At JNBA, we are big believers in the value an advisor can provide to clients. A trusted relationship can produce a rewarding experience and long-term mutual benefits for investors and their advisors and advocates. As we continue our blog series on “The Value of an Advisor,” which highlights what research states are some of the biggest potential benefits investors can realize when they have a skilled advisor in their corner, today we take a closer look at the value a financial advisor can bring to constructing and managing a portfolio.

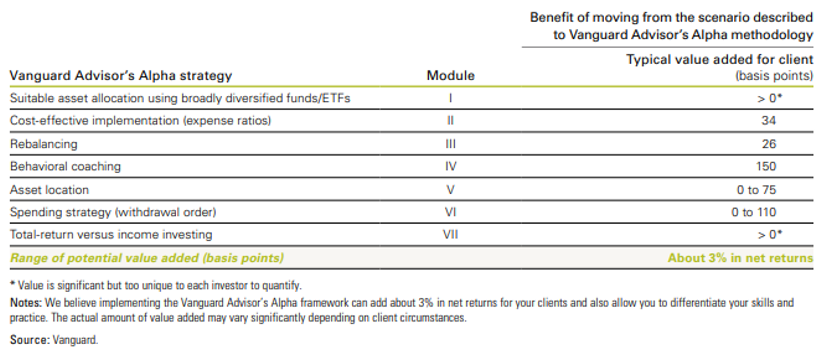

Managing a portfolio by following best practices can potentially add over 75 basis points (bps) or 0.75% of annual value when compared with an investment strategy that is not actively tax managed, according to research by Vanguard. Additional returns of another 50+ bps or 0.50%+ might also be achieved, often with lower risk as well, by emphasizing low-cost investments and deploying systematic rebalancing (see Figure 1). Like any estimate, the actual amount of value added may differ based on one’s individual situation, but it is difficult to disagree with Benjamin Franklin’s words of wisdom that, “in this world nothing can be said to be certain, except death and taxes.”

In our experience, most financial advisors too often focus on the pre-tax performance of client portfolios despite the likelihood that after-tax performance will differ substantially. Below, we explore the potential after-tax benefits that can be achieved by using a highly informed, tax-managed approach to investing that centers around best practices.

Typical amount of value added using best practices

Cost-Effective Investments

First, we believe that appropriate asset allocation using both low cost and broadly diversified mutual funds and exchange traded funds (ETFs) offer investors the best opportunity to achieve higher returns with less risk. To achieve this end, we leverage the size of JNBA in purchasing what are known as institutional mutual fund share classes; these are typically the lowest cost share class (which most individuals of modest wealth cannot qualify for on their own) and can often be >25 bps less expensive than other retail share classes. ETFs are also usually low cost and offer cheap exposure to market beta which is important since asset class selection is responsible for the bulk of investor returns.

After determining a proper mix of investments to construct the asset allocation, which will maximize a client’s chance for achieving their desired financial outcome and minimize risk, we move on to assessing the tax impact of placing different securities in different investment accounts (taxable brokerage accounts, individual retirement accounts, and Roth IRAs). In our industry’s parlance, this is known as Asset Location.

Asset Location

Many, if not most, actively managed investment strategies tend to be tax inefficient – negating any gains from their outperformance when held in taxable accounts – so we prefer to hold these in tax-advantaged qualified accounts such as 401(k) plans and IRAs. This frees up valuable capacity or “space” in taxable accounts for more tax-efficient investments including ETFs as well as individual stocks (especially ones that do not pay dividends). For very wealthy investors that might be able to pass along some of their wealth, there is a benefit upon death known as the step-up in cost basis, so holding growth-oriented vehicles in taxable accounts can maximize one’s terminal wealth if given a long enough timeframe for the power of compounding to take hold.

Our advisors are intimately familiar with the asset location process and can help a client understand the unique interplay between holding various assets in accounts with different tax treatment. For instance, taxable bonds have historically outperformed municipal bonds by over 100 bps per year, but this only proves to be valuable if the income can be sheltered in a tax-advantaged account for better after-tax results. For example, an investor in a high-income tax bracket might eschew owning municipal bonds in their taxable account and hold their entire fixed income position in their IRA in order to capture this return differential and free up valuable capacity to own more stocks in taxable accounts. In fact, studies by Vanguard suggest up to an additional 75 bps of performance may be realized by investors properly using asset location principles. The study also conveys that the benefits of asset location are greatest for clients with multiple account types and some degree of exposure to fixed income. In our view, this makes sense since bond returns are generally taxed at higher rates than stocks, and tax alpha impacts outcomes more for lower returning bond portfolios.

Tax Optimization

In our experience, taxes are an important consideration for most, if not all, clients. After all, clients only get to keep, spend, or bequest net returns, so the focus of wealth management should be to attain the highest return after taxes. In fact, during periods where future investment returns might turn out to be more modest and tax rates could reset to higher levels, investors embracing tax-efficient portfolio construction could realize their goals faster. We employ many “tax levers” on behalf of our clients, which can add up to 25 bps of additional returns, which might include:

- Defer the realization of capital gains, which amounts to an interest-free loan from the IRS, compared with a strategy in which capital gains are taken periodically.

- Manage the holding period to avoid short-term capital gains. For instance, a winning investment might be taxed at 35% instead of just 15% if an investor sells too early.

- Harvest losses, an active tax management strategy that realizes negative capital gains. This allows an investor to offset capital gains realized elsewhere in the portfolio to minimize current or future tax obligations.

- Additional tax management techniques include avoiding wash sales, tilting away from dividend paying stocks in taxable accounts, and paying attention to individual tax lots.

Systematic Portfolio Rebalancing

Unlike the aforementioned advantages, the primary benefit of regular portfolio rebalancing is that it helps control risk by reducing portfolio volatility, even though it can also enhance returns. After the 2008 financial crisis challenged the retirement plans of most Americans, many investors discovered there is material value of advice in reducing wealth volatility over time. While studies estimate an investor utilizing systematic portfolio rebalancing can perhaps add 25 bps of additional return, the real benefit is often peace of mind gained from knowing their advisor is attempting to perpetuate the wealth that was created by promoting financial stability over time.

To that end, JNBA undertakes a thorough review of portfolios every 10 business days through an active oversight process to ensure that we can take advantage of the cyclicality of performance trends across asset classes. When left to their own devices, many investors ignore asset class deviations and focus on the more interesting but less productive exercise of analyzing individual investments. We have a well-defined protocol for systematic rebalancing of client portfolios because over our 40+ years of being in business, we have learned the primary benefits of diversification come from mitigating unintended exposure to asset classes. Reallocating to less volatile asset classes not only reduces overall portfolio volatility, but also removes much of the harmful emotions from investor decision-making.

Over the next few months in our “The Value of an Advisor” series, we will continue to share how best practices addressed in industry research work to support clients’ long-term financial outcomes.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at www.jnba.com/disclosure