There is no doubt that the ongoing developments in Russia and Ukraine are not only fluid, but also unprecedented in recent history. While our hearts certainly go out to all the individuals and families impacted by the humanitarian crisis overseas, one of our core job functions, and why people hire us, is to analyze the environment and make well-thought-out and unemotional decisions as it pertains to our investment strategies and positioning client portfolios. We’d like to take a moment to share what could still be ahead and address how this might impact inflation, global growth, and central bank policy.

Sanctions from the global community have impacted both financial markets and volatility. Oil jumped to its highest levels in eight years and is back above $107 per barrel (highest since 2011), while numerous global technology and logistics companies are pausing/ceasing operations in Russia. However, from the market close on Wednesday, February 23, through today, the S&P 500 is up 3.8% since the invasion began. This illustrates how often markets discount the future – an invasion was more than priced into the market in the first half of February, as the bellwether S&P 500 finished lower for the month overall down 3% (-8% YTD through Feb).

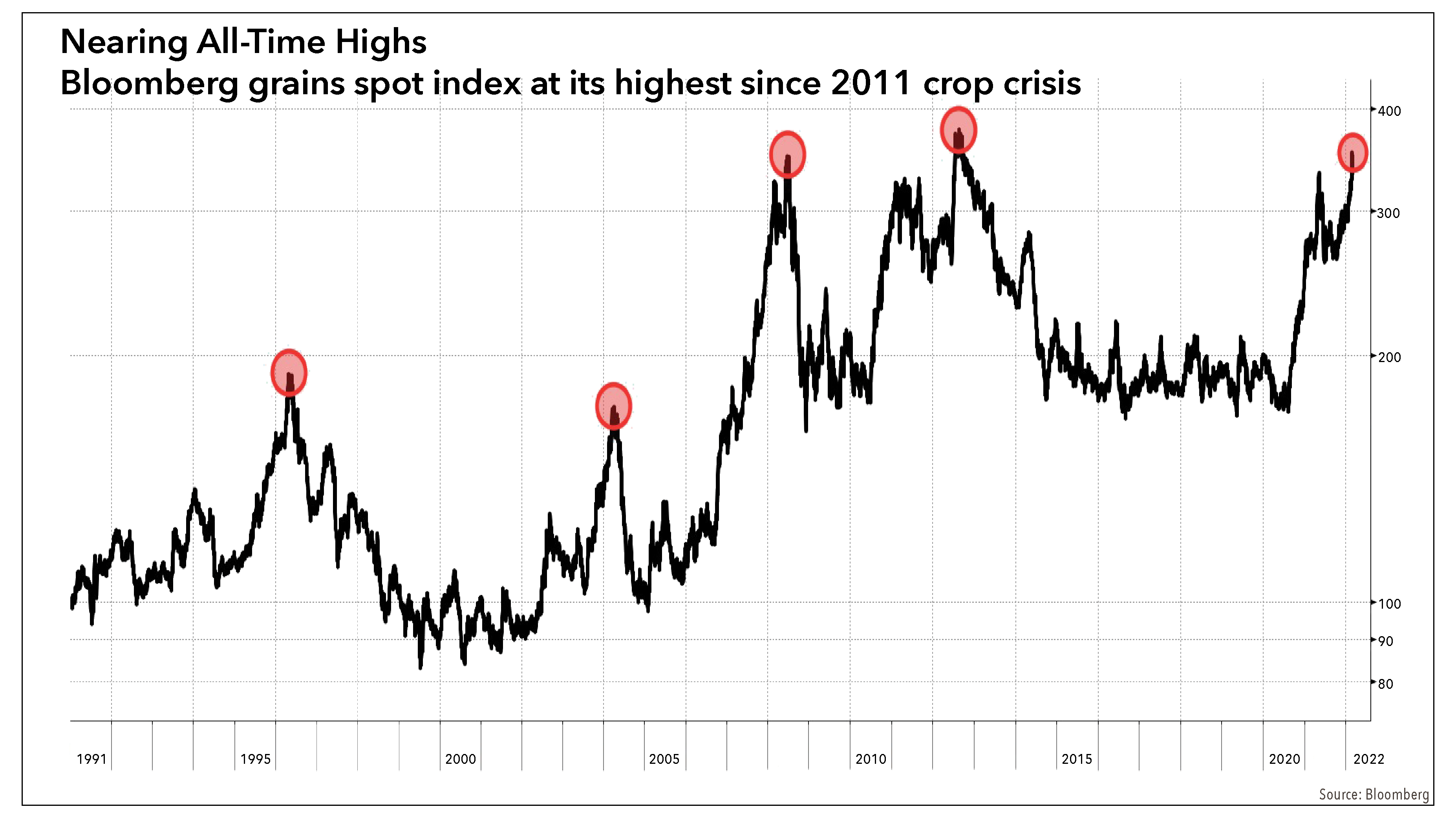

While corporate fundamentals remain strong for the time being, geopolitical risk threatens that calculus if the Federal Reserve or other central banks need to accelerate their interest rate hiking campaigns to deal with growing price pressures fueled by tight labor markets and now fresh and unexpected supply chain disruptions. Russia is a very large global commodity exporter and that will no doubt impact wheat, corn, and energy prices and availability throughout Europe and Asia (see chart above).

We feel that heightened volatility will likely persist for some time given a lack of clarity on the myriad of paths this situation could take from here. Overall, we see the latest developments as a negative for the underlying dynamics of growth and inflation. Clearly, economic growth was already slowing and will likely decelerate further as economic sanctions disrupt global trade, unfortunately, just as COVID-related supply chain pressures were beginning to ease. In fact, the most recent estimates for 1st quarter growth are now in the 0-2% range for U.S. GDP. We see greater risk for sustained higher inflation in the wake of recent events. As such, we tend to be positioned with above-average cash positions including our inflation hedges, and have reduced equity exposure where appropriate, to become slightly more defensive as fat tail risks have increased by a decent amount.

In the weeks ahead, we’ll be watching a few things closely to guide our thought process for managing portfolios. First, any changes in longer-term inflation expectations that may be incorporating challenges that are longer term in nature. Second, signals from the Federal Reserve as it relates to the timing and magnitude of future rate hikes. And finally, credit spreads and nominal interest rates which might indicate that monetary policy is tightening too quickly and pushing up the risks of a recession. In the view of the JNBA Investment Committee, our current positioning gives us adequate scope to deal with all these challenges until more clarity emerges.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at www.jnba.com/disclosure.