We entered 2025 on a high note, with the S&P 500 at all-time highs following a post-election surge. The weak start to the year, accelerated by tariff policy uncertainty, was steadily erased, with stocks rallying from April lows to again reach new highs.

Despite the strong past performance backdrop, a challenging start to the year, and generally high expectations, corporate earnings continued to grow with U.S. Large-Cap profit margins at record highs. Meanwhile, inflation continued to ease, and unemployment rose modestly but remained near multi-decade lows. Elsewhere, international stocks outperformed U.S. companies, and the U.S. Aggregate Bond index rose over 7%, delivering strong returns for diversified portfolios.

While diversification is a bedrock of JNBA client portfolios, we’ve fielded concerns from clients as the market continues to reach new highs. The backdrop of a stellar three-year return has left no shortage of concerning headlines, and dramatic investments in AI fuel worries of overinvestment or “bubbles” emerging. While our quarterly commentary typically covers the broader equity, fixed income, and economic landscape, this quarter calls for a closer look at U.S. Large-Cap stocks.

While the largest companies in the world and their continued AI spending have received the bulk of investors’ attention, overall market returns beyond the tech sector have also performed very well.

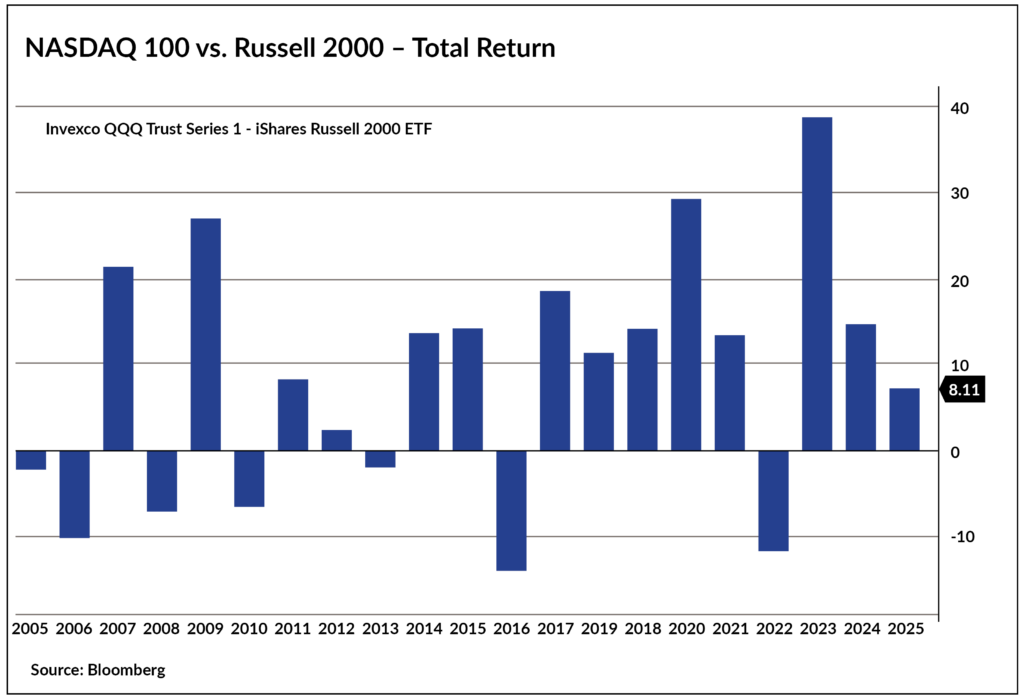

The chart below shows the gap between the annual performance of the tech-heavy NASDAQ-100 (as measured by the QQQ ETF) minus the performance of the Russell 2000 (as measured by the IWM ETF). Broadly, while big tech has outperformed several smaller companies, it’s quite narrow: Big tech has only outperformed small caps by ~8% this year.

In 2024, the story was the Magnificent Seven and investors’ reliance on a handful of tech giants, creating highly concentrated market performance. There’s a lot of reality to that, but in 2025, U.S. stocks delivered strong gains overall, even outside the companies leading the AI boom.

