With stocks and bonds sputtering on the heels of a January that saw many financial assets claw back a large chunk of their 2022 losses, investors are starting to wonder about the speed with which inflation will subside and how Fed policy might alter the trajectory of economic growth. In recent weeks, investors have recalibrated their expectations for a recession downward, as fresh data suggests the economy is in better shape than expected. Recent data on Gross Domestic Product (GDP), retail sales, job growth, and inflation are all suggesting that the overall economy remains more resilient than most experts expected. Conversely, manufacturing remains in the doldrums with both a strong dollar and higher interest rates weighing on demand.

However, with the economy more resilient than many thought, investors are starting to worry once more that the Federal Reserve may need to raise rates much higher and leave them at elevated levels for a longer stretch of time. While the Fed has not altered its hawkish stance, investors have begun to re-align their positioning with current Fed thinking, as two-year bond yields have risen nearly 0.5% in the last month.

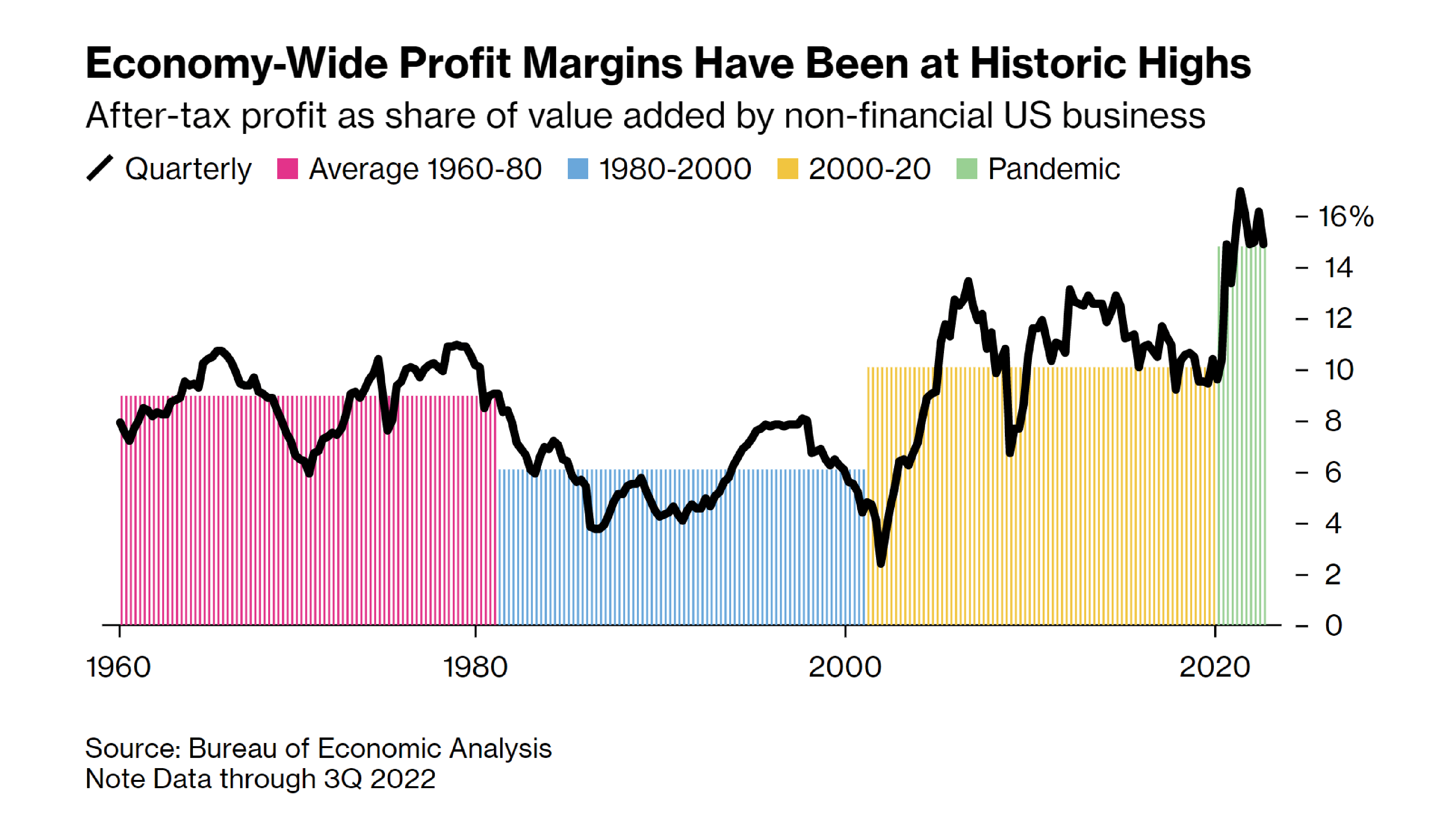

Through February 27th, the S&P 500 was up 4%, versus an 18% decline in 2022 – the worst fall since 2008. Although inflation has edged lower for seven consecutive months, it is not coming down fast enough and the job market remains strong with unemployment at 53-year lows. Companies are having a harder time pushing through price increases faster than inflation. As such, margins are starting to fall from historic highs (see chart), and fourth quarter earnings are on track to decline from the prior period – the first such drop since 2020.

Recession fears could easily return with a slowdown in hiring and additional layoffs, but for now, without a much greater fall in earnings, the likelihood of substantially higher unemployment seems far away. This is troublesome as inflation has been above 4% for almost two years now, and a softer labor market would likely help to dampen inflationary pressures.

As of now, the JNBA Investment Committee expects another 25-bps hike in rates to between 4.75% and 5.00% at the next Fed policy meeting in mid-March. While the disinflationary process appears to have begun, we believe the central bank will not consider cutting rates until inflation falls comfortably below its Fed Funds rate for at least several quarters. For now, we are content to deploy capital into the shorter end of the yield curve where we can earn above-average coupons while taking less interest rate risk. Additionally, municipal bonds are at their highest yields in many years even as state and local government finances remain in good shape.

Even as lingering inflation persists, our outlook for global growth has improved slightly, and we believe investors should still be willing to take calculated risks. We have a more bearish view on the U.S. dollar and a more favorable view on commodities as well as non-U.S. stocks which feature cheaper valuations and more undervalued currencies. In the U.S., last year’s sell-off in growth stocks created an interesting opportunity for investors to acquire shares in higher quality growth companies at attractive prices. While it appears the stock market may have put in a bottom last October – given the widespread rallies across all types of financial assets – we continue to expect heightened volatility as the breadth of earnings revisions remains negative, which means we plan to deploy capital carefully over time.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at jnba.com/disclosure.