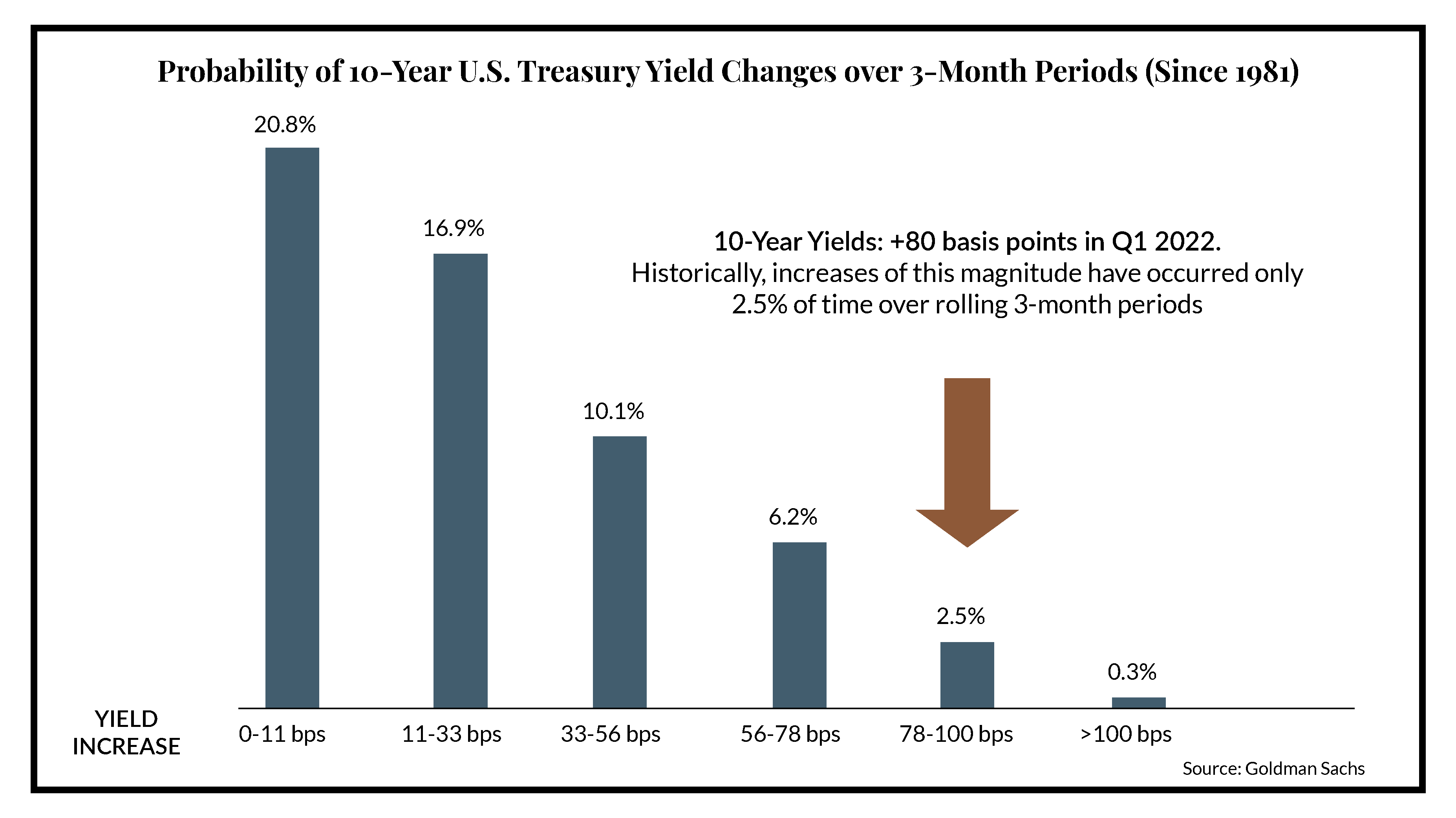

Yesterday’s market swoon, the largest daily decline in almost two years, was fueled by concerns that some of the ugliest earnings reports from retailing powerhouses like Walmart and Target will spread to other types of businesses. While much of the data seems to indicate that household balance sheets remain strong, and retail sales earlier this week revealed a consumer that appears eager to spend, it is becoming increasingly clear that many businesses are struggling to adapt to inflation, dealing with staffing shortages, facing consumer demand shifts from goods into services, and absorbing higher supply chain costs from both freight and energy. As such, we believe the probability of a mild recession has increased as inflation is receding too slowly for consumers and businesses and now appears to be undercutting confidence in economic growth. The fixed income markets began to reflect this earlier this month after an extremely rare (see chart above) but horrendous first quarter with 10-year treasury yields rising above 3% for the first time in many years. The one silver lining is that bond yields have stabilized over the last few weeks, even as inflation continues to make headline news, at least providing diversified investors some benefit after their worst start to a year ever.

Key Areas of Focus

As we look for opportunities, our Investment Committee searches for major disconnects between the prices of securities and the fundamentals behind those companies. Today, we feel there are very few glaring mispricings in today’s markets as security prices have largely embedded how fundamentals might unfold in today’s economic situation.

The market has sold off hard, and most major indices have now declined close to 20% or more. Typical declines without a recession rarely extend much beyond 20%. With a recession they might fall another 10-15%, so if history is any guide the stock market is likely getting close to what will be the bottom for this move. We’ll feel more confident that a recession has been priced in if we see earnings estimates revised lower. If the market holds steady at that point, then it may be a good time to ratchet up equity exposure compared with simply avoiding it altogether and missing the furious rallies that often occur amidst bear markets. If the economy proves resilient in the face of a tightening Fed and no recession occurs, then the market slide has moved beyond what is associated with a normal “correction,” and would represent a reasonable entry point for long-term investors.