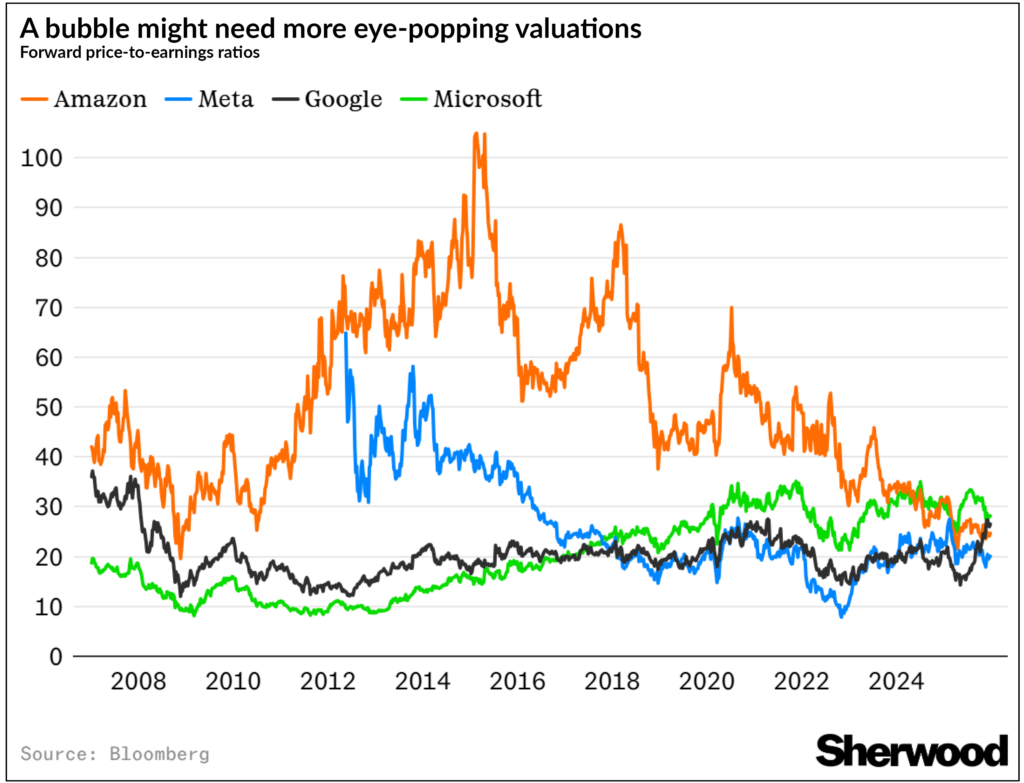

While AI names have been rewarded so far, it’s difficult to predict how the massive investment in all things AI will eventually play out. Investors must make judgements on extremely limited information during the early stages of actual AI deployment, and as the uses of the technology become more apparent, it may turn out their initial assessments were wrong. An overestimate of the future value, however, does not mean an eventual “bust” would be sure to follow. In context with the current environment, the largest companies fueling these concerns continue to trade at historically reasonable levels.

Ultimately, concerns for longer-term valuations boil down to the question of whether this massive capital expenditure will generate compelling returns on invested capital. While we won’t know the answer to this question for some time, the mere existence of this critical question will likely continue to hover over the markets in 2026.

The comparisons to the 1990s Tech Bubble may not be entirely applicable, either. One of the more remarkable things about the dotcom boom and bust was how rational it was in hindsight. The internet really was a dramatic technological innovation that altered the course of the world, but the early bets on the past legacy computer companies or unstable new internet ventures that eventually failed are a far cry from the small group of the largest companies in the world with reasonable justifications to spend hundreds of billions on AI.

Spending heavily to protect these already valuable, highly profitable, low-debt companies could be justified as an insurance policy — even if AI ultimately adds little new value. In September, Meta CEO Mark Zuckerberg summarized it well: “If we end up misspending a couple hundred billion dollars, I think that is going to be very unfortunate, obviously, but… I actually think the risk is higher on the other side.” He may be wrong in the end, but it’s not hard to see the logic from his seat helming a trillion-dollar company with a healthy balance sheet seeking new growth opportunities.

This is not a statement that AI investments will win out in the end. It’s likely there will be further bumps ahead, but there is a strong case for investors to respect the potential of technology and the rationale from those investing in it rather than dismiss it as a bubble due to rapid initial gains.

In the end, U.S. Large Caps represent just one of the sub-asset classes in our diversified portfolios, with a majority of equity investments outside of U.S. Large Caps. With improved performance from broader U.S. companies in Mid and Small Caps, strong outperformance from international stocks still trading at historically reasonable valuations, and a fixed income environment providing healthy yields and accommodative Fed policy, the outlook for diversified portfolios still provides opportunities for further growth.

While the 12-month market outlook may be top of mind, understanding the impacts on long-term performance and the benefits of diversification to dampen volatility are paramount to deliver on our clients’ long-term goals.

Based on the information available, solid corporate earnings, steadily rising but still low unemployment rates, and slowly easing inflation trends may provide a solid foundation for continued upside over the next 12 months. The diversification to have broader investment exposures for both 2026 and beyond, while not relying too much on any one asset class, could provide a needed, steadying influence amidst periods of heightened volatility. Flexibility remains vital as new data emerges, but we believe we are well positioned for potential weakness while still having ample exposure in the event of continued strength.

As your financial advisory team, we are here to help navigate your portfolio through whatever the markets bring and will stay focused on a long-term view to help keep you on the right path in achieving your goals.

As always, please reach out to your JNBA Advisory Team with any questions.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at jnba.com/disclosure