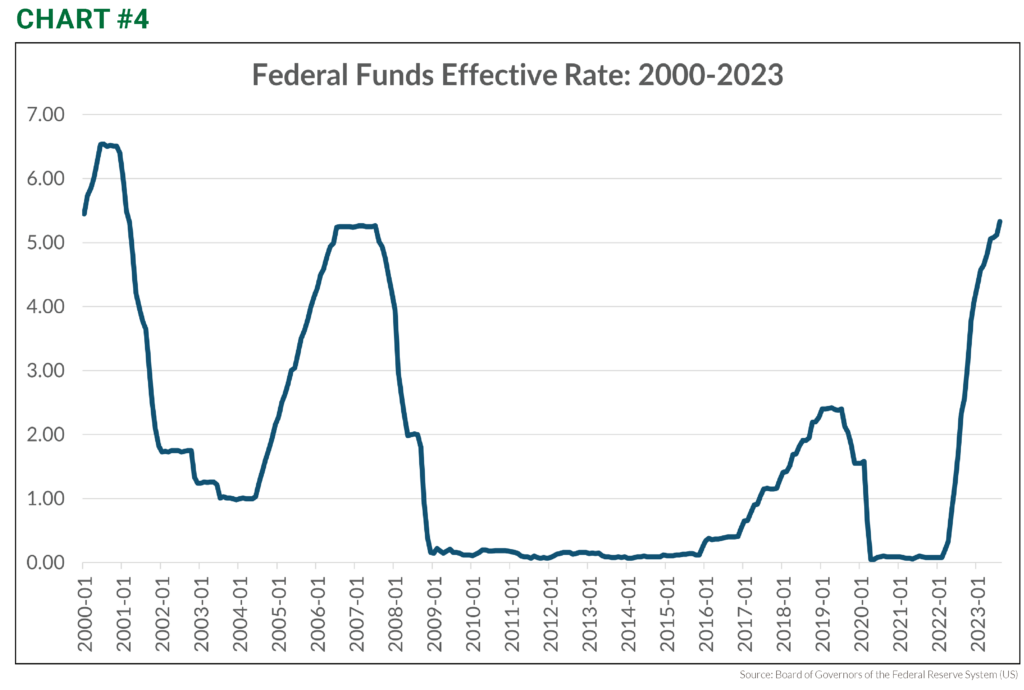

On a longer-term basis, the tumultuous past three years have brought about more uncertainty into markets. In general, an increased rate environment combined with a more unstable macro environment has led to a general repricing lower for long-term expectations. While the S&P 500 has historically generated an annualized return of approximately 10%, longer-term expectations are now closer to 7% or 8% over the next 10 to 20 years. While these long-term capital assumptions may prove conservative, it’s important that investors recognize that we may be entering a more modest, but still healthy, overall return environment.

On the flip side, fixed income markets are offering the highest longer-term rates that we have seen in decades. Following the Fed announcement on Wednesday to maintain current rates, with potentially one more hike this year, we appear closer to a terminal rate. While the duration of this elevated rate remains a key question, fixed income as a whole is offering its most compelling rate in over a decade, which should give investors a firmer backstop to pivot towards if we encounter equity weakness.

Overall, this could provide a healthy longer-term return for more diversified portfolios, albeit in a different path than the previous years of all-equity driven performance.

Lastly, we expect a mixed bag for volatility in markets going forward. The economy and corporations are still working through various supply challenges, inflation, and unemployment shifts related to the pandemic. The availability of higher yields in fixed income may lead to a faster shift towards bonds at the first signs of a recession, but that eventual trouble continues to be pushed further and further out as the economy continues to provide upside surprises. On the fixed income side, the Fed’s aggressive rate hike cycle has been the main source of poor bond performance. With that cycle nearing completion, the outlook for fixed income returns appears more stable going forward.

Members of the JNBA Investment Committee discussed this topic in our latest 10-minute Market Update podcast.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors.

Please see important disclosure information at jnba.com/disclosure