Financial market volatility resurfaced last month with stocks falling the most since March 2020 as elevated inflation (+7.5% year-over-year in January), rising interest rates, and waning central bank support all combined to dent consumer sentiment while clouding otherwise positive jobs data and earnings reports.

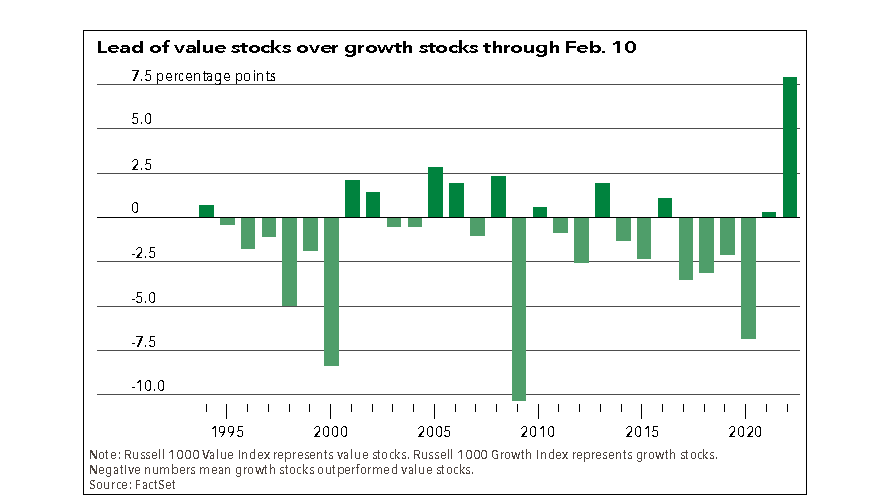

Markets have recovered a portion of their losses through mid-February, but it is clear volatility remains elevated for many asset classes. Despite some tough sledding last month, there were still opportunities to enhance portfolios – value stocks posted their biggest month of relative outperformance against growth stocks since the dotcom bubble (see chart), and the average dividend paying stock in the S&P 500 outperformed nonpayers by more than 6%, the most in 17 years.

Recently, COVID trends have shown improvement and many “economic reopening” stocks are performing much better. Additionally, despite pressures around supply chains and input prices, corporate earnings remain robust thanks to strong demand, even though we are seeing fewer companies beat estimates and simultaneously increase earnings guidance. Expectations appear to have finally caught up to reality. More volatility, not less, can be expected as financial conditions now start to tighten.

Geopolitical Tensions

Rising tensions with China and Russia also loom large in the background, with possible military conflict only increasing the likelihood of higher energy prices and more pressure on global supply chains. Energy stocks have done well lately thanks to higher oil prices, but an invasion would likely boost them even further given limited OPEC+ supply, so the timing is less than ideal.

At this point, we believe our combination of inflation hedges are effective at mitigating much of this risk. Commodity producers are the cheapest they’ve been in the last 100 years on some measures, even as inflation has ticked above 7%. The strategic case for resource stocks is compelling, offering investors the potential for excess returns, diversification, and inflation protection.

Inflation and Rate Hikes

The JNBA Investment Committee has slightly decreased its targeted allocation to stocks as a more hawkish stance by the Fed, with its updated plans for faster-than-expected interest rate hikes, has pushed up short-term rates and subsequently flattened the yield curve. The speed and magnitude of the move higher in short-term rates over the last several weeks has been noticeable, as investors fear an overly aggressive Fed may derail the economic expansion that is currently underway.

The Fed remains concerned about persistently high inflation and has not only accelerated its taper timeline, but has also opened the door to rate hikes starting next month. Other major central banks are also moving away from extreme accommodation, which is helping reduce the gravitational pull downward on U.S. Treasury yields. In addition, after financing the majority of treasury issuance since 2020, the Fed is now willing to end the purchase of treasuries, and that can put pressure on the bond market as well.

From an investor’s point of view, it’s really all about how many more rate hikes might happen (and how quickly) beyond what’s already anticipated by other investors, and it is that which will move the market in the months ahead! To that end, bonds have already “baked in” quite a few assumed hikes by selling off last month to provide the higher yields offered now. While higher rates are undoubtedly a positive for bond investors in the long run, there’s some short-term pain for those focused on the capital appreciation side of the ledger. For investors with investment horizons beyond the maturity dates of their bond portfolios, they’re better off with higher rates because bonds with lower rates will eventually roll into those higher yielding securities. It is important to remember that while bonds may only provide very modest income now, their diversification properties relative to stocks is especially valuable. Case in point – both bonds and stocks were impacted last month by rising inflation and the prospect for higher rates, but bond losses paled in comparison to equity losses.

Summary

While painful in the near term, market downturns and volatility are part of investing, just as winds and waves are part of sailing on the high seas. While the S&P 500 Index rose more than 14% annualized in the 10 years through 2021, this was a period in which there were 14 drawdowns of at least 5% (historically, there are 3-4 of these per year on average). Four of those drawdowns were greater than 10%. As investors, we can’t control financial markets, but we can control how we construct our portfolios and how we react. Preparing for the waves and riding out the storms is usually the best course of action. As such, our Investment Committee will continue to focus on highly profitable, cash-generative firms with sturdy balance sheets and a track record of paying and/or growing dividends that have historically weathered these types of environments.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at www.jnba.com/disclosure.