Given the combination of widespread vaccine availability, loosening of business restrictions, ultra-low interest rates, and massive government stimulus, the U.S. economy has fundamentally roared back to pre-pandemic levels and has stoked investor optimism across a variety of asset classes. Global stock markets have surged this year and remain close to all-time highs even as some investors have begun to worry that growth will begin to decelerate into 2022. At the same time, inflation is accelerating to uncomfortable levels that might force the Fed’s hand to raise rates sooner than initially expected. Currently, the market is playing tug of war between buoyant investor sentiment, stock market valuations, and corporate profits being reported. These profits are coming in much stronger than expected, which might just make those elevated valuations appear more reasonable in hindsight. However, the market seems to have already anticipated these higher expected profits, as the typical stock price boost often seen after a company exceeds its earnings per share estimates has been absent as of late.

Given this backdrop, we believe that a globally diversified approach to investing, when coupled with disciplined rebalancing to mitigate unintended risks, offers a strong and resilient path to success in an uncertain investment environment. While we are optimistic on stocks relative to most other asset classes, we expect volatility to continue in the second half of 2021 as the pandemic has created distortions in economic data that could cause investor unease. Currently, we do not expect this temporary bump in inflation to turn into runaway inflation, and we believe that increases are being driven primarily by the low base figures of 2020. Note that when smoothed over two years, inflation looks more reasonable. Most supply bottlenecks and labor shortages are likely to improve over the next couple of quarters, but the additional spending power of consumers will fade with the disappearance of direct stimulus checks. As the divergence between actual production and consumer spending dissipates, the pricing power of firms should be held in check. As such, any additional increase in rates fueled by fears of higher inflation might present a nice opportunity to lock in higher income from bonds or stocks (as stock and bond prices adjust lower, the yield an investor will receive increases).

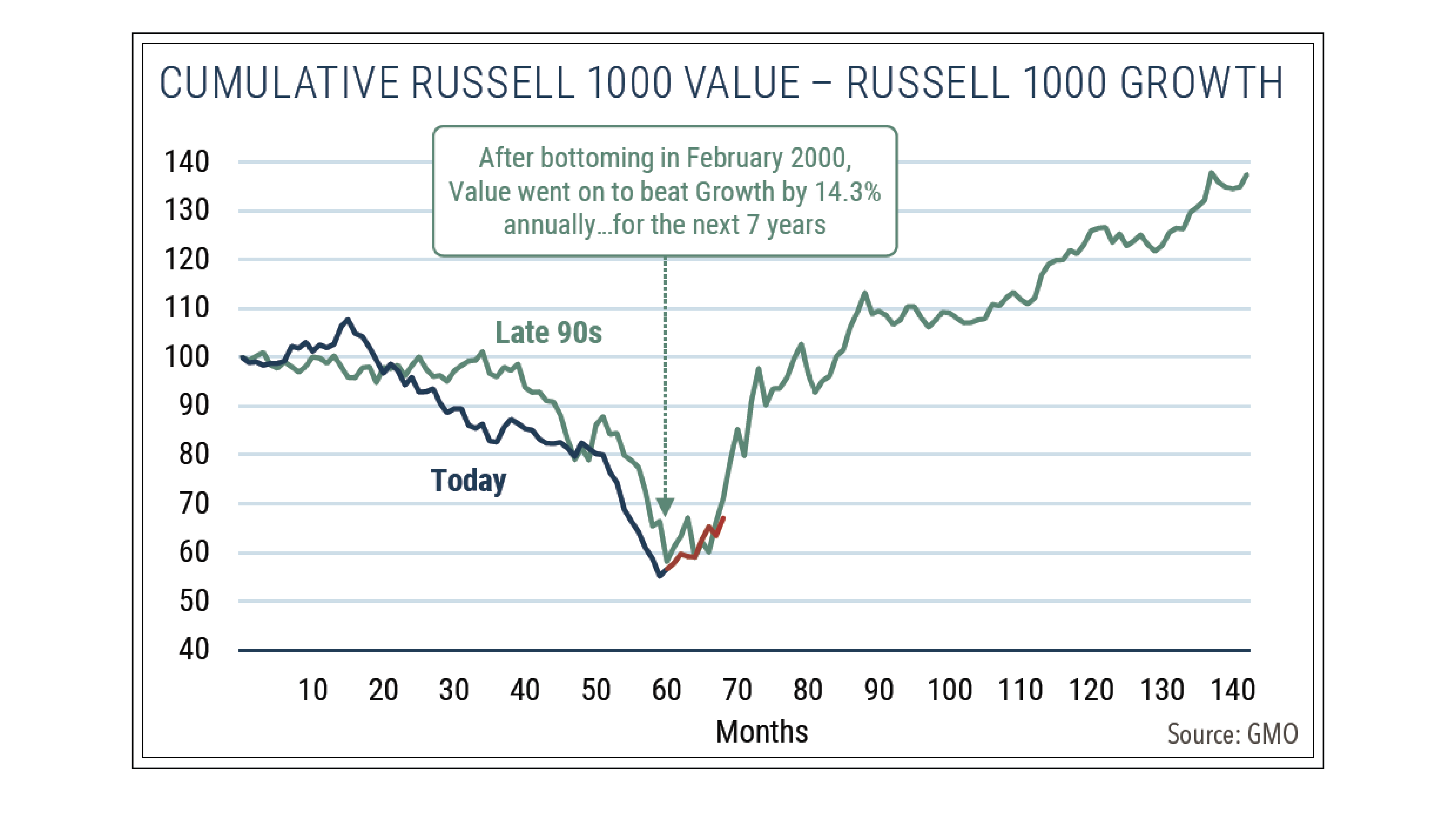

While stock valuations appear to be resting at the upper band of their historical range, we find both international and value stocks to be marginally more attractive than the general market. These stocks should benefit more than growth stocks from a stronger economy, particularly when rates start to rise. As we expected, cyclical stocks have outperformed as economic activity has accelerated and the yield curve has steepened, and we do not think this trend reversal is finished (see chart above). Commodities are starting to appear a bit overheated, reflecting a surge in demand in the face of lower inventories and supply constraints.

As some bond investors have begun to worry about rising prices, we remain calm as inflation expectations have barely budged. Investors should benefit from higher rates and lower default rates as fundamentals remain healthy and the economy continues to recover. The JNBA Investment Committee expects the economic rebound to replace rather than augment fiscal relief programs since those will eventually disappear. If the recent spike in inflation proves to be more than transitory, we are confident that our exposure to non-dollar denominated and floating rate debt, along with other real assets, offers a compelling hedge. Furthermore, the risk of higher inflation would introduce additional volatility that could be used to enhance income and capture attractive dislocations in market pricing.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosures information at www.jnba.com/disclosure