When working with our clients, one of the most common questions we face in portfolio management is: when is the right time to invest? Whether onboarding a new client or incorporating new deposits or cash, our investment team takes several factors into account when deploying funds into an investment strategy.

Beyond the unique client circumstances for each portfolio, such as short-term income, liquidity, or tax needs, the current market environment is typically the first consideration. It’s an important factor, and at JNBA Financial Advisors®, we have a research driven, model-based DCA (Dollar Cost Averaging) strategy to determine the rate to deploy new capital. While this process attempts to consider the overall market landscape, an underlying principle is that, typically, time in the market is more impactful than timing the market.

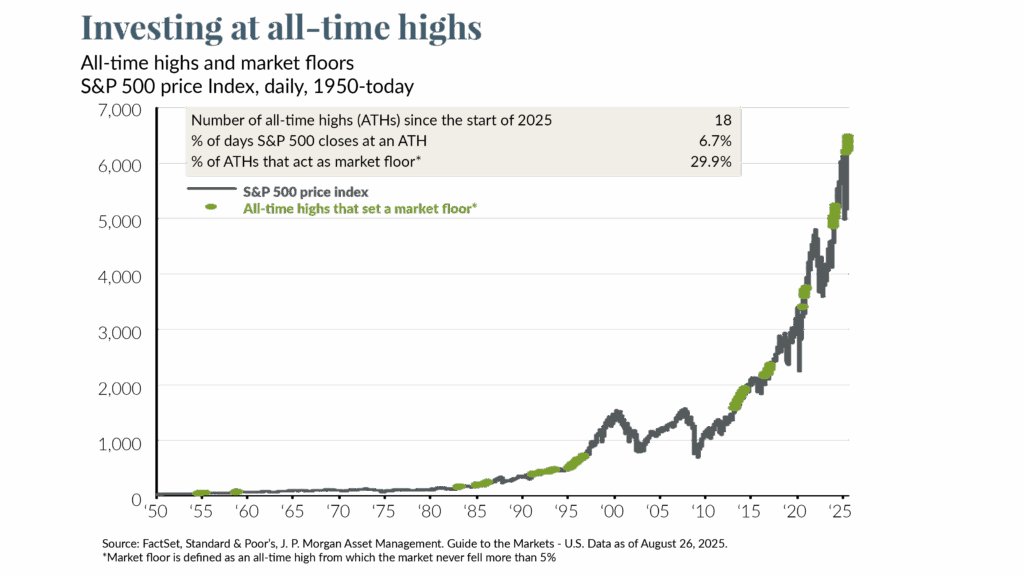

It’s a simple principle and is based on historic market performance but naturally raises questions in times like these with the S&P 500 again near all-time highs. Periods of strong performance naturally lead us to consider a more cautious approach. Investors usually use all-time highs as a reason to stay in cash or on the sidelines, perhaps waiting for the next opportunity to “buy the dip.” However, history suggests that investing at all-time highs is not a bad strategy because new highs are typically clustered together. In other words, “market strength begets more market strength.”

In reality, markets reaching new highs can often serve as a new “floor” for future performance, an all-time high from which the market has never fallen more than 5%. Since 1950, there have been many times when an investor sitting on the sidelines with markets near all-time highs would have never seen a better entry point.

