The American Rescue Plan Act of 2021 revamped the dependent child tax credit in many ways. It allows for advanced payments of the child credit, raised the child credit amount, and increased the amount of the credit that is refundable.

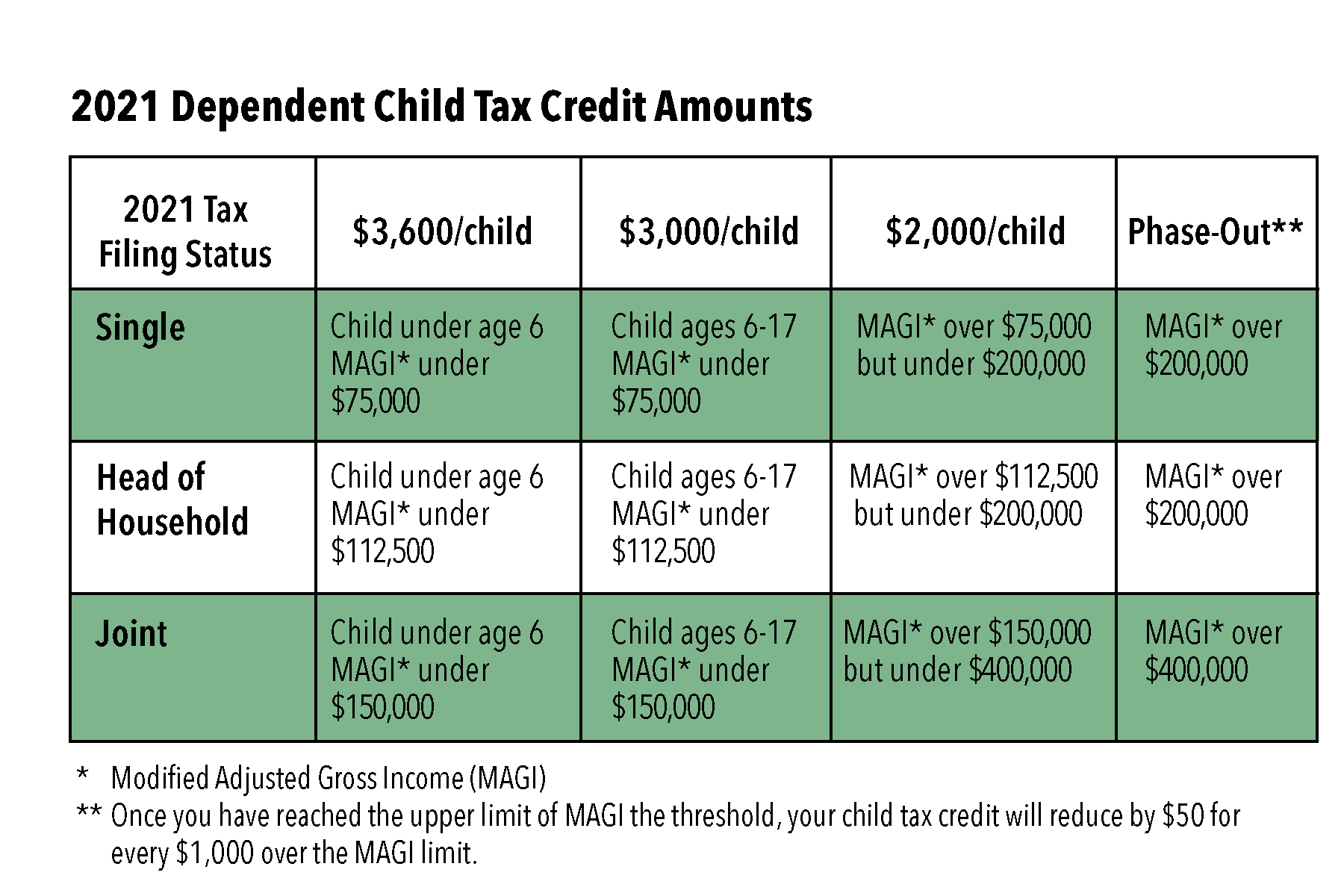

In 2021, families with dependent children who are claimed on their most recently filed tax return are eligible to receive advanced payments as well as a year-end tax credit. For families with children under the age of 6, payments increased from $2,000 to $3,600, while children up to age 17 saw an increase of $1,000 – from $2,000 to $3,000. In July 2021, the IRS began direct depositing funds or issuing checks to families with dependents in 2020. Payments are issued on the 15th of each month and can be for as much as $300/month per dependent.

If you had a child in 2021, you can update your dependent status using the Child Tax Credit Update Portal on the IRS’s website. By doing so, you will receive advanced payments for the remainder of 2021. If you choose not to update your dependent status, you will receive the tax credit when you file your 2021 taxes.

Ahead of year end, we encourage you to review your eligibility for the child tax credit and consult with your accountant to avoid any surprises come tax filing time. Please see the table below for tax credit guidelines. If you need to opt out of future payments, you can visit the IRS’s Child Tax Credit Update Portal to update your payments. To opt out on time for a December payment, please change your payment status by November 29, 2021.

Currently, the expanded child tax credits are set to revert back to 2020 amounts at the end of 2021. Proposed legislation in the American Families Plan would extend the 2021 tax credit amounts through the year 2025, but nothing has been finalized as of the time of publication of this article.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at www.jnba.com/disclosure