It’s been a bit of a chaotic start to the year and, as would be expected, JNBA has fielded a lot of questions about not only client portfolios, but the overall market environment in general. After a relatively strong first 6+ weeks of 2025, markets have pulled back from February highs, with the U.S. feeling the brunt of the pain.

Ongoing administration shifts around U.S. tariff policy have been front and center, with wide ranges of outcomes for what these policies will eventually look like if/when implemented. The percentage levied on countries, which countries will be impacted, sectors or specific goods, timing, and potential duration of tariffs have all been moving targets over the last few months. With so much turmoil surrounding these potential policies, the range of potential outcomes has widened considerably. When there are more scenarios to factor in, there’s more unpredictability. When there’s more unpredictability, risk assets tend to retreat before a clearer picture emerges. Undoubtedly, data will continue to flow in, but for now, estimates of the impact on GDP growth in 2025 vary from -0.5% to -1.5%, depending on the scope of tariffs and counter-tariffs considered. While certainly a drag on economic growth, it is not necessarily recessionary.

Purging of the federal workforce, tariff fears, and overall policy uncertainty have weighed on consumer and business sentiment, which could ultimately undercut the rebound in spending and investment that typically follows temporary weather-related disruptions. Rising geopolitical uncertainty, including the breakdown of U.S. support for Ukraine in the war against Russia, has also generally been viewed as negative. These risks will test the resilience of the U.S. economy in the months ahead. For now, unemployment remains low, personal income is growing at a solid pace, household debt service remains manageable, and credit conditions are broadly favorable – all of which support aggregate demand. With the Fed’s decision to hold rates steady at this week’s meeting, the financial markets will be laser focused on incoming data in these key areas over the coming months.

Amidst this dynamic environment, the JNBA Investment Committee made some targeted asset class weighting changes across the various portfolio strategies at JNBA. In early January, we reduced equity exposure relative to our base/neutral targets. The proceeds mostly went into fixed income and short-term U.S. Treasury Bills in an effort to counterbalance further downside equity volatility while earning 3-4+% interest along the way. (More information about the strategy shift can be found here.)

Taking a step back, it may be more helpful to share some of the key principles within our portfolios that won’t change in any given month or year.

Diversification

One of JNBA’s core principles is diversification. Diversification within the portfolio is maintaining exposure to various sub-asset classes in both stocks and bonds, whether that be international stocks, different fixed income holdings, or the overall balance between the two.

