Nine months into the year and the story remains similar to the end of the second quarter (Q2). After a disruptive start to the year, the broader stock and bond environment has climbed steadily but surely, shaking off typical September weakness. The S&P 500 is up ~14% YTD and at all-time highs, creeping towards an average yearly performance, while small- and mid-cap U.S. equities have slightly lagged. International equities have seen some of the best performance of the last decade compared to the U.S., up ~20-25% YTD. This shift, driven in part by the U.S. dollar index declining more than 10% YTD, has created a healthy overall return for diversified equity portfolios. Coupled with steady fixed income performance up almost 6% YTD, overall performance YTD has been positive across our strategies.

The main drivers of U.S. equity performance remain similar to 2023 and 2024, with the largest companies growing at an above average pace driven by continued investment in Artificial Intelligence (AI). The Magnificent Seven concentration continues to drive overall returns, with some evidence of improved participation from the remaining 493 companies of the S&P 500.

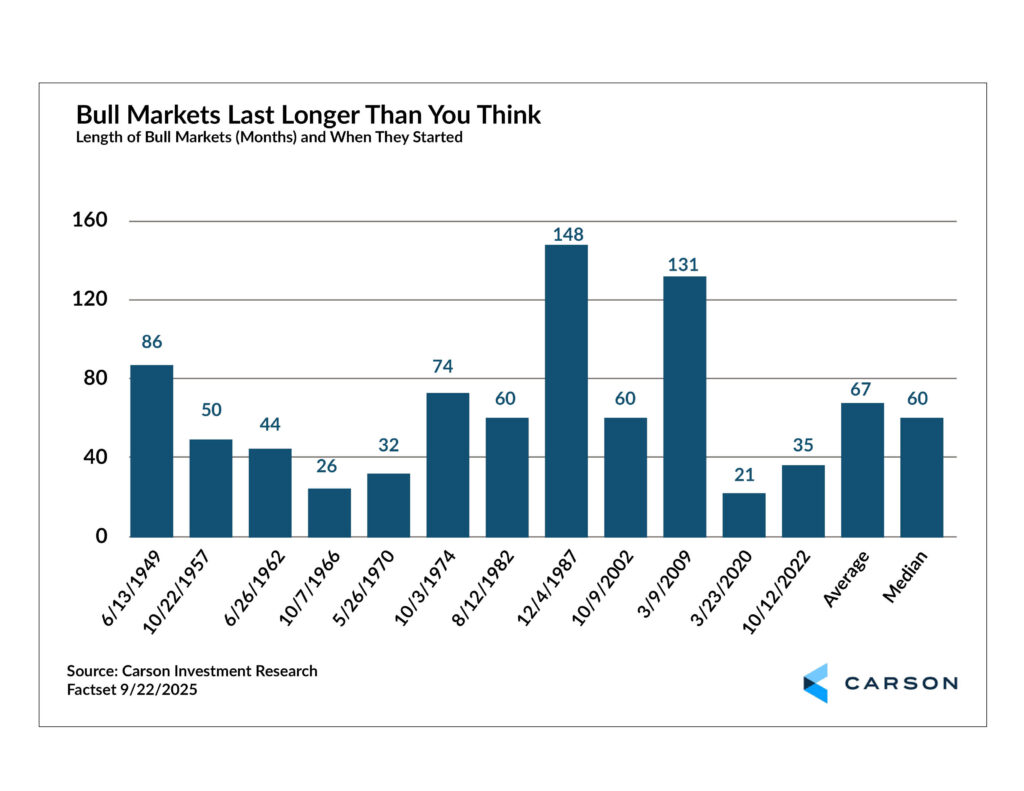

With markets once again at all-time highs and a steady climb from April lows, investors seem to be on edge, questioning sustainability. While the catalysts for this current bull market may be new as it approaches 36 months from late 2022, the overall length of positive performance remains well within range of typical bull market rallies.

