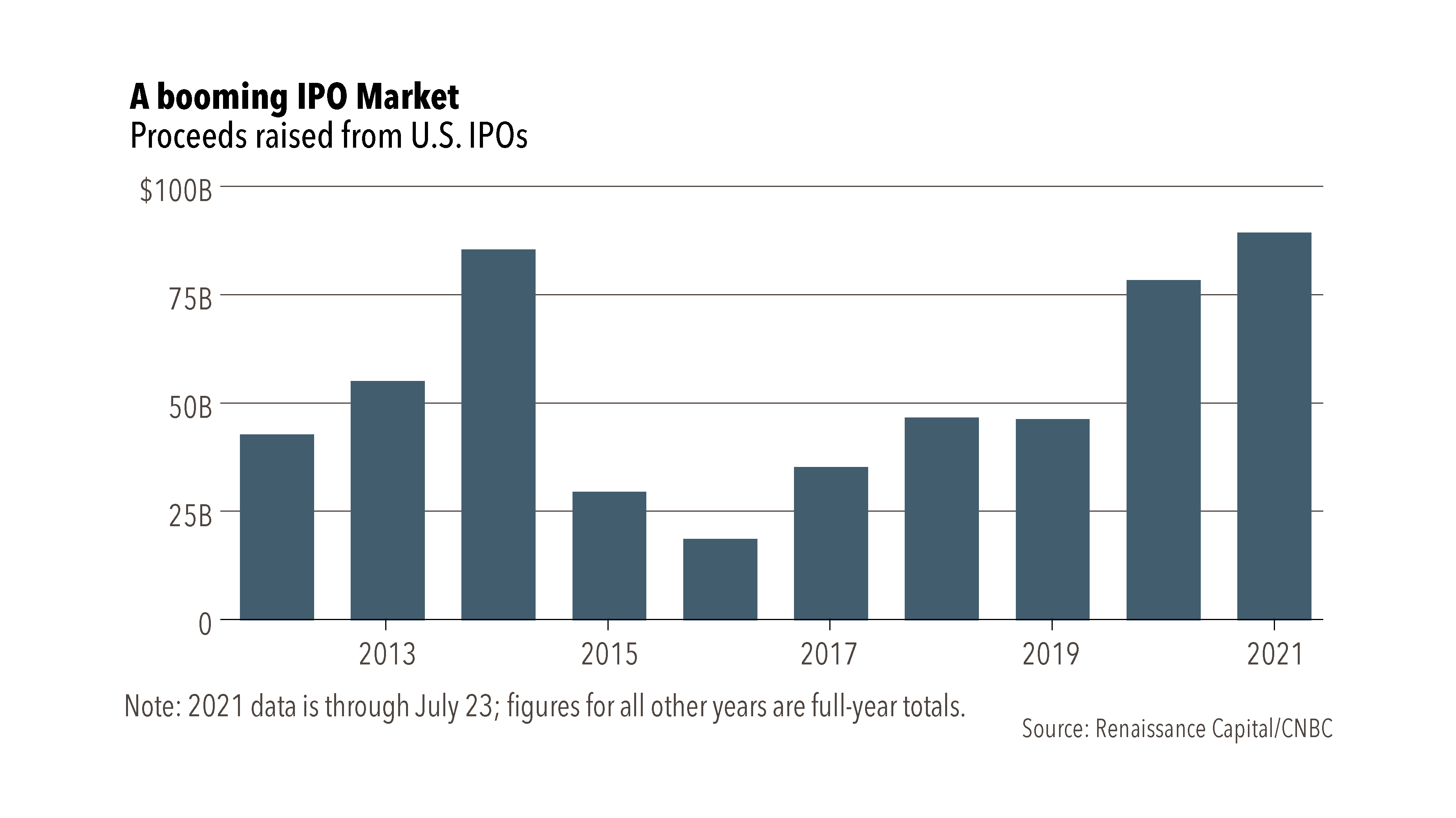

Having doubled off its March 2020 lows, the S&P 500 has continued to set several new record highs this year, and it has now been around 10 months since the last 5% correction. Investors remain enamored with strong quarterly profits, which continue to beat estimates. Meanwhile, companies are taking advantage of the strong enthusiasm for stocks by selling a record number of shares to the public (see chart). However, we (and many financial market professionals) remain a bit perplexed by the lack of volatility given the multitude of underlying concerns, whether it’s peak GDP growth, a transitory (but large) spike in inflation, fading fiscal stimulus, extreme unrest in Afghanistan, and worries about the Delta variant’s impact on the supply side of the global economy. Even as economic growth forecasts have largely normalized, and companies fret about the impact of rising input costs and labor shortages on abnormally high profit margins, we remain overweight stocks. For the moment, the JNBA Investment Committee believes that valuations are largely supported by corporate bullishness around the strength of demand and the widespread ability of most firms to use their strong balance sheets to capitalize on opportunities.

In addition, we believe much of the current bullishness for stocks has just as much to do with the extremely low yields offered by most fixed income securities. “There is No Alternative,” or TINA as many investors would say, when observing over $16 trillion of negative yielding debt globally. While that might be true for the moment, we remain confident that investors will be best served by building a diversified portfolio across a wide array of asset classes. Moreover, there are always opportunities to add value as the market churns under the surface. For instance, we have recently pulled back on small-cap stocks following our overweight decision from Q2 of last year and believe international stocks and mid-cap value stocks may now offer a chance to play some relative catch-up in the years ahead. While we think September could usher in a period of more relative calm on the labor front as inflation worries ease and commodity prices continue to pull back, we also know the Fed is close to tapering their bond purchases which could send rates higher. As a result, we continue to favor various inflation hedges. This includes real estate, commodities/materials, and gold – but also floating rate notes, as we think low default rates present a unique opportunity for bond investors to earn some additional yield without taking undue risk.

Lastly, even as stock valuations appear to be resting at the upper band of their historical range, we believe the Fed is willing to tolerate above-average inflation over the near term and are not expecting a rate hike in 2022. With monetary policy remaining dovish, we believe corporate profits will continue to grow with improving U.S. labor force dynamics and the potential for higher vaccination rates. As such, the JNBA Investment Committee remains overweight stocks while keeping a close eye on the global growth outlook which will increasingly depend on the shape of the pandemic in the months ahead.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosures information at www.jnba.com/disclosure