With the U.S. Congress passing legislation to lift the government’s debt ceiling this week, it appears a large overhang to recent months has been removed, and the markets have already been focusing on other things.

The continued area of attention is the familiar debate on future rate hikes. Pundits have been talking about a “pause” and a “skip,” but the market-implied odds of a hike have been creeping higher, thanks to persistent robust economic data and firm inflation data which came in hotter than expected last Friday.

While the rapid rate hikes were the main source of pain for both stocks and bonds in 2022, the market has been surprisingly resilient so far with the broader S&P 500 up approximately 10% YTD. To date, this corporate earnings season has been solid, while we have seen increased valuations drive this year’s rally despite small changes in earnings outlooks.

This “risk on” sentiment has likely been fueled by several factors – from an approaching end to the rate hike cycle, to recessionary forecasts that continue to be pushed further into the future, or simply a reversal of sorts to a potential overreaction we saw when both stock and bond markets fell in 2022. While the headlines that matter have changed, it seems heightened sensitivity and volatility we have seen over the last 3+ years continues to lurk under the surface.

When we encounter increased volatility, we first focus on current risk exposures within our existing positions. Portfolio exposures must be well understood not only on their specific attributes, but also by how macro events such as pandemics, geopolitical conflicts, or significant shifts in monetary policy may affect specific holdings. A large array of scenarios needs to be considered and measured on the appropriate timeline and risk preference.

These same factors also should be considered when evaluating new opportunities. The difference is that in general, heighted market volatility may necessitate even greater conviction in an idea, a more unique opportunity, or a more enticing valuation than when evaluating normal opportunities. This “bar of conviction” is naturally adjusted to reflect the current environment, and in times of market stress, it may be raised. The key is determining how high the bar of conviction should be set.

When looking at an investment, sometimes the macro environment may dictate how to proceed, and adapting and remaining flexible become just as important as an investor’s skill and resources, as well as staying in the game. Having the capital available, the patience to wait for an opportunity and the flexibility to move quickly along with the right timeline, perspective, and ability to trust in your conviction often provides the best chances for long-term success.

Within this current backdrop, we are incrementally constructive on stocks across most strategies. With earnings season largely complete, the potential for rates to level off over the coming months, and continued mixed economic variables, the key catalysts to monitor over the summer will be similar to what the Fed is watching: ongoing fluctuations with inflation as well as any changes in the unemployment picture.

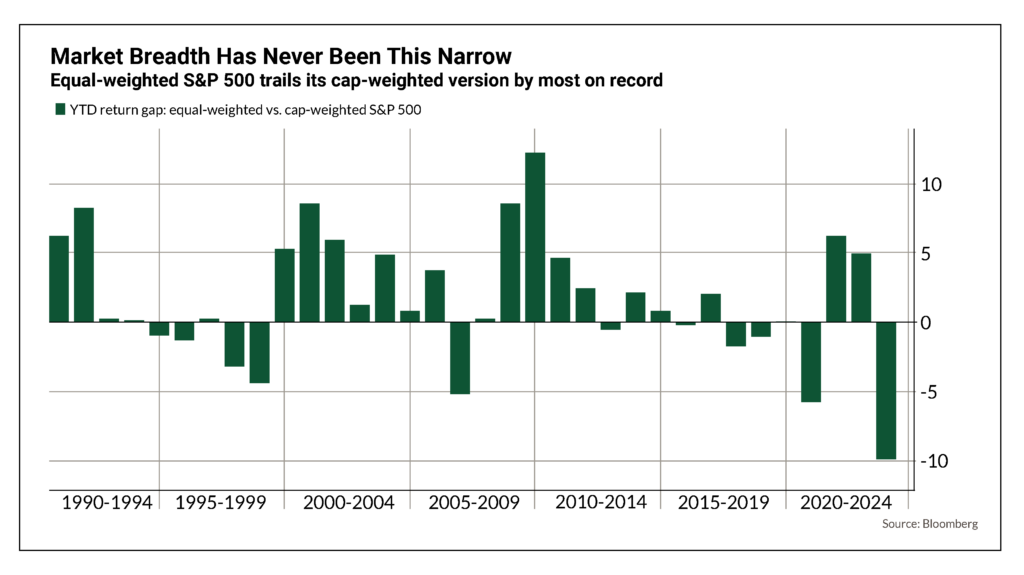

The JNBA Investment Committee is also monitoring what has been a fairly concentrated rally in equities. We’ve seen strong performance from large cap technology names driving total market returns while small caps and traditional dividend/value segments have lagged. Year-to-date, the tech heavy NASDAQ 100 is up approximately 30% while the Dow and Russell 2000 indexes are roughly flat. To look at it another way, the S&P 500 has had a 10% gain YTD. If we take out the effect of the select large technology firms and simply weight all 500 companies within the index equally, the return drops to -1% for the year, creating a performance gap of roughly 10% between the S&P 500 and an equal-weighted index. (See chart below.)

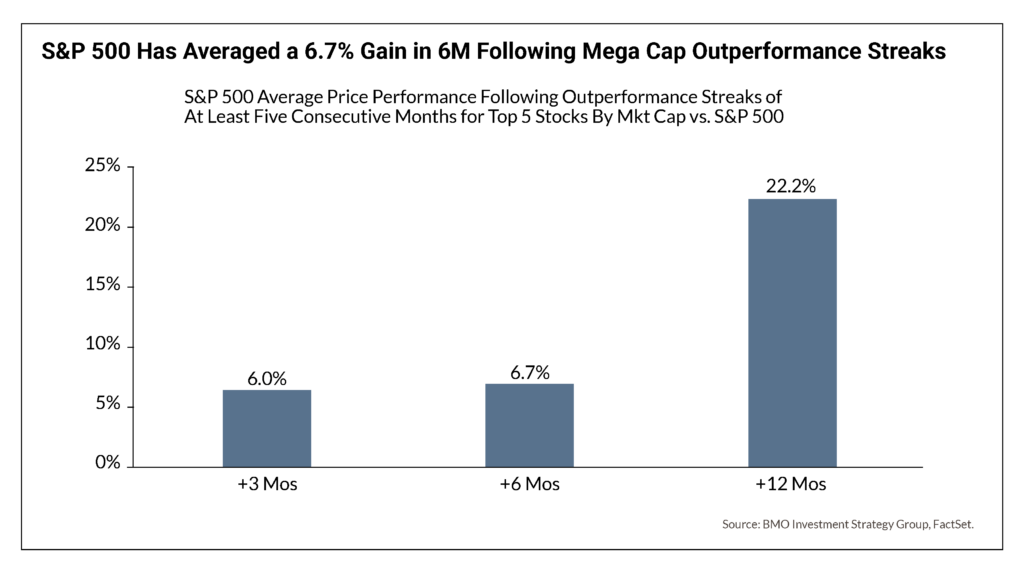

While such disparity isn’t unheard of, historically this hasn’t been a bad thing for markets. In the past, the S&P 500 has posted strong performance in the next 3, 6, and 12 months following similar periods of Mega Cap performance. While the past doesn’t predict the future, we believe opportunities may emerge as different sectors and segments of the market normalize.

The JNBA Investment Committee is also focusing on de-risking portfolios where appropriate, reducing credit exposure within our fixed income holdings while maintaining above-average cash levels to remain flexible for opportunities on the horizon. We continue to be long-term focused but near-term flexible as we navigate a continually dynamic environment. As always, please reach out to your Advisory Team with any questions you may have.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at jnba.com/disclosure.