Updated April 1, 2021 in response to additional IRS guidance

As we prepare for the upcoming tax season here are a few reminders.

1099 Delivery Reminders

- All TD Ameritrade 1099s should be available online.

- Realized gain/loss (cost basis) and IRA distribution details are included on your 1099 tax documents coming directly from TD Ameritrade. Please provide your 1099s to your tax professional for preparing your 2020 tax return.

- Clients who have established online access can also access any 1099s and either print, save, or email them to their tax professional. To switch between accounts, click on the Accounts filter towards the middle of the screen to select the appropriate account.

- Also, clients who wish to download their account information directly into TurboTax or H&R Block should use their account number as their username and the Document ID located in the upper right-hand corner of the 1099 form as their password.

- We fully understand the frustration corrected 1099s often cause as neither JNBA nor TD Ameritrade can control this delay in adjusted information. With global ecommerce, companies often must modify reported dividends, interest, or capital gain information. As a result, by law, those companies are required to pass these revised figures on to the appropriate parties, in this case, TD Ameritrade.

Tax Returns

JNBA requests your 2020 tax returns to provide well-rounded and accurate financial planning advice. If you did not sign a Tax Professional Authorization form, please send a copy of your 2020 tax return to your Advisory Team or upload your return to your JNBA Modestspark Portal.

IRA Contributions

- On March 31, 2021 the IRS provided additional guidance for the 2020 tax filing season. The new deadline for IRA contributions is May 17 (this now matches the extended tax filing deadline). To make the May 17 deadline for IRA contributions, contribution checks (made payable to TD Ameritrade with “2020 contribution” written in the memo line) should arrive at our office no later than May 12, 2021.

- If you need to confirm your IRA contributions already made for 2020 or are considering moving money from a non-IRA account to an IRA for your 2020 contribution, remember to allow time for processing to meet the May 17 deadline.

QCD – Qualified Charitable Distribution

If you are over age 70 ½ and gave money from your IRA directly to a charitable organization, please share those distribution details with your tax professional. The 1099-R generated for your IRA shows total distributions and does not include details on distributions to a qualified charitable organization. This will be important information to share as distributions to charity, up to $100,000, are not taxable.

Social Security Tax

Those who worked for multiple employers in 2020 may have paid too much in Social Security tax. The maximum amount withheld by employers was $8,537.40 per taxpayer. If your Social Security withholdings exceeded that maximum, you may be able to claim the excess as a credit.

Long-Term Care Insurance

If you own long-term care insurance, you may be eligible for an income tax credit for premiums paid during the 2020 tax year. Specifics vary from state to state, and you should consult your tax professional for additional information.

Minnesota Resident 529 Plan Contributions

As a Minnesota resident, you may be eligible for a Minnesota nonrefundable income tax credit or an income tax deduction for contributions to any state’s 529 plan. The nonrefundable income tax credit is subject to phase-out. You should consult your tax professional for additional information regarding the credit or deduction.

Health Insurance

The Affordable Care Act requires that a taxpayer and each member of his or her family has qualifying health coverage for each month of the year, qualifies for an exemption, or makes an individual shared responsibility payment when filing his or her tax returns. Like last year, those who had qualifying health coverage for the whole year will simply have to check a box stating that they are covered.

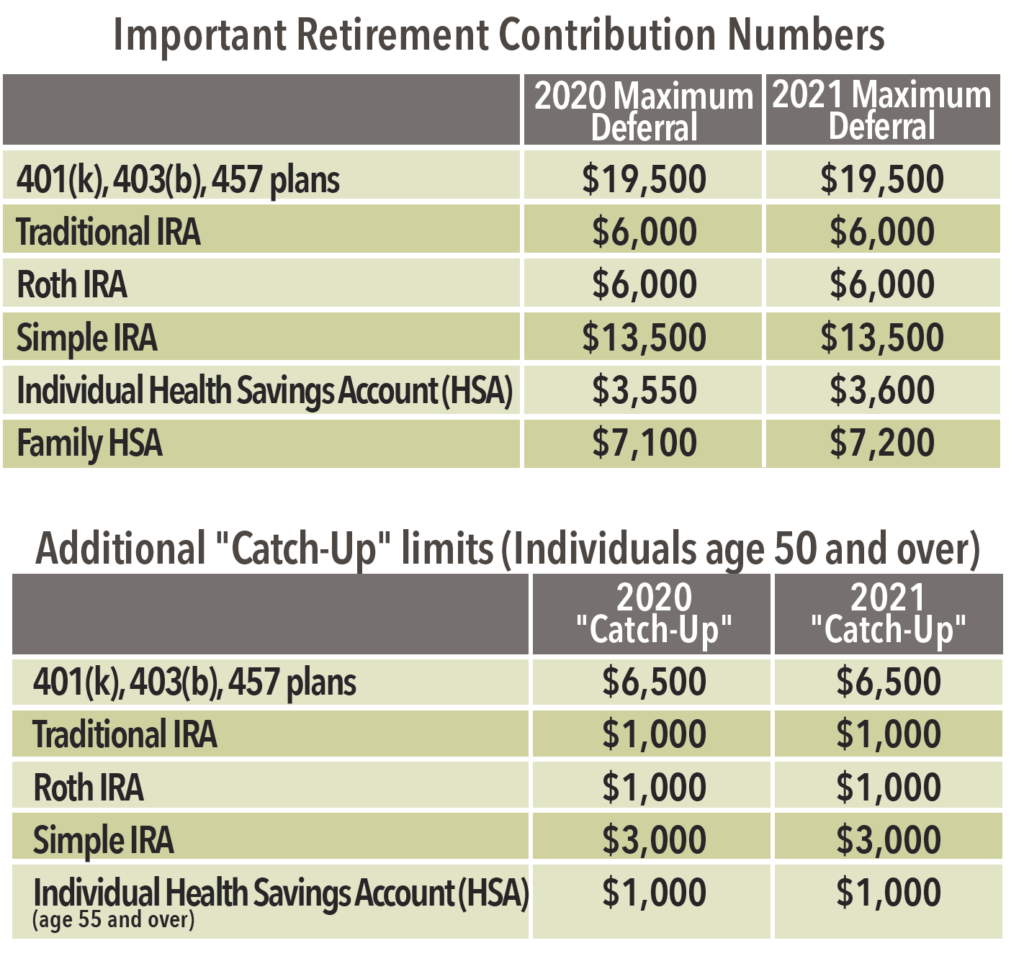

Important Employer-Provided Benefit Reminders

As you gather documents for your 2020 tax return, this is a good time to complete a thorough review of your employer-provided benefits. Look for opportunities to increase your 401(k) contributions to maximize your savings for the new tax year, confirm the beneficiaries listed on your employer-provided benefits are still accurate, and determine if any adjustments should be made to your tax withholding. Withholding adjustments can be a good topic to discuss with your tax professional as they review your information to prepare your 2020 tax return.

JNBA is not an accountant and no portion of the above should be construed as accounting advice. All accounting issues should be addressed with an accounting professional of your choosing.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosures information at www.jnba.com/disclosure