It is unequivocally clear to us that restoring price stability is the Fed’s number one priority. We believe a mild recession would be a “less worse” outcome than stagflation (defined as low growth plus high inflation). Neither are pleasant for markets, but on the cusp of entering a bear market with various markets down nearly 20% or more, there should be some opportunities ahead for patient investors. We believe inflation is the primary culprit and feel confident that a combination of additional rate increases, no more fiscal stimulus, and the start of quantitative tightening will eventually take the wind out of its sails to a noticeable extent.

Our Investment Committee also feels household and bank balance sheets are currently healthy enough, and the unemployment rate low enough, that corporate earnings should not fall off a cliff as the Fed tightens, since overly accommodative monetary policy over the last few years has led to an economy without any serious imbalances. If there is a bear market, we think it could be over more quickly than most since valuations have become more attractive and the severity of economic stress could be manageable.

Managing Through Volatility

Many investors when faced with adverse circumstances feel compelled to “do something” or try to find a quick solution. The S&P 500 has fallen 20% from its highs on 10 different occasions since 1950 and has recovered every time – and stocks usually turn higher before an upturn in the economy is visible to the vast majority of people. Pulling money out of the market in times like these has potential longer-term side effects as historically if you miss sharp rallies off the bottom, you do not benefit from the updraft (i.e., market is up 15% over a couple weeks so you lose 1.5% annually over 10 years on the stock portion of your portfolio if you do not participate in the rebounding market).

Faced with few compelling places to hide out and nearly all major asset classes struggling, we believe that becoming more defensive earlier this year, continuing to hold above-average levels of cash, and employing broad diversification have been prudent steps to mitigate the impairment of long-term capital. At the moment, there is no doubt that big market declines are unnerving and media pundits are tripping over one another to outdo themselves with doomsday scenarios. But it is critical to tune out the low probability events and remind yourself that your financial plan and investment strategy were developed together based on both historical and forward-looking assumptions – which absolutely include volatile periods like we are experiencing in the markets today. As your financial advocate, rest assured the JNBA Investment Committee will continue to navigate any remaining volatility that lies ahead by staying focused on key indicators. We will respond in kind to any shifts in the economic outlook that warrant changes to the underlying structure of your portfolio, while maintaining exposure to the upside that will likely come when markets regain certainty around the underlying trend in earnings and inflation.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at www.jnba.com/disclosure.