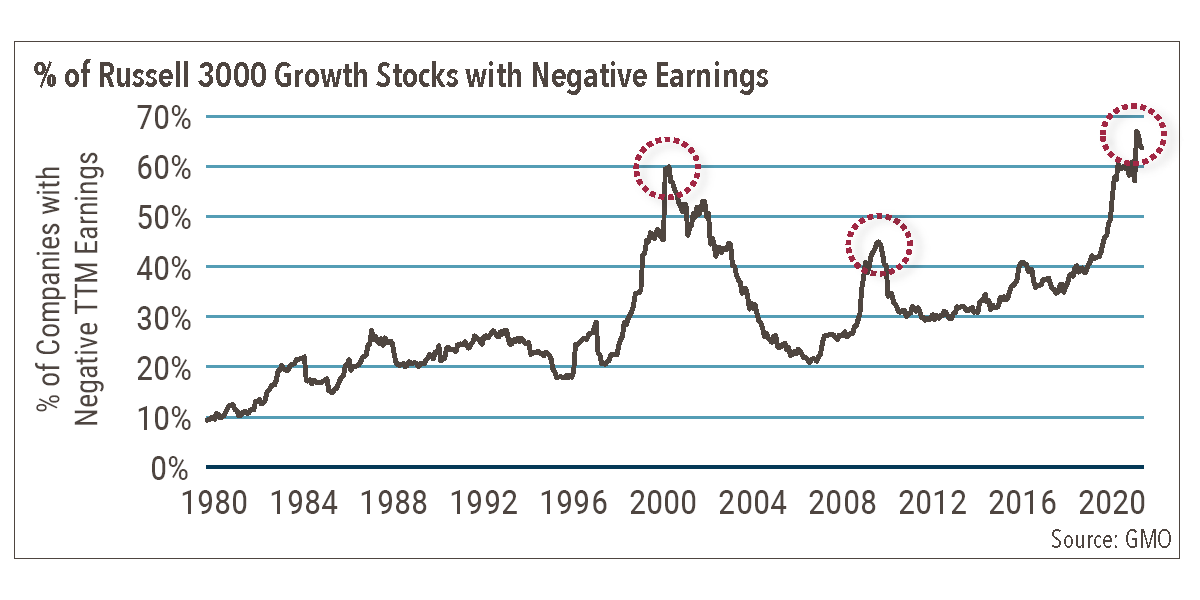

Despite ongoing supply chain problems and an acceleration in inflation that briefly gave investors the jitters in September, markets have quickly rebounded back to near all-time highs with sentiment remaining ebullient as we head into the seasonally strong holiday period. Third quarter earnings results have given investors much to be optimistic about in our view, as market-beating earnings growth has kept relative valuations in check (more than four out of five companies exceeded profit estimates in Q3). Corporate profit margins remain near record levels as companies have taken advantage of strong demand to pass through higher input costs to consumers. On the business front, a recovery in capital investments and improvements in workforce productivity are giving companies optimism that long-term growth will remain sustainable. Together, the combination of a robust global economic recovery alongside negative real interest rates (thanks to abundant monetary accommodation by the world’s central banks) has spurred investors to chase a variety of more speculative risk assets (see chart below) as they second-guess the wisdom of holding cash.

As such, global stock markets have surged this year and are just shy of all-time highs. Despite extended valuations in most asset classes, we are confident that investors will be best served by building a diversified portfolio and rebalancing in a disciplined fashion to maintain their risk profiles. Although financial markets now appear to have penciled in at least two interest rate hikes in 2022, we believe the Fed’s future monetary stance will remain highly accommodative and expect inflation to be more of a tailwind for stocks as long as the labor market continues to tighten and household balance sheets remain strong. Until corporate profits, interest rates, or consumer sentiment are adversely impacted by rising price levels, we do not see inflation as a major headwind for stocks.

As we turn our gaze towards next year, we will be closely watching certain areas that could cause angst among investors, including: faster than anticipated monetary tightening in the face of higher inflation; the potential for higher corporate taxes; the federal debt limit being challenged; slowing GDP growth in China; the transition to clean energy; and cybersecurity risks. Potential reasons for optimism, however, are much longer term in nature. Some of these reasons for optimism include a multi-year infrastructure spending bill, accelerated adoption of technology, as well as biological breakthroughs regarding COVID-19 vaccine boosters and highly effective anti-viral pills.

While poring over the globe for attractively priced risk assets, we continue to find opportunities in both international stocks and real assets. In the unlikely chance that the recent uptick in inflation proves to be long-lasting, we view real estate and senior secured bank loans, whose rents and coupon payments can rise with inflation and interest rates, as strong inflation hedge instruments. Lastly, the JNBA Investment Committee is becoming more bullish on the outlook for small-cap, cyclical value, and emerging market stocks as we approach the end of the year given their relatively lower valuations, sensitivity to rising inflation, and solid GDP growth.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosures information at www.jnba.com/disclosure