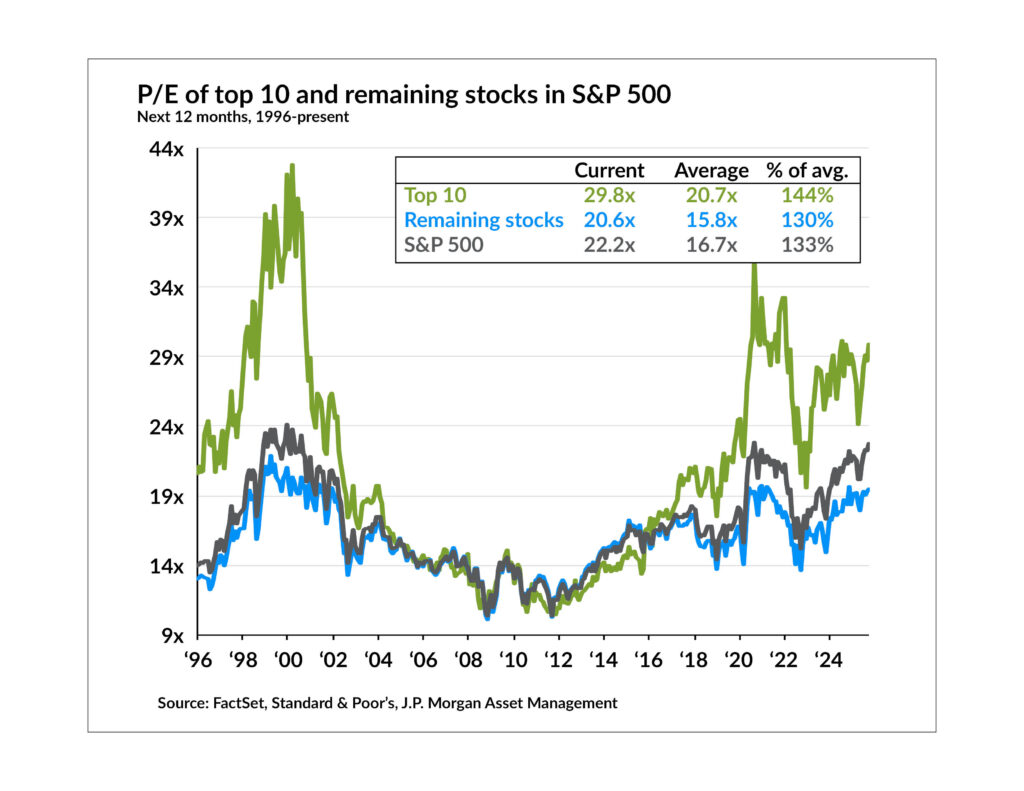

Those catalysts, namely the largest companies in the world still making up a large bulk of overall performance, continue to create an uncomfortable environment. It doesn’t take much searching to find comparisons to previous instances of extreme market concentration, namely the 2000s Tech Bubble.

