What changes to make?

With May in the rearview mirror, most equity markets are broadly positive five months into the year; however, these figures are a bit deceptive. A weak start to the year, then a sharp April downturn before a rally throughout the last 1.5 months, created a bit more of a rollercoaster ride for equities than the YTD figures imply.

Whenever these periods of weakness occur, it’s common to hear the refrains to “stay the course” and focus on the long-term. This remains to be vitally important for long-term portfolios, and when we encounter clients feeling uncomfortable in the current environment, we always try to bring it back to the long-term picture and what has or may change in the next five years in their life.

More often than not, the strategy each investor was invested in months or even weeks prior to a downturn remains the optimal strategy. This can be a frustrating reality when the urge for action in volatile times to get a portfolio back on track feels so strong. While staying the course is important, there are still steps investors can take to potentially improve their long-term outcomes in light of recent damage.

Tactical Asset Allocation

To bridge the gap between the long-term strategy and current market conditions, the JNBA Investment Committee makes tactical asset allocation decisions with the goal of enhancing return or risk characteristics. The main tactical lever we utilize at JNBA is the overall allocation of stocks vs. fixed income/cash. We have built this strategy based on third-party models and our internal Investment Committee’s review of our client’s specific portfolio holdings. In practice, we adjust each portfolio’s U.S. Large Cap equity allocation by ~10% between stocks and bonds/cash. For example, a 60/40 balanced portfolio will adjust their stock exposure by roughly 6% based on the current environment, depending on each client’s unique situation.

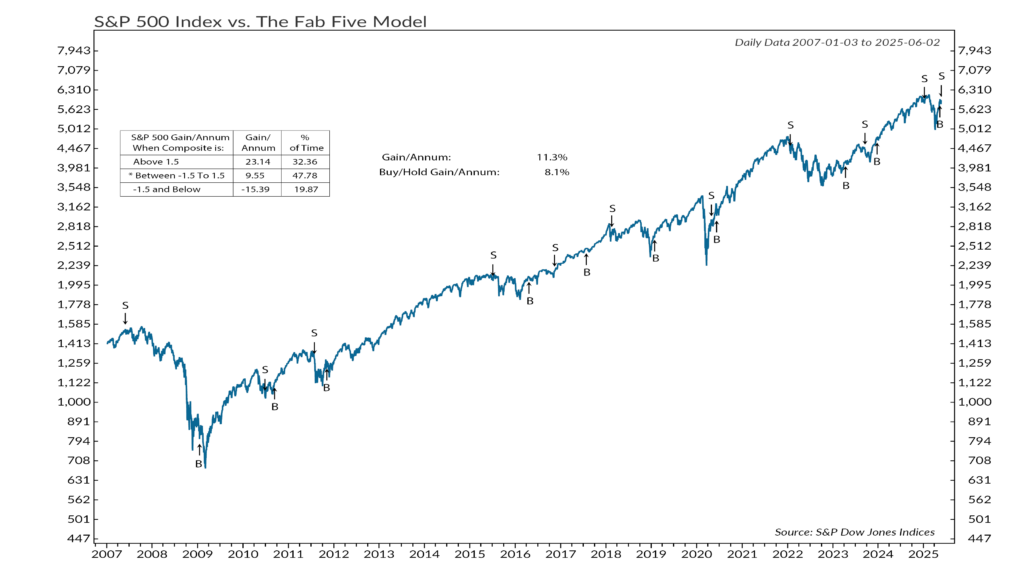

How often this shift is made is largely based on an external independent research provider, Ned Davis Research. They have developed a rigorous model based on economic and market data to determine when to be more or less exposed to the S&P 500 at various times. On average, the model typically shifts its recommendation 1.1 times per year, with recent shifts going underweight stocks in 2022 before shifting to overweight stocks in most of 2023 and all of 2024.

The track record and recent performance of the model is encouraging not only from pure performance, but also when reviewing the percentage of the time the model is “right” and the overall risk/return when the model is “wrong.” It can be challenging to implement models based on a variety of objective, data-driven metrics when we have a period such as the last couple of months.

So far in 2025, this stock vs. bond/cash model has been unusually active. The model has shifted three times already this year, most recently back to a more cautionary position in early June, with modestly positive results so far. This back and forth can be tricky from both a trading and tax management stance, but we remain diligent in reviewing each client’s individual portfolio and making changes in line with their unique strategy and tax plan.

While it’s uncommon to see so many changes in just five months, it begins to make a little more sense in the context of what’s going on in the economy and markets YTD. The unfortunate word of the year (or the last five years it seems) has been “uncertainty.” With recent policy, economic, and market data creating a frequently changing picture over the next 6-12 months, a model based on this data will naturally shift more rapidly and frequently than normal. The last similar instance of the overall model changing so quickly was in the middle of the COVID-19 pandemic.

While our Investment Committee evaluates each data point in the context of the environment for the majority of its decision making, we believe the long-term track record of these types of tactical shifts, while sometimes uncomfortable, provides strong alignment with our client portfolios and overall financial goals. At our core, we rely on diversified passive exposure to earn returns in-line with broader market indexes in any given year. At the margin we are value-oriented and opportunistic. Our time horizon is multi-year, with the foundation of our portfolios designed to meet the long-term financial life planning objectives of our clients.

As always, if you have any questions, please talk to your JNBA Advisory Team.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at jnba.com/disclosure