As we look towards 2024, now is a great time to review the upcoming changes across several areas that may impact your financial plans for the next year. We have compiled the specifics here to help you start thinking about how these changes fit within your overall financial life plan.

IRA Contribution Limits

The maximum amount you can contribute to a Traditional IRA or a Roth IRA in 2024 is $7,000 (or 100% of your earned income, if less), which is an increase of $500 from 2023. The maximum catch-up contribution for those age 50 or older remains an additional $1,000. You can contribute to both a Traditional IRA and a Roth IRA in 2024, but your total contributions cannot exceed these annual contribution limits of $7,000 between both accounts. It is important to note that there are income limits as well as nuances to tax deductibility for both of these retirement savings vehicles.

Traditional IRA Income Limits

The income limits for determining the deductibility of Traditional IRA contributions in 2024 also have increased. If your filing status is single or head of household, you can fully deduct your IRA contribution in 2024 if your modified adjusted gross income (MAGI) is $77,000 or less (up from $73,000 in 2023). If you are married and filing a joint return, you can fully deduct your IRA contribution if your MAGI is $123,000 or less (up from $116,000 in 2023). Note that these figures assume you are covered by a retirement plan at work. If your income is above these MAGI amounts, consult your tax professional as you may be eligible for a partial deduction up to certain income limitations.

If you are not covered by an employer plan but your spouse is, and you file a joint return, you can fully deduct your IRA contribution if your MAGI is $230,000 or less (up from $218,000 in 2023) and eliminated if your MAGI exceeds $240,000. Single filers, head-of-household filers, and married joint filers who are not covered by an employer plan can generally deduct the full amount of their contributions with no income limitations.

Roth IRA Income Limits

The income limits for determining how much of the $7,000 contribution amount you can contribute to a Roth IRA have also increased for 2024. If your filing status is single or head of household, you can make a full Roth IRA contribution if your MAGI is $146,000 or less (up from $138,000 in 2023). And if you are married and filing a joint return, you can make a full contribution if your MAGI is $230,000 or less (up from $218,000 in 2023). Again, contributions cannot exceed 100% of your earned income. If your income is above these MAGI amounts, consult your tax professional as you may be eligible for a partial contribution up to certain income limitations.

Employer Retirement Plans

In 2024, most employer retirement plans are experiencing an increase to deferral limits. The maximum amount you will be able to contribute (your “elective deferrals”) to a 401(k) plan is $23,000 (up from $22,500 in 2023). This limit also applies to 403(b) and most 457 plans as well as the Federal Thrift Savings Plans. If you are age 50 or older, you can also make catch-up contributions of up to an additional $7,500 to these plans in 2024 (the same as 2023). Special catch-up limits apply to certain participants in 403(b) and 457 plans. The amount you can contribute to a SIMPLE IRA also increased to $16,000 in 2024, and the catch-up limit for those age 50 or older remained the same at $3,500.

The maximum amount that can be allocated to your account in a defined contribution plan (for example, a 401(k) or profit-sharing plan) in 2024 is $69,000, up from $66,000 in 2023. This includes both your contributions including catch-up and your employer’s contributions.

Health Savings Account (HSA) Limit

For 2024, annual savings limits have increased for individuals and families saving into Health Savings Accounts. For the upcoming year, an individual can contribute up to $4,150/year. A family (a plan covering more than one person), can save up to $8,300/year. Those who are turning 55 or older in 2024 can contribute an additional $1,000 “catch-up” amount to their HSA.

Qualified Charitable Distribution (QCD) Adjustments

Individuals over age 70.5 can distribute funds from their IRA accounts directly to a qualified 501(c)(3) organization and have that distribution not counted as income for the tax year. In prior years, this was limited to $100,000 per person. Beginning in 2024, the limit will now be linked to the rate of inflation. The 2024 QCD limit is $105,000 per person.

