After appearing to form a bottom in mid-June, the market surged higher as investors began to anticipate a slower pace of rate hikes from the Fed as it became more likely the economy would post a second straight quarter of negative economic growth in real terms (adjusted for inflation). While the JNBA Investment Committee believes it is premature to call for a pivot – or even a pause – in the Fed’s ongoing interest rate hiking campaign, we believe the trajectory for future economic growth has moderated. Clearly, the bounce from pandemic era fiscal stimulus has faded and the impact of higher rates is starting to bite not only many household budgets already stretched by inflation, but also more interest rate sensitive sectors such as automobiles and housing.

In our view, it is not necessarily a foregone conclusion that this growth slowdown will turn into a recession in the next 12 months. Why? Household balance sheets are still in relatively solid shape, and the demand for workers remains resilient with new claims for unemployment remaining low. While economic soft landings are quite rare when the Fed is tightening monetary policy very quickly, they are relatively more likely when the labor market is healthy, as it is now. The Fed chairman at the recent Jackson Hole conference made it clear the Fed will continue hiking interest rates until there is a material drop in inflation, and even then they may not cut quickly, likely increasing the odds for a recession later next year and potentially into 2024.

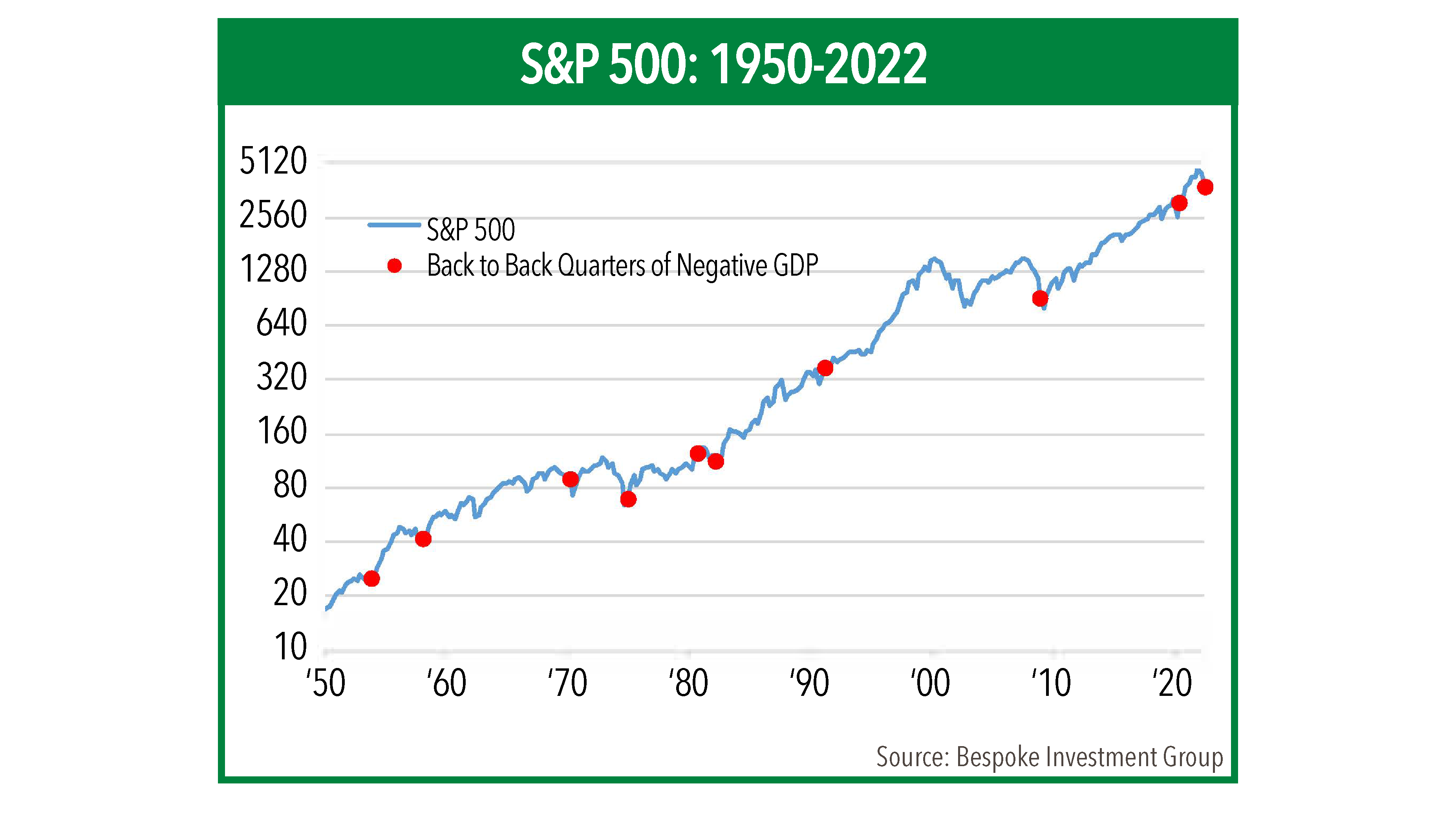

After one of the worst starts to a year in generations with stocks entering a bear market and bonds also down double-digits, financial markets appeared to have found their footing in June just before the economic data for payrolls and inflation came in better than expected along with second-quarter corporate profits. Stock markets are forward looking, and a strategy of buying in a bear market has historically worked well for investors. In fact, according to Bespoke Investment Group, the median gain for the S&P 500 has been 31% in the following 12 months after the prior nine times we have seen back-to-back GDP declines in the U.S. economy, with positive returns eight out of nine times.

Nonetheless, with inflation still far too high and broad-based for the Fed’s liking, and leading economic indicators having declined for many consecutive months, we believe caution remains the order of the day. The Fed has made it very clear it believes it will need to weaken economic demand sufficiently to put in motion a long-lasting decline in inflation. This means it will move rates higher from the “neutral” territory where they currently stand and into modestly restrictive territory over the coming months.

In the long run, we believe inflation is biased to be structurally higher than the Fed’s 2% goal but will move towards that level with much of next year in the 4-5% range. We are favoring intermediate and shorter-term debt, which offers better odds than cash to keep up with inflation, while their higher yields create a cushion against the impact of rates rising more quickly than what’s already expected and priced into bonds. Meanwhile, if the Fed tightens too much and pushes the economy into a recession – or even slows it down enough that long-term inflation expectations decline further – there might be some scope for limited capital appreciation in fixed income. In our view, corporations have locked in cheaper, long-term debt and have strong balance sheets such that a recession might actually help credit spreads not to widen too much as they usually would. Meanwhile the demand for safe assets in a recession could increase demand for bonds as long as inflation is on the wane.

With higher inflation still running the show, we believe most investors would do well to maintain something close to their long-term allocation to stocks and bonds, with stocks appearing slightly more attractive on the margin as lower commodity prices, global supply chain enhancements, strong payroll growth, and resilient corporate profits have been enough to improve sentiment after this year’s valuation reset. We continue to favor dividend growth and value stocks that offer income and/or lower valuations as capital gains could be harder to come by in a period where earnings growth may be tested and the cost of capital is rising. With an uncertain backdrop marked by slowing growth and rising interest rates, the JNBA Investment Committee believes volatility will present patient, disciplined investors with solid opportunities to add further to both stocks and bonds as investor fears vacillate between too high inflation and too slow growth. As such, we are not surprised nor worried to see a modest pullback as some investors sell to take profits as the investor pendulum has swung from overly pessimistic to something more optimistic.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at www.jnba.com/disclosure.