The value investors receive when they partner with a financial advisor who is looking out for their best interests cannot be understated. The JNBA team believes deeply in bringing value to each of our client relationships and interactions, and we’ve spent the past 40 years working to make sure our clients get the most out of our relationship. That means providing value around everything from ongoing coaching and guidance to portfolio construction to tax efficiencies and much more. Sometimes people are surprised to learn the many different areas in which an advisor can provide value. That’s why today, we are kicking off a series of blog posts highlighting some of the biggest benefits investors can potentially realize when they have a skilled advisor in their corner.

The value of comprehensive and holistic financial life advice has always been difficult to define in pure technical terms, especially when the practice of “wealth management” doesn’t mean the same thing from advisor to advisor.

Many investors appreciate working with an advisor for the comprehensive and customized planning that stems from having an intimate professional relationship and the 360-degree view of their finances it provides. However, there isn’t always a quantifiable way to measure investor success. Fortunately, a few critical studies that attempt to calculate the value of advice in real dollars have gained traction. While the metrics vary from study to study, there are a few core concepts that, when applied, add real measurable wealth over the long term.

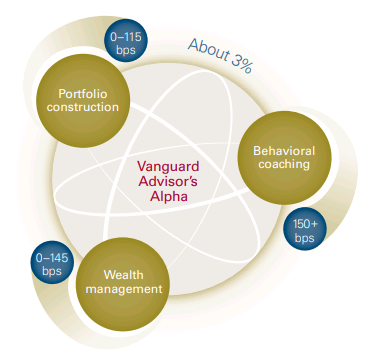

For instance, Vanguard estimates that advisors can add “about 3%” to clients’ net returns through a concept called Advisor Alpha (see image below). Meanwhile, Morningstar uses the term Gamma to describe how it measures the additional expected retirement income achieved by an individual investor who leverages a wealth advisor to make informed and experience based financial decisions at every step. Notably, Morningstar estimates a retiree can generate 29% more income by working closely with an advisor to focus on following best practices in five core financial planning areas.

Source: http://static.twentyoverten.com/the-added-value-of-financial-advisors.1465329922518.pdf

Investment Management

We at JNBA have created a disciplined process and approach to investments over our 40-year history, which we’re proud to see reinforced by our consistent client retention rate. The studies support our experience that an advisor’s ability to implement cost-effective investments, optimize asset location within a portfolio, rebalance actively, and provide guidance on a withdrawal strategy can boost returns substantially for clients.

By harnessing broadly diversified and cost-effective investments such as exchange-traded funds (ETFs) and mutual funds with low-cost institutional share classes in client portfolios, we are able to achieve the allocation we desire while still using top fund managers and keeping costs low. This creates potential opportunity for greater returns within the client’s portfolio.

We work diligently optimizing the tax efficiency of client portfolios through asset location, not just asset allocation. For example, after we determine the ideal allocation between equity and fixed income, we consider what type of funds to hold within each of a client’s accounts. From a tax perspective, it may be more efficient to hold certain funds (e.g., growth stocks, dividend payers, municipal bonds, real estate, etc.) in a taxable account or a retirement account.

The backbone of our investment strategy at JNBA is active oversight of portfolios. We review client portfolios every 10 business days through a rigorous dual approval process by leveraging our investment committee and industry leading portfolio software. This helps us find opportunities to buy low and sell high throughout the year and historically has helped reduce risk and increase return for our clients.

Financial Life Planning

As our clients’ trusted financial partner and advocate, we have the privilege of being part of all aspects of their financial lives. This allows us the ability to view their finances and future plans from a comprehensive viewpoint. For example, as individuals approach retirement, they often ask us how they will start to pull money from their portfolio instead of receiving a paycheck from their employer. Our job is to incorporate all sources of income and help develop a spending strategy that allows clients to withdraw from their portfolios in the most tax-efficient manner possible. This may include Accelerated IRA distributions or Roth Conversions when the client is retired in their 60s but before they claim Social Security or are required to take a minimum distribution (RMD) from their IRA. We look for opportunities to maximize lower tax brackets for the client and to build out a withdrawal strategy that supports that goal.

In addition to a customized withdrawal strategy, we work with clients to develop a plan and understand the likelihood that a portfolio will survive based on the expected longevity of the investor. A study in 2011 by Allianz Life revealed that the greatest fear among retirees is not death (39%) but rather outliving one’s resources (61%). In our role as a financial partner – and advocate – we help develop a conservative plan that has a high probability of success and help clients keep on track to achieving their goals and aspirations.

Another important part of our role as the advisor is to help clients stick to their financial plan. For many investors, the plan is logical and makes sense. However, emotions can get the best of them in a market downturn, and they may feel inclined to sell to cash. Our job is to help clients stay on track, stick to the plan, and weather the storm. A Vanguard study shows that advisors can help clients add 1.5% in returns over time by removing these emotional decisions.

In summary, all of these strategies serve to add and preserve wealth for investors, but the ultimate success is determined by an advisor’s ability to educate, coach, and advise clients on how to incorporate these core pieces of planning within their financial life plan and stand by their side until their goals are fully realized. Advisors play an important role when unfavorable markets cause investors anxiety. In a trusting relationship, good advisors step in to remind investors of their long-term goals and to point them toward the things they can control, including costs, diversification, and tax efficiency. This kind of behavioral coaching has proven to add wealth by protecting clients who would otherwise abandon an investment strategy in a down market or fail to take risk when it is most rewarded. Our experience has shown that most investors who ride out periods of volatility with an advisor’s coaching often see much higher returns in the long run.

Over the next few months, JNBA will specifically share how each individual best practice addressed in these critical studies works to support clients’ long-term financial outcomes, which ultimately produces a great investment experience for them and a rewarding experience for us as your trusted advisor and advocate.

Sources:

https://www.vanguard.com/pdf/ISGQVAA.pdf

https://www.morningstar.com/content/dam/marketing/shared/research/foundational/831611-GammaEfficientPortfolio.pdf

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at www.jnba.com/disclosure