Market Update: Bank Failures in a Different Environment from 2008

Markets have been incredibly volatile recently with the Federal Reserve stepping in to protect both insured and uninsured depositors of Silicon Valley Bank and Signature Bank last weekend. With a duty to safeguard the stability of the banking system, the Fed took action to ensure depositors are made whole under the Federal Deposit Insurance Corporation […]

Q1 2023 Economic and Market Update

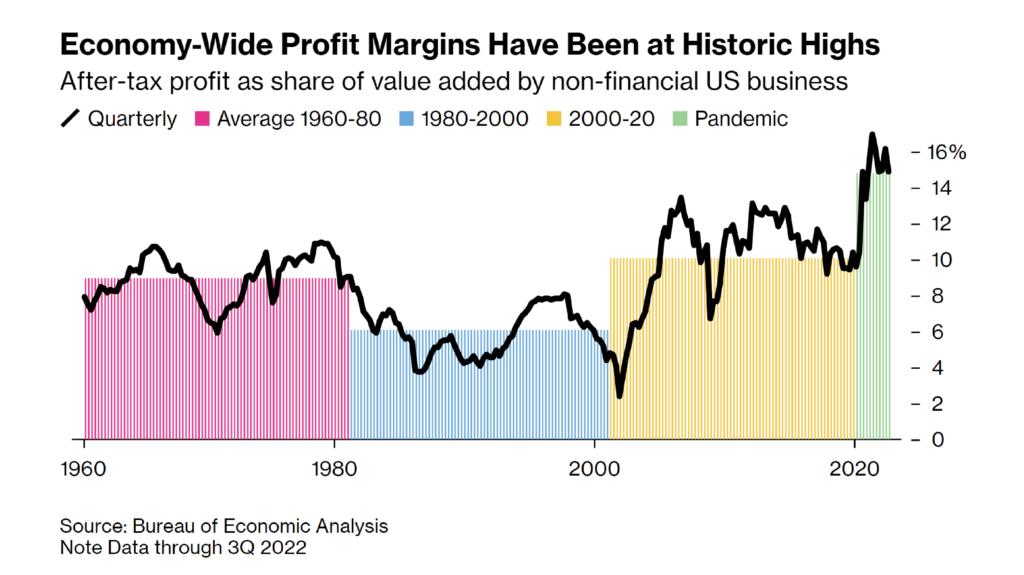

With stocks and bonds sputtering on the heels of a January that saw many financial assets claw back a large chunk of their 2022 losses, investors are starting to wonder about the speed with which inflation will subside and how Fed policy might alter the trajectory of economic growth. In recent weeks, investors have recalibrated […]

Podcast: Market Update: Out of the Woods?

Just over a month into the new year, 2023 has provided investors with some long-sought good news. After a challenging 2022, both equities and bonds are off to a solid start, Europe and China are stimulating the global market, and the Fed may be coming close to the end of its tightening cycle. While this […]

The U.S. Debt Ceiling: What it Could Mean for the Markets

The Debt Ceiling is once again making front-page news, and investors are becoming increasingly anxious over what it means for their personal lives as well as their portfolios. In a nutshell, the JNBA Investment Committee believes the risk of the U.S. government defaulting on its debts is quite low. However, we acknowledge that the consequences of a […]

The Value of an Advisor: Portfolio Construction

At JNBA, we are big believers in the value an advisor can provide to clients. A trusted relationship can produce a rewarding experience and long-term mutual benefits for investors and their advisors and advocates. As we continue our blog series on “The Value of an Advisor,” which highlights what research states are some of the […]