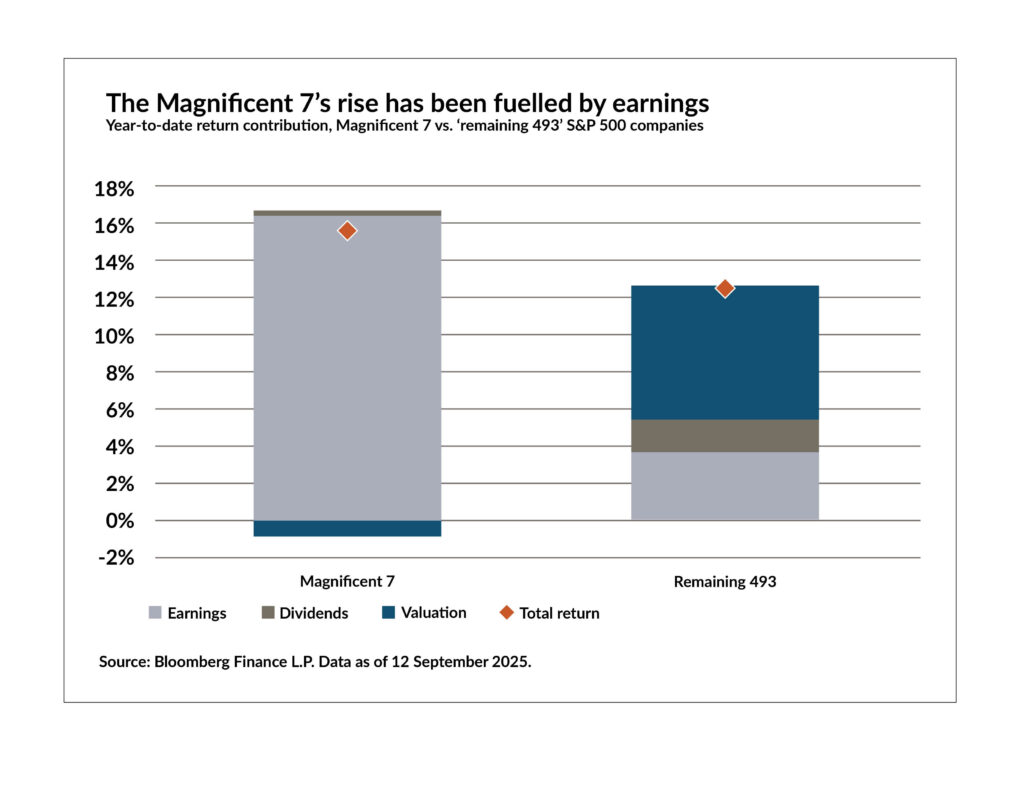

The famous last words for any investment: “This time is different” has many investors on high alert. While concentration in the past created challenging outcomes, it’s worth noting how different and unique the Magnificent Seven growth has been compared to past cycles.

The returns of the largest seven companies have primarily been a result of outsized earnings growth compared to the rest of the market and record profit margins, a trend that has continued since 2023.

