As we continue our series on the value that financial advisors provide to individuals and families, we’d like to explore various advantages of withdrawal strategies. As wealth is accumulated and you start to plan to live on the money you have saved over your working years, there can be tremendous value in a well-defined and structured withdrawal strategy that is optimized to minimize taxes.

Many people approaching retirement wonder how they will start withdrawing funds from their portfolio. After years of saving, it can be hard to imagine turning your paycheck off and starting to take distributions from your portfolio. Often individuals or couples will try to set cash aside to cover upcoming expenses so they do not need to touch their portfolio. At JNBA, we see it as our fiduciary obligation to help ensure you withdraw funds in the most efficient way possible to reduce taxes while staying mindful of your overall asset allocation.

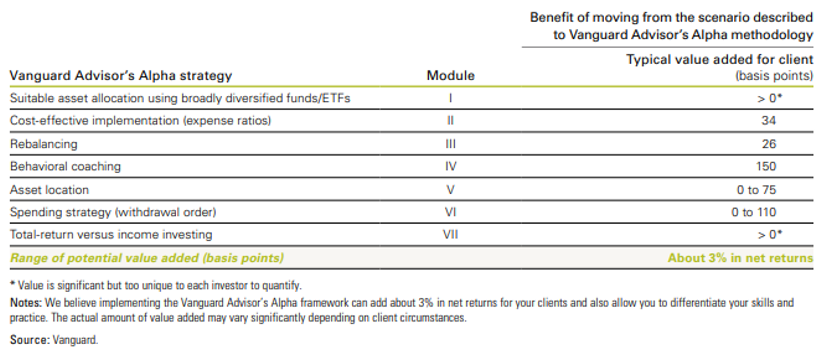

When an individual is still working, it is in their best interest to save money into different “tax buckets” so they have tax diversification – in other words, some pre-tax money, some after-tax money, and some tax-free money available to them in retirement. This might include saving in a Roth 401(k), Traditional IRA, and a taxable brokerage account. By having access to all three tax buckets in retirement, you will have created better opportunities to manage the tax liability generated by withdrawing funds from your portfolio. In a study conducted by Vanguard, researchers found that an advisor can add up to 1.1% of additional value just by helping clients develop a tax-efficient spending strategy from their portfolios.

Typical amount of value added using best practices

For retirees, it will be important to determine from which accounts you should spend first. Individuals over age 72 are required to take a minimum distribution (known as an RMD) from tax-deferred accounts such as a 401(k) or Traditional IRA. If you fall into this category, you will want to withdraw funds to satisfy your RMD first before looking to make distributions from your other accounts. If you are under the age of 72, it is likely better to spend from your taxable accounts first due to the less advantageous tax treatment on pre-tax IRAs. Distributions from tax-deferred accounts (such as a 401(k) or Traditional IRA) are taxed at ordinary income rates. On the other hand, distributions from taxable accounts are not considered income, so investors pay capital gains tax (currently lower than ordinary income tax) on any realized gains to generate the cash needed for a distribution. Paying more income tax now and reducing the amount of tax-deferred growth over time could have a negative impact on the portfolio and result in fewer funds available later in retirement to meet goals such as long-term care expenses, gifting, or leaving a legacy.

For investors who anticipate they will be in a higher marginal tax bracket in the future, it may make more sense to withdraw from tax-deferred accounts early in retirement. This may be the case for individuals who retire in their early 60s (or sooner) and anticipate higher income in future years due to their social security income and RMDs. In this scenario, an investor has a handful of years where they may find themselves in a relatively low tax bracket. During this time, they could explore accelerated IRA distributions or Roth conversions to take advantage of paying ordinary income tax at a lower rate on their tax-deferred accounts. A knowledgeable advisor can help these investors analyze the benefits of deferring Social Security to extend the length of this low-tax period known as a “golden window.”

Ideally, an individual would not spend from their tax-free (Roth) accounts until all taxable accounts have been depleted. Tax-free accounts are the most tax advantaged given you do not pay tax on either the growth of the assets or distributions from the account.

As you can see, there are many variables to consider when optimizing your personal withdrawal strategy. Each client situation is unique given the potential for different income sources (pension, rental income, etc.) in retirement as well as differences in portfolio construction. In the years leading up to retirement, a true financial advocate will work closely with their clients’ tax professional to optimize tax strategy with the ultimate goal of paying the least amount of taxes over the “golden window.” Of course, the ongoing conversation and review become even more important as an individual’s goals, cash needs, and tax laws continue to evolve and change over time.

If you are approaching retirement and wondering how best to withdraw funds from your portfolio in a tax-efficient manner, we encourage you to contact JNBA and speak with a member of our advisory team.

As we continue our “The Value of an Advisor” series, we will share more about how best practices addressed in industry research can support individuals’ and families’ long-term financial outcomes.

Sources:

https://www.vanguard.com/pdf/ISGQVAA.pdf

JNBA is not an accountant and no portion of the above should be construed as accounting advice. All accounting issues should be addressed with an accounting professional of your choosing.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at www.jnba.com/disclosure