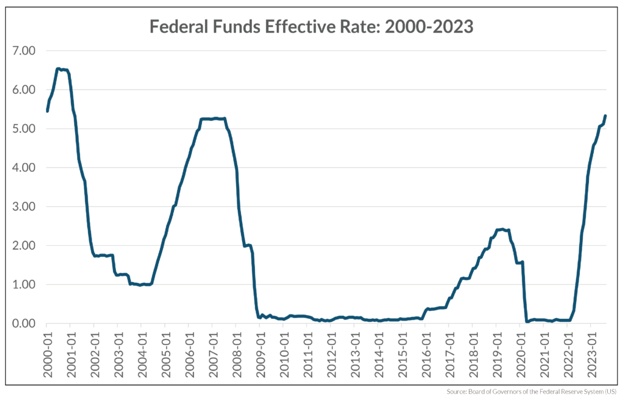

The last three years across markets have brought about dramatic changes as the effects of the pandemic resulted in historic shifts in fiscal and monetary policy, inflation, employment trends, and overall consumer spending and savings habits. One of the largest impacts from these disruptions was the strong increase in inflation we saw at the beginning of 2022 and subsequent continual increases to interest rates by the Fed. A result of this rapid climb in rates has brought negative performance across the fixed income landscape, where we saw two consecutive years of negative aggregate bond returns from 2021 to 2022 for the first time ever.

So far, 2023 has not brought much relief as the U.S. Aggregate Bond Index hovers around zero to 2% for the year. Despite higher and higher coupon payments stemming from higher rates, each successive hike leads to a repricing of each outstanding bond making the market value of the bond lower.

The last 2+ years have certainly been painful for fixed income markets. While current risk-free rates north of 5% are compelling, investors continue to be cautious of more hikes to come, resulting in further price decreases. All eyes remain focused on the Fed and when this hiking cycle reaches its conclusion, with the market wondering: “Are we there yet?”

Even though the anticipation of this trend coming to an end has led to more frustration for fixed income investors, there does appear to be some light at the end of the tunnel. While markets continually seemed to doubt what the Fed was anticipating for how many hikes would be left, the market consensus appears to be in line with what the Fed is now saying.

So, what is the Fed saying? Following its September meeting where it maintained Fed Funds Rates at 5.25 to 5.50, Fed officials believe there remains the chance for one more hike in 2023, before expected rate cuts around 0.50% sometime in 2024. Prior to the September meeting, markets were pricing in about a 50/50 chance of one more hike and approximately a 1.00% cut in rates in 2024. The “hawkish” messaging from the Fed appears to have finally sunk in, causing disruptions in both equity and fixed income markets, which are now pricing more what the Fed is conveying as 10-year interest rates have reached their highest levels since 2007.

Officials have stated the last hike in 2023 will depend on inflation and unemployment-related data. Unemployment rates remain low, and the Fed also lowered its 2024 unemployment forecast from 4.5% to 4.1%. Inflation has been in a downward trend, but surges in oil prices may cause some headline disruptions. These initial “cracks” in the downward trajectory of inflation as well as headline concerns around auto strikes and GDP impacts as well as a potential government shutdown have led to renewed concerns for an imminent recession despite the more favorable outlook from the Fed.

With markets now more in line with what the Fed is anticipating, any new surprises would seemingly have to come from the Fed and therefore continued economic data. Predicting these metrics can be a challenge, but going forward the risk/reward appears to be more favorable to fixed income than in previous years. With current rates above 5%, yields are at the highest level in decades. If rates were to be held following one more hike in 2023, that 5% coupon would be clipped without disruption to the overall price of a bond. If we were to see the cuts the Fed is anticipating in 2024, bond prices would benefit, and the total bond returns could reach the upper single-digits to low double-digits. We view this as a very compelling risk (more hikes than forecasted) versus reward (rates maintained or potential cuts) scenario, especially when compared to similar yielding CDs. CDs would not have the added benefit of potential price appreciation from any future rate cuts as well as lower reinvestment compared to shorter maturity CDs.

One complicating matter may be a potential government shutdown as core economic data is provided from government sources, but there appears to be a temporary resolution in place. That said, Fed officials believe they have enough data outside of the typical sources where their decisions would still be well-informed. Regardless, markets appear less likely to be surprised by additional hikes.

Overall, this higher return environment should continue to provide a healthy longer-term return for more diversified portfolios, albeit in a potentially different path than the previous years of all-equity driven performance. We continue to be long-term focused but near-term flexible as we navigate a continually dynamic environment.

For additional context, in late September, the JNBA Investment Committee released a podcast titled “Seasonal Trends,” in which we provided our thoughts on the current market environment , including some of the recent challenges we’ve experienced in equity markets. These communications are still highly relevant and can be found here on the JNBA website.

As always, please reach out to your advisory team with any questions or concerns you may have.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at jnba.com/disclosure.