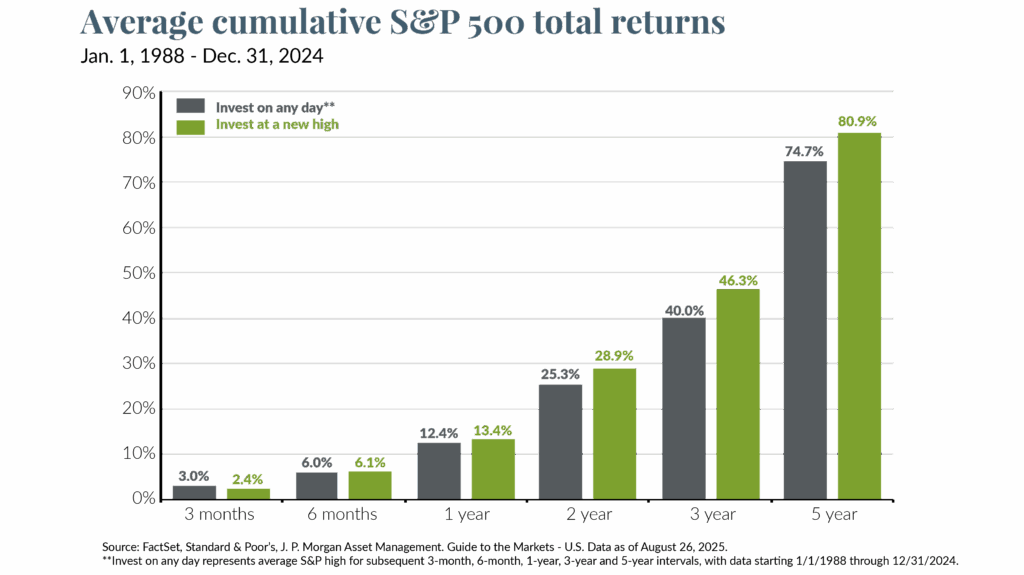

Perhaps more surprisingly, a strategy consisting of investing only at new highs can be comparable to investing on any given day. And in longer periods as noted in the previous chart, investing at market highs actually outperforms investing at lower market levels.

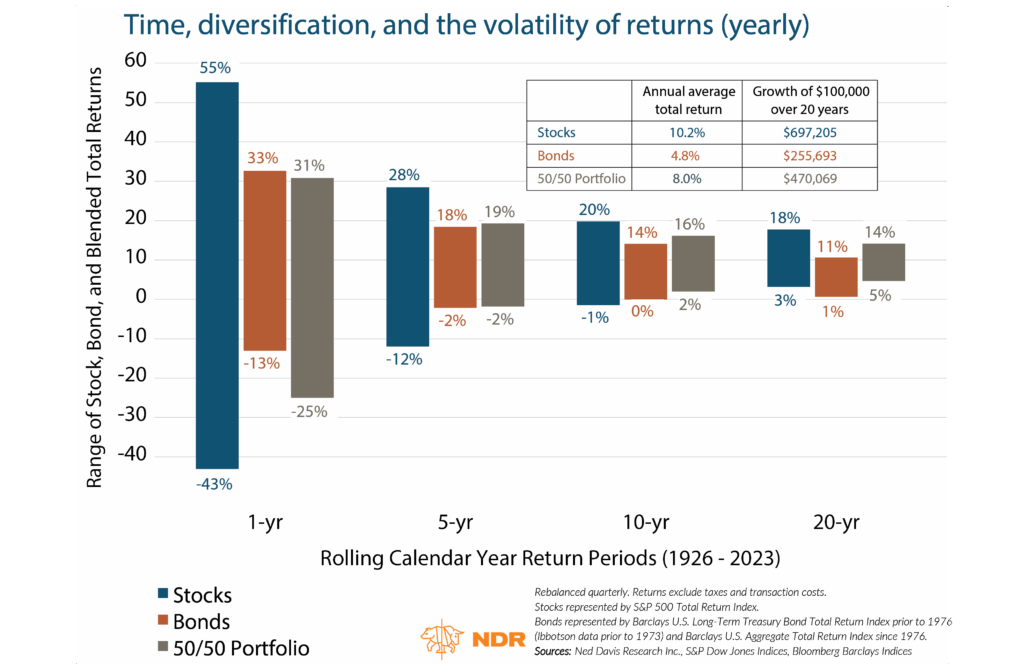

Unfortunately, the reality is that any long-term investor will eventually deploy new funds at an inopportune time. In the years 2008/2009 and 2022, we saw periods of weakness that took extended market rallies to recover from. At JNBA, we are focused on long-term performance in line with our clients’ long-term objectives. It may provide some comfort that for diversified portfolios, what may seem the worst periods to invest may yield healthy returns over the long-term.

Below, we highlight the hypothetical performance of simplified investment strategies across the various target allocations. The bars show the highest and lowest returns experienced during each time period (1-year, 5-year rolling, 10-year rolling and 20-year rolling). This is measured by an index’s historic performance to illustrate past performance and volatility. As asset class performance ebbs and flows, the data illustrates the benefits of long-term diversification across stocks and bonds that become amplified over time as historic portfolio returns level out.

Market timing may be one of the more challenging aspects of investing. We believe having the proper trading and rebalancing strategy in place, a direct alignment between portfolio management and the client’s long-term objectives, and a keen understanding of historic market performance provides a clear path to cut through the uncertainty of the moment. Reviewing all JNBA clients’ portfolios every 10 business days is reflective of our commitment to have a strong pulse on market activity and the implications and opportunities it presents.

As always, if you have any questions, please talk to your JNBA Advisory Team.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at jnba.com/disclosure