2024 Tax Season Reminders

As we prepare for the upcoming tax filing season, here are a few reminders: 1099 Delivery Reminders Most Schwab 1099s should be available online by the end of this month (February 28). Reporting Treasury Interest on Non-IRA Accounts As a reminder, and as appropriate, we have strategically invested cash in Treasury funds to generate additional […]

Three Ways to Give to Causes You Care About Before the Year Ends

As we approach the end of 2024 and the traditional “Giving Season,” many individuals and families are reflecting on how they can best support the causes closest to their hearts. If charitable giving aligns with your values, you may want to explore the latest strategies and tools that can help you maximize the impact of […]

What is the difference between a health savings account (HSA) and a flex spending account (FSA)?

Healthcare costs can be expensive, even for the healthiest people. Even if you have health care insurance, you may want to take advantage of other options for saving for medical expenses not covered by insurance. Outlined below are some of the differences between the two most common accounts offered to individuals and families, health savings […]

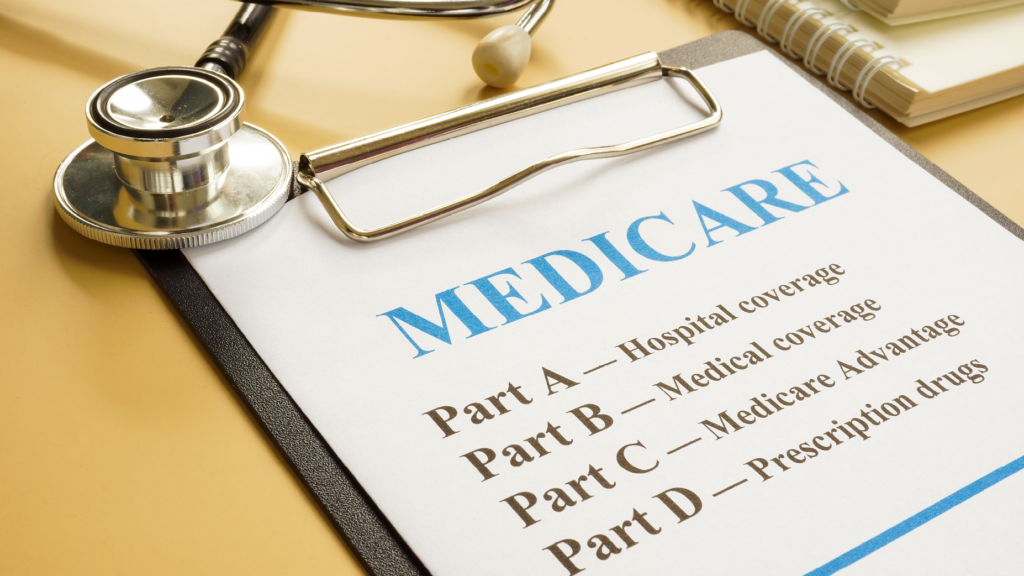

Medicare Open Enrollment: Changes and Dates to Know

Medicare Open Enrollment for 2025 is just around the corner, running from October 15 to December 7, 2024. During this time, Medicare participants can review and make changes to their Medicare plans, ensuring they have the right coverage for the year ahead. To prepare for the upcoming enrollment period, below are a few notable changes […]

Sunset of the 2017 Tax Cuts and Jobs Act

With the presidential election upon us in just a few short weeks, you may be asking yourself what tax changes may be on the horizon. While each candidate may have their own strategies and ideas for new tax policies, it remains unclear what new tax legislation would make it through Congress and ultimately be signed […]

Using an After-Tax 401(k) to Boost Retirement Savings

One of the most popular retirement savings vehicles available to employees is a 401(k) plan. These plans offer tax-deferred contributions, where plan participants reduce their taxable income and defer tax responsibilities until withdrawing funds from the plan in retirement. While most of the contributions to 401(k) plans are made via pre-taxed income, it is possible […]

The Secrets of Longevity & Happiness: Lessons from Dan Buettner’s Blue Zones

Have you ever wondered what the secret is to a long and happy life? Minnesota native Dan Buettner has dedicated the last two decades to researching this with National Geographic, exploring the globe and discovering “blue zones,” or communities — demographic and geographic areas of the world — where people are most likely to live […]

The Comprehensive Role of Life Insurance: Thinking Beyond Immediate Needs

Life insurance serves a dual purpose: addressing immediate financial obligations like funeral expenses and providing long-term financial security for family members and beneficiaries. Beyond these fundamentals, life insurance plays a crucial role in establishing a stable retirement for surviving spouses and supporting business continuity through buy-sell agreements. Ensuring Security of Surviving Family Members For married […]

Minnesota Estate Tax for Florida and Arizona Residents

Earlier this year, JNBA Financial Advisors had the pleasure of hosting Chad Carr, an estate attorney and partner from Twin Cities-based firm Stadig Johnson to share his expertise with our Advisory Team regarding Advanced Estate Planning Strategies for those subject to Minnesota Estate Tax. While Estate Tax can be fairly straightforward, there are some nuances […]

Watch out for these tax scams!

Taxation can be a complex landscape, rife with potential pitfalls and scams that unsuspecting individuals and businesses may encounter. Here we delve into the IRS’s Dirty Dozen tax schemes, highlighting the most frequent scams that taxpayers are encountering. 1. Syndicated Conservation Easements: Conservation easements serve as important tools for protecting natural habitats while providing tax […]