On September 17, the Federal Reserve announced a 25-basis point (bp) interest rate cut, in-line with market expectations while describing the decision as a “risk management cut.” This move comes amidst calming inflation trends and slowly but steadily rising unemployment rates. With the Fed aiming to provide a less constrictive environment as part of its dual mandate of stable prices and maximum employment, Chair Jerome Powell had this to say:

“Risks to inflation are tilted to the upside and risks to employment to the downside. A challenging situation. When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate. With downside to full employment having increased the balance has shifted.”

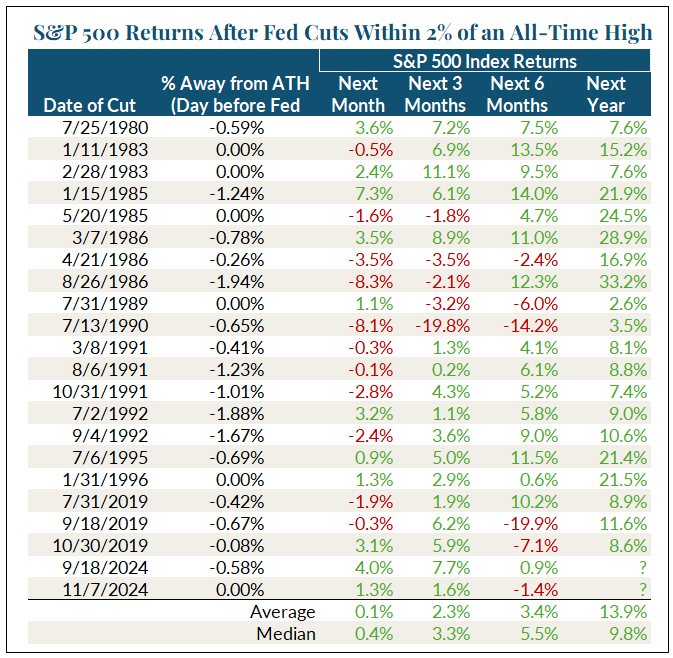

The main question for markets is how much further interest rates will be adjusted. The Fed is currently forecasting 50 bps of further cuts in 2025, but that will largely depend on future unemployment and inflation data gathered in the coming months. For now, although easing monetary policy when the market is at all-time highs may seem at odds, history shows the S&P 500 has often performed well in similar situations.

If you have any questions on the markets, current economic activities, or your investment strategy, please reach out to your JNBA Advisory Team.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at jnba.com/disclosure