After a challenging 2022, YTD performance up 20% in the S&P 500 through July has been a welcomed reprieve, despite the pullback and volatility we have been experiencing in August. Within this strong performance backdrop, there have been constant concerns around Fed interest rate hikes, banking sector turmoil, debt ceiling debates, and a potential recession leading many investors to feel that things could change at any moment.

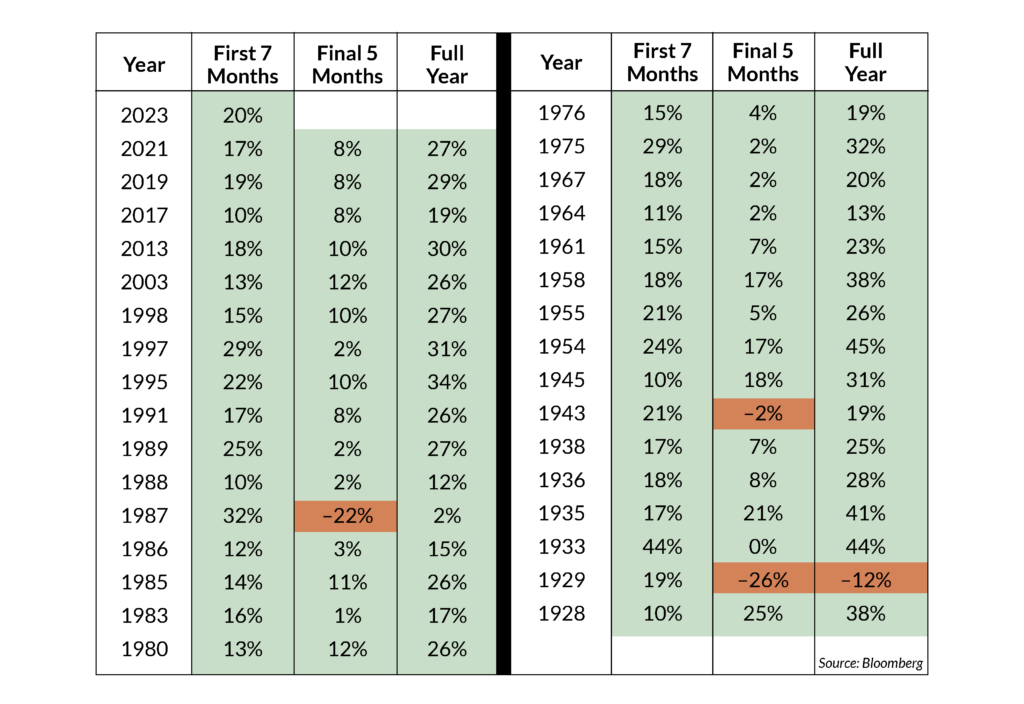

While these worries are certainly fair, history provides a compelling case that markets may have more resiliency following strong performance than one would expect. Since 1928, there have been 32 years where the S&P 500 has been up +10% or better though the first seven months of the year. In those 32 years, there have only been three previous instances where the following five months of the year were negative, and only one such year where that negative performance resulted in the full year results turning negative.

Overall, the historic data shows that markets typically fare well after rallies to start the year, albeit at a bit more moderate pace. For the three negative results to occur, something as severe as the 1929 or 1987 market crashes were needed to reverse the trend.

Previous years can give a bit more comfort for the here and now, but it’s fair to say few predicted the extreme market corrections that dislocated markets in 1929 or 1987. The recessionary concerns markets have been fixated on for months may fit that narrative, and so far, weaker performance in August has begun to raise some anxiety.

