It’s that time of the year again – leaves are falling, air is getting chillier…and open enrollment season is upon us for the for the upcoming tax year! Open Enrollment is a good time to review your contributions to various employer plans to help ensure you are maximizing your contributions in an efficient way as well as ensuring you are receiving the highest benefit from your employer.

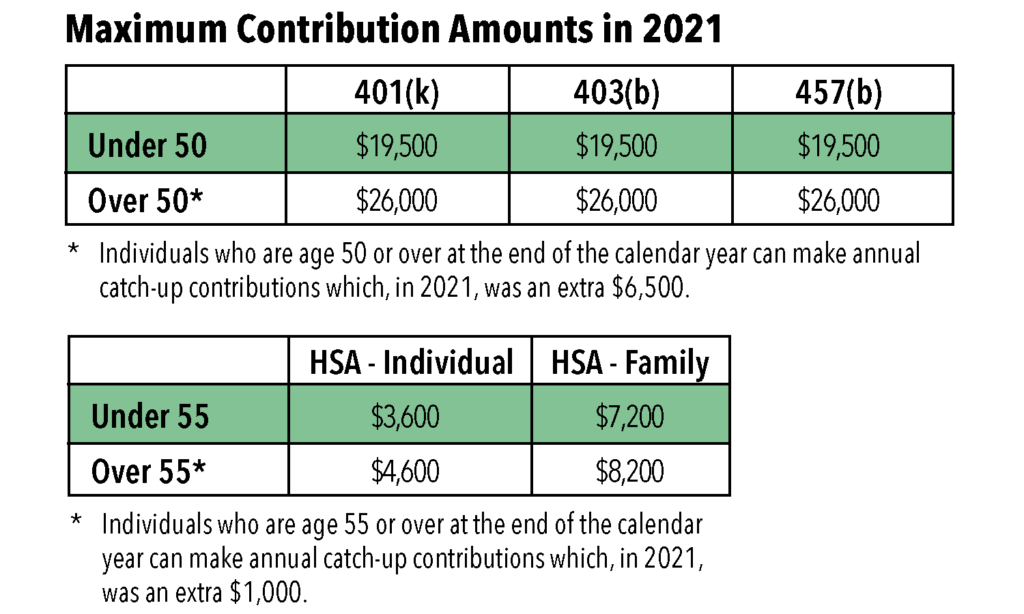

There are numerous types of employer-sponsored plans that assist employees in achieving retirement savings goals. The most common plans include not only Traditional and Roth 401(k), 403(b), and 457(b) plans, but also Health Savings Accounts (HSA), Flexible Spending Accounts (FSA), cash balance pensions, and employer stock purchase plans. In order to maximize the value you are receiving, you should review your benefits to see if your employer offers a match on any of their offered plans. To receive the entire match, make sure to contribute at least that amount (typically a percentage). Be sure to check maximum contribution amounts as these typically change each year, and you may need to adjust the percentage you are contributing to each plan for the new tax year.

When reviewing your employer-sponsored plans, it is also important to review the benefits of contributing to a Roth 401(k), if offered. By contributing to a Roth 401(k), you are creating a pool of tax-free assets that will grow tax-free and be free of tax upon withdrawal in retirement. However, you do not receive the pre-tax savings benefit you would receive if you contributed to a Traditional 401(k).

If you elect to enroll in a high-deductible health plan for the year, then you can elect to contribute to a Health Savings Account. This is one of your best savings vehicles for health expenses both today and in the future. The contributions to HSAs go in pre-tax and grow tax free if used for qualified health expenses for you, your spouse, or your dependents. The unused funds carry over year after year, so you do not lose them.

You also want to use this time to think about how your family has changed over the past year or if you anticipate any changes in the coming year to ensure your life insurance coverage, beneficiary designations, etc. are still appropriate.

Open enrollment is also a time to review your investment allocation among your employer-sponsored plans to ensure they are still appropriate for you and are in sync with your overall financial life plan. Finally, if your plan changed custodians, you should review the plan details so that you understand all options that are available to you on the new platform.

Should you have any questions about how to optimize your employee benefit elections, please contact your JNBA Advisory Team.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at www.jnba.com/disclosure