Medicare and Social Security Adjustments

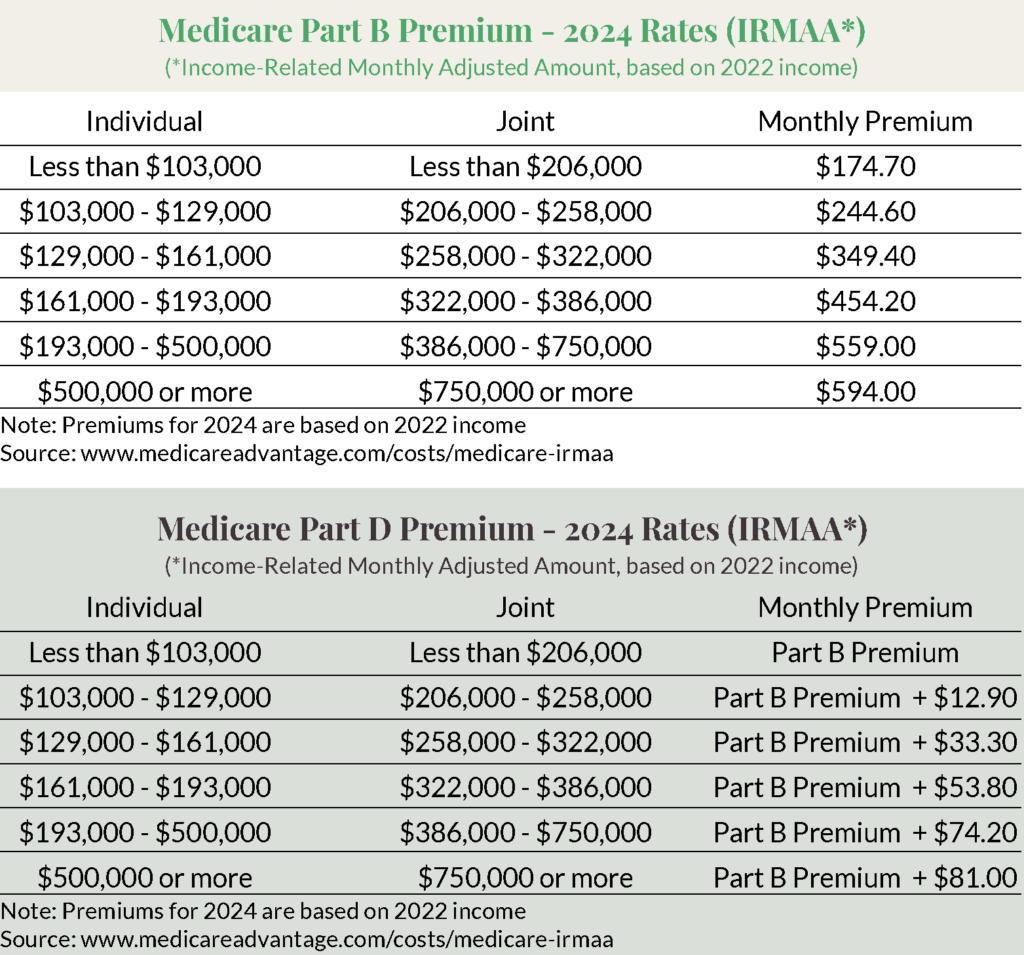

The Centers for Medicare & Medicaid Services (CMS) has announced the new supplemental Part B and prescription drug Part D premiums for calendar year 2024, which are detailed in the tables below.

The Social Security cost of living adjustment (COLA) is 3.2% for 2024.

Annual Gift Tax Limit

The 2024 gift tax limit is $18,000 (increased from $17,000 in 2023). For married couples, the limit is $18,000 each for a total of $36,000. If you gift more than this sum to any one person, you must file a federal gift tax return.

If you have any questions about these new 2024 numbers and how they could impact your financial life plan, please contact your JNBA Advisory Team.

PLEASE NOTE: JNBA is neither an attorney nor accountant, and no portion of the above should be construed as legal or accounting advice. All legal and accounting issues should be addressed with the legal and accounting professionals of your choosing.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at www.jnba.com/disclosure