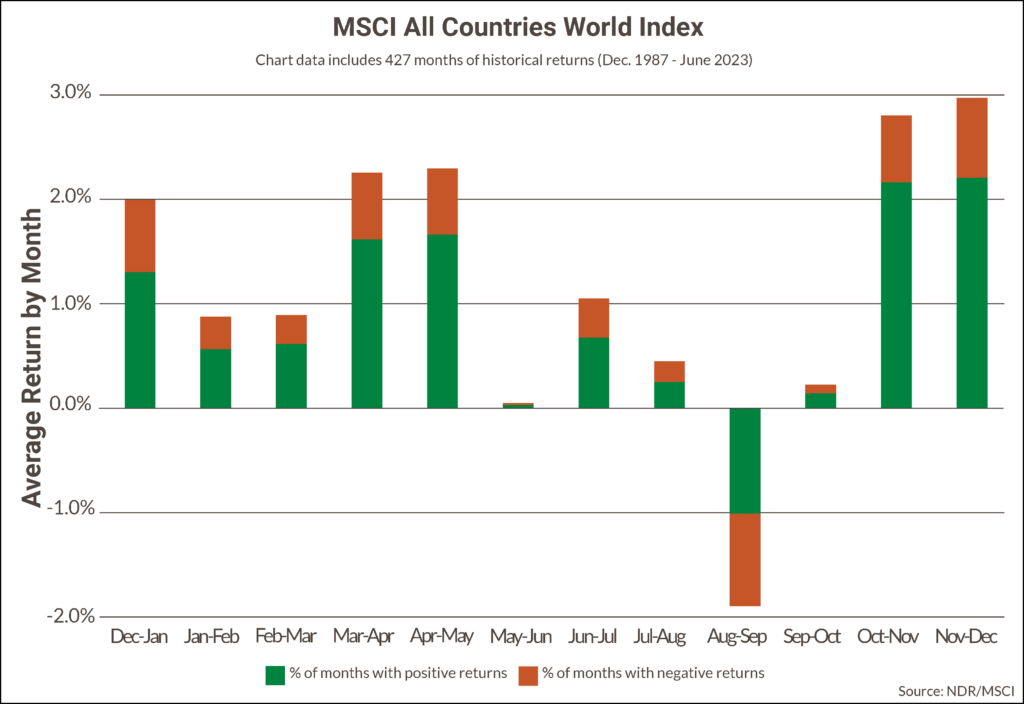

As shown in the following chart, historic market data can provide some context to how normal this mild rough patch has been with August and September historically being a year’s weakest two-month span with a mean drop of -1.9% in global stocks since 1987, the only negative two-month period. August through October typically has also been the weakest three-month stretch. However, the bright side is that seasonal influences historically have then taken a decisive turn for the better, with October through December the year’s best three-month period.

While the investment world can never stress enough that past returns do not guarantee future performance, the historic performance of markets certainly fits a narrative for further potential upside, albeit with potentially higher volatility than the first half of 2023. Regardless of what the past says, we remain positioned for a variety of scenarios. The context of an average weaker August through October stretch does not give free reign to write off meaningful market and economic activity.

The downgrade of U.S. debt by Finch in early August certainly meets this criteria which was primarily driven by the increasing debt load for the U.S., as well as continued governance issues around how each debt ceiling level has been handled in recent years. While it’s hard to argue with these points, they certainly aren’t a new development, and we have seen markets digest and eventually shrug off a similar credit downgrade by Standard & Poor’s in 2011.

U.S. Treasuries remain one of the most liquid and traded assets in a world with increasingly fewer alternatives. The credit downgrade from AAA to AA+ also does little to change the overall risk criteria or metrics for the primary users of these securities (i.e., banks, pensions funds, currency traders) so far resulting in minimal disruptions across equity and fixed income markets.

From a broader perspective, we are still focused on the key drivers for longer-term performance going forward: unemployment, inflation, and corporate earnings. As we near the end of summer, these metrics continue to provide reasons for optimism. So far unemployment has remained very healthy, inflation remains on a downward trend, and earnings have continued to provide upside surprises in increased positive revisions.

Going forward, pricing in these more optimistic scenarios may be a delicate balance. A strong seven months and improved chances for a ‘soft landing’ for an economy coming off a period of rapid inflation and growth has raised expectations across markets. A challenging start to August in both equities and bonds, with long-term rates reaching their highest levels since 2008, has resulted in a quick reset to those expecting rates to lower alongside an eventual recession. While any positive surprise in early 2023 was rewarded, the bar for the economy looking ahead appears to have been raised, and continued corporate earnings growth will be vital for further market upside.

Across JNBA portfolios, we have a broader exposure in equities with a slight bias towards Value and Quality which we believe could provide a more defensive posture should sentiment or economic activity begin to deteriorate. Overall, the Investment Committee is remaining opportunistic and would rather maintain a bit heavier exposure to the potential in equity markets knowing that we are still well below 2021 highs as long as economic activity continues to provide modest upside surprises. That said, we’re remaining vigilant and flexible letting the historic upside returns that equities have provided serve as our starting point as the year unfolds. If you have any questions about your portfolio, please reach out to your JNBA Advisory Team.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at jnba.com/disclosure.