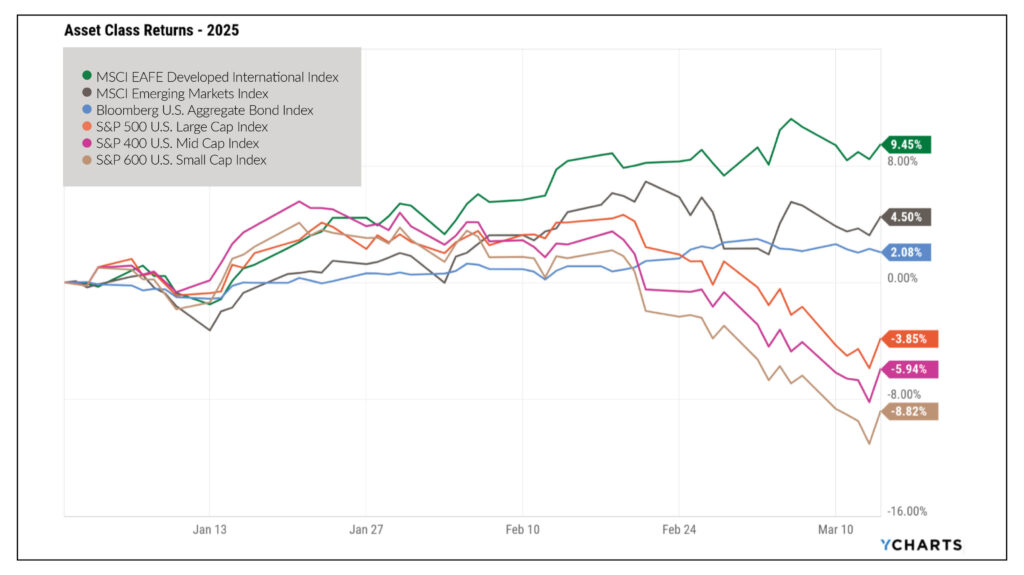

Diversification is especially important during more challenging and turbulent times. As it often happens, right about the time investors begin to question the merits of diversification in today’s world, real world events unfold that propel diversification back into favor. 2025 has thus far provided a great example of why Henry Markowitz, the pioneer of Modern Portfolio Theory, coined the phrase, “diversification is the only free lunch in investing.” So far, year-to-date, the best performer on average for many years now, U.S. equities, are negative, whereas historic laggards like international stocks are currently the best performing equities. Bonds have also done well, back to playing the needed role of steadier returns with a healthy coupon rate. This has led to more balanced portfolios with both stocks and bonds to be flat to modestly positive on the year, which may come as a surprise to investors focused on the day-to-day moves in the popular U.S stock indices.

By maintaining exposure to various asset classes, the JNBA Investment Committee can keep portfolios more in alignment with the long-term strategy, while remaining flexible enough to navigate the challenges that exist within the markets, as well as clients’ situations and life transitions.

Volatility and Market Timing

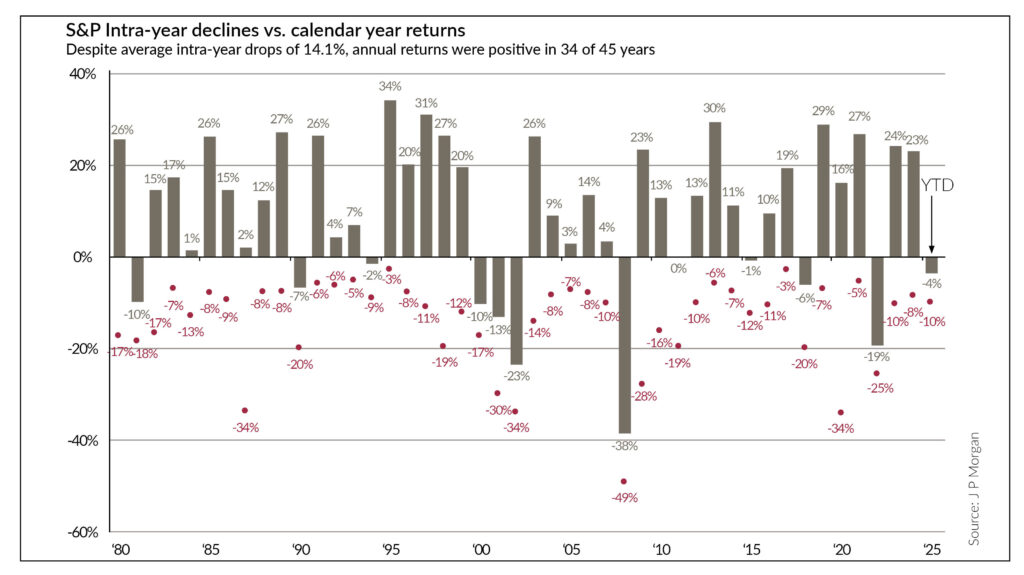

While these periods of volatility are never ideal and certainly never enjoyable, they are far from uncommon. Over the past 45 years, the S&P 500 has averaged an intra-year drop of ~14%. Despite this fairly large pullback that typically happens each year, annual returns for the S&P 500 have been positive in 34 of the last 45 years. According to Ned Davis Research, Inc., since 1928 there has been a 10% or more drop in the markets 1.2x per year on average.

