Updates on Account Transition to Charles Schwab & Co.

With the merging of TD Ameritrade and Schwab over Labor Day weekend getting closer, our goal is to continue to keep you informed on what to expect as we help prepare for your accounts to move to Schwab. On or about August 1, 2023, you will receive a “Key Information Packet” from Schwab for each […]

Financial planning for milestone moments

JNBA’s Elise Huston shares tips in Mpls.St.Paul Magazine From getting married to buying your first home, from having children to planning for your retirement; these are a few of the many life milestones where it could be beneficial to plan ahead. So, how do you start? In the May issue of Mpls.St.Paul Magazine, JNBA’s Elise […]

Seizing the financial opportunities of your promotion

JNBA’s Nick Scheibel shares tips in Upsize Magazine Receiving a big promotion and significant compensation can be cause for celebration. And, it can also be a reason to talk to your financial advisor. JNBA Financial Advisor Nick Scheibel was recently published in Upsize where he shared tips for readers who find themselves in this potentially […]

Leaving on a jet plane? Consider adding travel insurance to your packing list

As we approach summer, travel begins to ramp up for individuals and families. It doesn’t matter if you’re headed to Paris, Texas, or Paris, France; travel can come with its share of headaches. Whether you are heading a state or two over for a family event or embarking on the adventure of a lifetime, you […]

Gifting to Kids for Home Buying

Home ownership is a goal for many young people, but as interest rates have risen and property prices remain high, purchasing a home has become increasingly difficult for first-time home buyers. For parents and grandparents of these homebuyers, the question of “How can we help?” will often arise. If gifting to adult children and grandchildren […]

Career Advancement and Significant Changes to Income

As you advance through your career, significant changes to responsibility and title may result in meaningful increases in compensation. While you likely will enjoy the increased cash flow in your checking account, it is also an opportunity to consider how the increased income affects your long-term plans. Whether you have become a partner at your […]

JNBA in the MSP Business Journal: Employer Stock Compensation

Employee compensation packages can be as unique as the company offering them. For millions of Americans, compensation includes employer stock benefits. Stock compensation benefit packages can often be used to promote key employee retention and to attract new talent while incentivizing employee performance. The better the company performs, the more likely the employee is to […]

Executive Corner

Over the weekend, I took our elderly dog to the emergency vet. It was late Saturday night. I was scared, tired, and very uncertain about what our experience would be. I believe much of my anxiety resulted in what I will refer to as my “post-Covid experiences” where it seems to me that many things […]

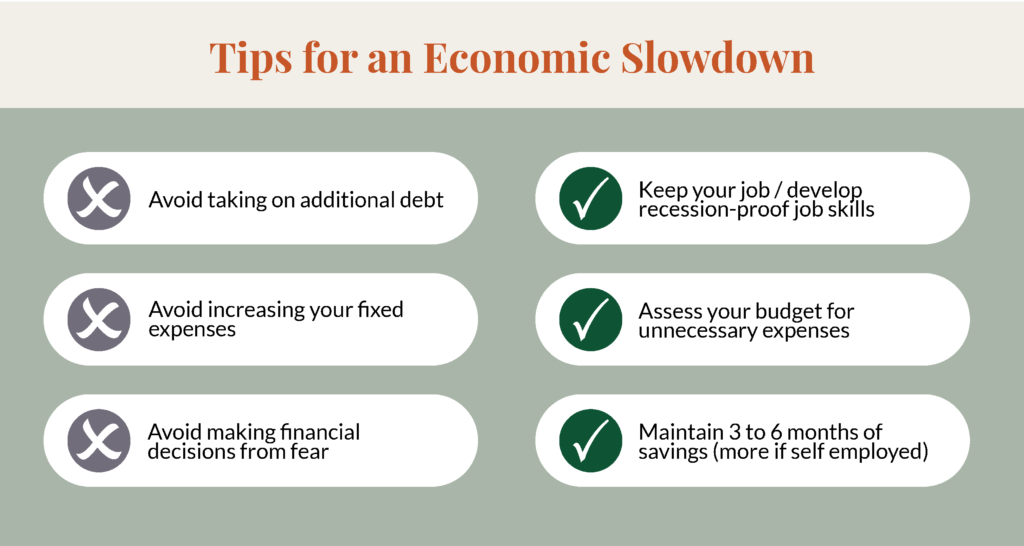

Recession? Things to Consider

Over the past few months, it has been hard to turn on a TV or have a conversation without the word “recession” being brought up. In the midst of these conversations, you’d often hear phrases such as “soft landing,” “mild recession,” or “hard landing” being thrown around. While some working professionals have weathered an economic […]

Is Disability Insurance Worth It?

Table of Contents: What is Disability Insurance? Short-Term Disability vs. Long-Term Disability Do I Need Disability Insurance? Factors to Consider Disability Insurance Cost Is Disability Insurance Worth It: FAQs In the first half of your career, your future earning potential and ability to save for retirement can be one of your greatest resources. But if […]