After a tumultuous first half of the year, markets steadied in July with the S&P 500 hovering near all-time highs while foreign equities continue to maintain strong YTD gains. Volatility also eased, with the S&P notching 25 straight sessions without a >1% move through the end of July.

Uncertainty around tariff policy has decreased for now, with the initial 90-day pause extended as new country deals were mapped out. The Fed has continued to hold rates steady following last week’s Fed meeting, while signaling potential future cuts in the back half of 2025. Perhaps most importantly, economic and corporate data have remained relatively strong. Earnings season, while still in progress, has largely delivered solid results. Tariff impacts are fewer than expected, driving stocks slowly higher. Employment data remains at a reasonable level despite unemployment ticking upward ever-so-slightly. Finally, inflation data continues to hold steady.

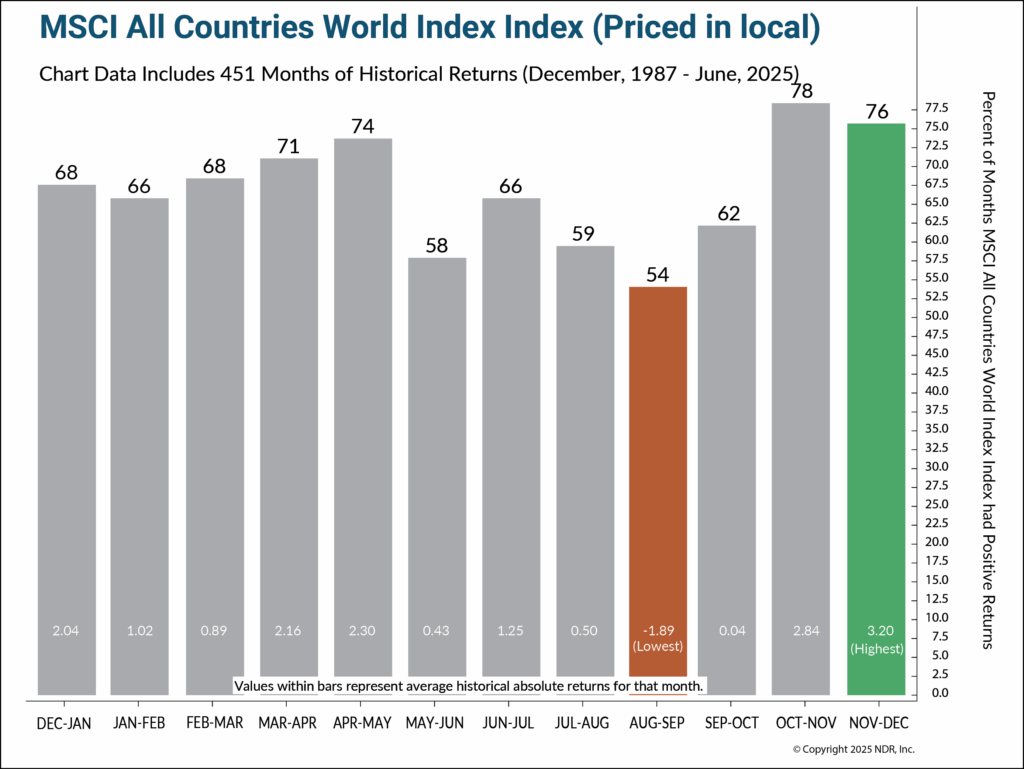

We often say that past performance does not guarantee future results, however it’s always worth keeping in mind how this end of summer stretch has performed in the past.

The current environment remains fairly similar to the strong starts in 2023 and 2024 midway through the year. In both of those periods, the JNBA Investment Committee highlighted the historically weak stretch we see in global equities around this time of year.

As shown in the following chart, August/September has been the weakest two-month period for global equities over the past nearly 50 years, while November/December has been the strongest. Similarly, three-month and six-month trends look much the same for late summer weakness.

Looking ahead, we believe the underlying metrics have yet to meaningfully deteriorate. Solid corporate earnings, steadily rising but still low unemployment rates, and easing inflation trends provide a solid foundation for further growth over the next 12 months. Elevated valuations remain a headwind, while international and fixed income diversification continues to reward investors YTD as we further navigate the short- and long-term impacts of ever-changing fiscal and monetary policies.

As always, if you have any questions, please talk to your JNBA Advisory Team.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at jnba.com/disclosure