While periods of volatility should be expected, it’s only natural for an investor to feel the need for activity. While being flexible is important, it is rarely beneficial to make large shifts in strategy during periods of market volatility. Multiple statistics illustrate that investors often end up buying back into stocks at a price higher than where they sold, thus resulting in the exact opposite outcome of what was desired. Substantial changes in strategy should instead be a well-thought-out transition that occurs when there is a rational discussion around whether there have been any changes in overall life circumstances or goals for the investments, rather than shorter-term fluctuations caused by external market forces.

We want to emphasize that our portfolio strategies have factored in historic ebbs and flows markets have taken over various periods and built projections that include stretches of volatility or poor performance. We believe time in the market and a portfolio that aligns with your long-term plan is more valuable than timing the market.

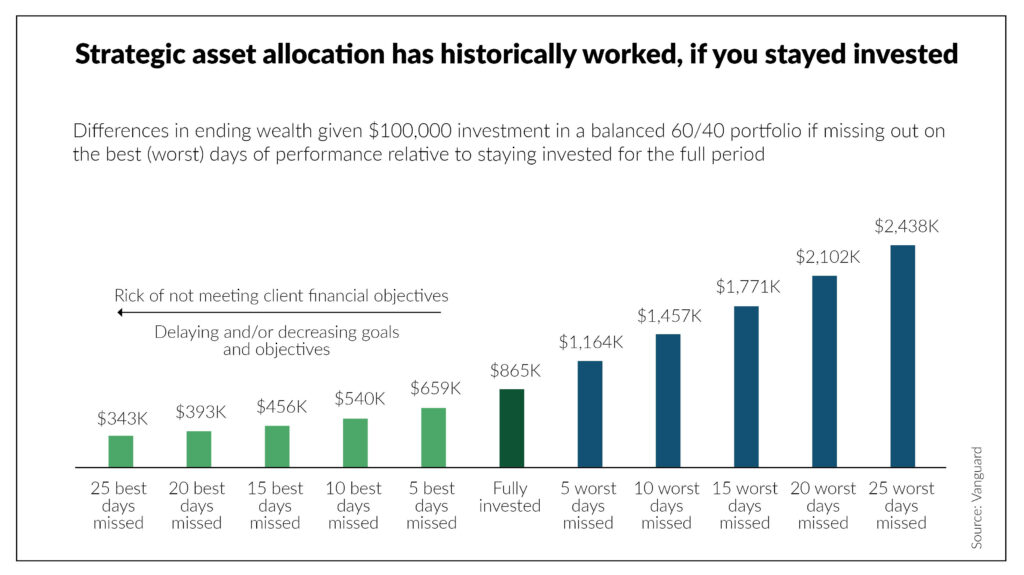

The above graphic highlights the damage that can be done from missing even a small number of the best days markets have historically offered. The important detail within the “best days” occurrences is that they have overwhelmingly come right in the middle of larger market pullbacks.

The best days often follow the worst days, and the damage that is often done by exiting financial markets (which typically occur when things are performing at their worst) can be very difficult for a portfolio to recover. It is very rarely the case where an investor will look back in their portfolio and say the reason for success was the ability to time market tops and bottoms. More often, we see the increased damage that can be done during those periods where there’s heightened emotion involved in the decision and a greater focus on the short-term environment.

It’s certainly understandable to want to “do something” when the dramatic headlines are as frequent as they are now. At JNBA, we firmly believe that by aligning our investment time horizons with our client’s long-term goals and objectives, clients can feel more at ease with the day-to-day headlines as they progress through volatility in the market.

What we’ve presented here is likely something each investor has heard before, but it’s always worthwhile to be reminded of how important it is to stay the course while still having flexibility to adjust portfolios when opportunities present themselves. If you have any questions or want to talk further with your advisor or a member of our Investment Committee, please don’t hesitate to reach out. All of us here at JNBA appreciate the opportunity to serve as advocates for not only your investment portfolios, but your long-term financial life plans.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at jnba.com/disclosure