After investor pessimism reached extreme levels earlier this month and the market fell to a two-year low in intraday trading on October 12, equity sentiment has since reversed and stock markets have rallied rather sharply. At a high level, financial markets discount the future – and a lot of bad news had already been priced into both stocks and bonds prior to this latest rally. This helps explain why after five and a half months of falling during the first part of the year, the market has been able to largely trade sideways, even in the face of 2022’s worst inflation figures and the growing probability of recession. More recently, headline inflation numbers have started to confirm that inflationary pressures may have peaked, and this better economic news has fueled optimism that the Federal Reserve is nearing the eventual completion of one of the most aggressive rate-tightening cycles in decades.

With the midterm elections now behind us, we believe the likelihood for additional stimulus is somewhat limited, which should comfort those worried about inflation. More recently, improving sentiment in China around the possibility for a re-opening of their very big economy has lifted investor spirits – after all, emerging markets have been weighed down by the burden of a strong dollar for nearly a year, and it is difficult for the U.S. economy to grow when the rest of the world is facing a recession.

Aside from some high-profile earnings misses, third-quarter profit reports were not as bad as feared, and we are starting to see the downward earnings revisions that are necessary for investors to conclude that a recession has been priced in – at which point they’ll hopefully look “through the valley” to the next economic upturn. Currently, the low single-digit earnings growth penciled in for 2023 would probably need to be cut by at least another 10-15% to reflect the likelihood that consumers would become more cautious in the face of an economic slowdown. That said, with corporations having “termed” out their debt (at low rates) so that it doesn’t mature all at once, we believe any recession is likely to be on the short and shallow end, especially if the war in Ukraine comes to a conclusion and/or if China stimulates its economy and reengages with the rest of the world.

The clear message from the Fed at their November meeting was that they would go slower for longer to be able to see how their prior hikes were impacting the trajectory of both inflation and economic growth. There is still a small risk that even if inflation slows, it could settle at too high a level and change the expectations of consumers, so the JNBA Investment Committee will be closely watching incoming data. Just as one robin does not make a spring, we believe the Fed will similarly be looking for additional data points to suggest that inflation is clearly on the wane before they consider pausing. We still expect rates to be held at elevated levels for some time so that inflation doesn’t become too entrenched with workers demanding much higher wages. Falling inflation also could improve investor confidence by enough to offset any pressure higher bond yields might have on stocks.

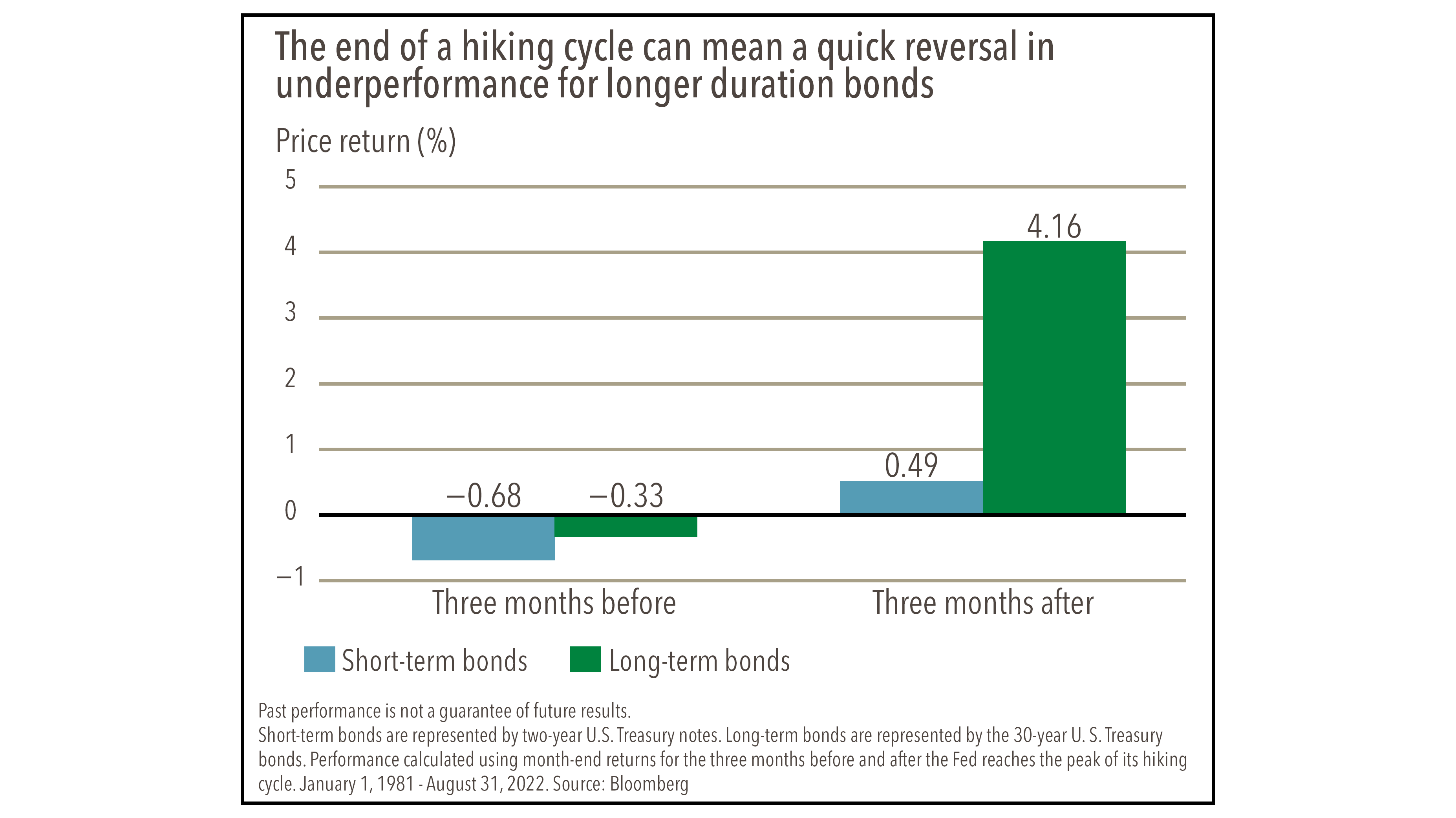

Our research and time-tested process has helped the JNBA Investment Committee stay on the right side of the major moves in markets in 2021 and 2022, and we are cautiously optimistic that both bonds and stocks are priced to have a much better 2023, even if the fundamental economic news isn’t all that much to write home about. Lately, we have found some opportunities in smaller companies as well as infrastructure-related stocks, and we anticipate adding to bonds more aggressively before the Fed is done tightening (see chart) as historically longer-term interest rates fall before the final rate hike of a tightening cycle is in. We will continue to be cautious in our deployment of capital into stocks as soft economic landings are rare and none have ever been achieved with inflation at these levels.

With most major stock markets well off their highs, we are likely to begin adding to stocks if the market dips at a faster pace than earnings are deteriorating as we know that trying to time the bottom in volatile markets rarely works out for even the most astute investors. Instead, we believe investors should focus on longer-term positives which include valuation ratios returning close to long-term averages as well as the historical track record which suggests markets do well after midterm elections (especially with a split government), after a bear market, and at the end of the calendar year.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at www.jnba.com/disclosure.