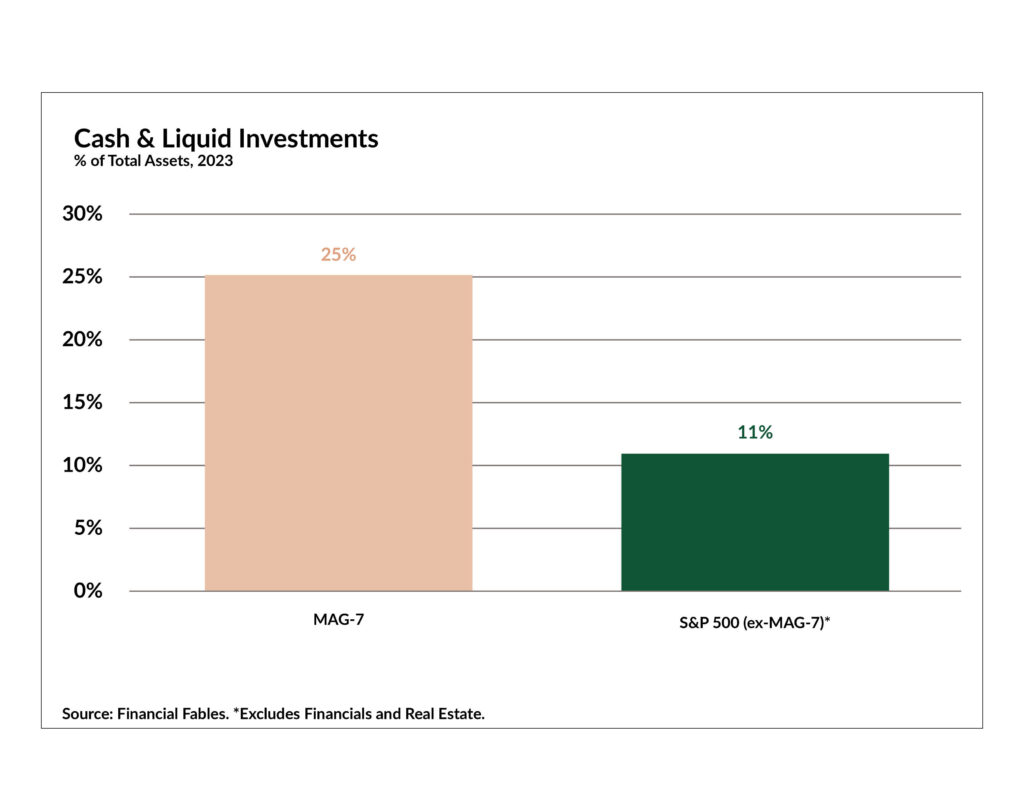

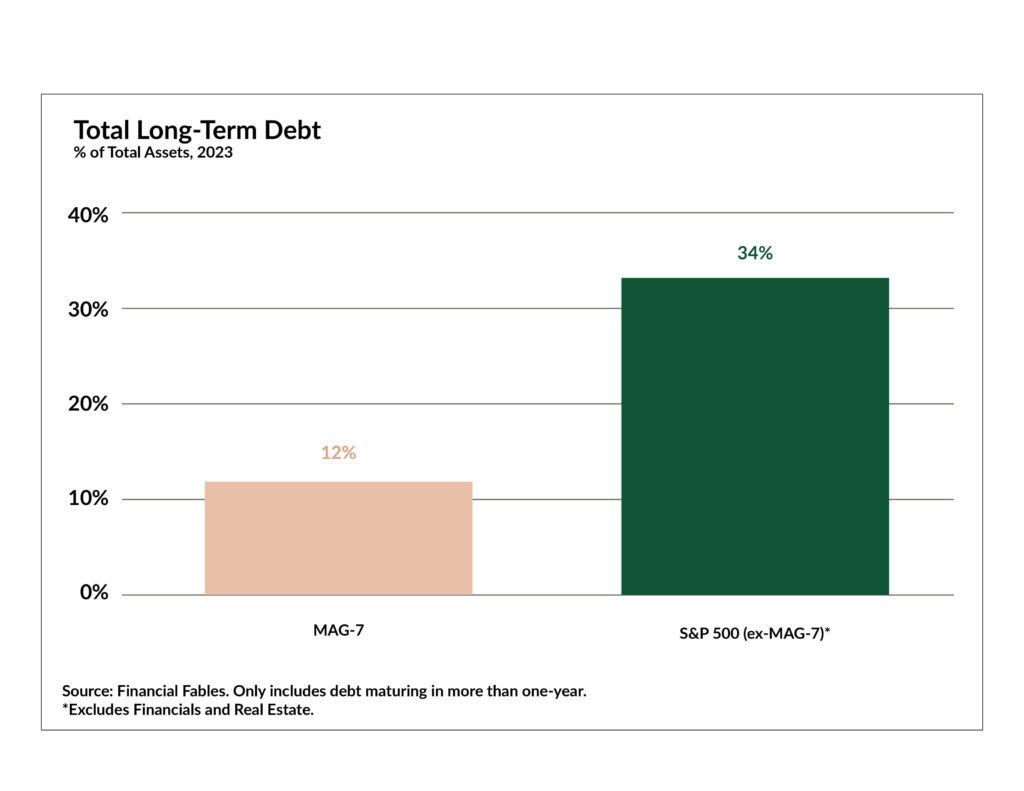

The Magnificent Seven also holds some of the healthiest balance sheets in the world, with most of their rapid investment in AI driven by cash on hand compared to previous debt-backed rallies.

While there are plenty of ways this latest rally may be different, the fact remains that for years now the U.S. stock market has been highly dependent on a small handful of companies, which can create uneasiness for how long it can last. While the stock market and the economy can often be at different stages, the two are strongly related over longer periods.

So, what is the health of the U.S. economy? The latest news on that front comes from the recent September Federal Reserve meeting, which saw the first policy rate cut of 2025. Fed Chair Jerome Powell appeared to push back somewhat on the idea that this is the start of a rate-cutting cycle, describing it instead as a “meeting by meeting situation.” Against this backdrop it seems unlikely that we’re going to get much forward guidance from here on out.

That said, the bias in this particular meeting was clearly on the labor side of the Fed’s dual mandate of maximum employment and stable prices. That makes a certain amount of sense given some recent data points, but it’s also interesting that the central bank’s Summary of Economic Projections (SEP) now sees lower unemployment for next year (down to 4.4% from 4.5% in the June SEP) and more persistent inflation (Personal Consumption Expenditures price index – PCE – at 2.6% instead of the 2.4% forecast in June). That might be one reason why Powell described the move as a preemptive “risk management cut,” saying that “what’s different now is that you see a very different picture of the risks to the labor market.”

The key word here is “risks.”

The risks to employment are tilted, said Powell, to the downside. The risks to inflation, he said, are tilted to the upside. This is a very difficult environment for any central bank to navigate. Add that with questions about Fed independence and that the central bank has been missing the inflation side of its mandate for years, this leaves the markets with a very tricky set of decisions in the months and meetings ahead.

Looking Ahead

The markets’ steady climb since the Liberation Day lows has been driven first by tariff reprieves and second by continued strong earnings growth. What to watch for the remainder of the year and going into 2026 is the extent to which the trends in unemployment and inflation data continue while corporate earnings continue to deliver. Both big “ifs,” but so far, corporations and broader economies have passed the test despite the bar slowing but surely rising.

As it stands today, the economy remains in pretty good shape. While growth is expected to slow, most investors do not see an imminent recession on the horizon. Stocks may be poised to trend higher through the end of the year, although a near-term pullback is possible. Longer-term risks remain, with narrowing leadership and a slowly eroding labor market.

While there are some potential near-term issues from unemployment, inflation, and earnings data, as well as the government shutdown, it is hard to see a sustained decline when growth is holding and the Fed is cutting rates. We would likely need to see higher sustained inflation expectations for the Fed to begin worrying about inflation over the labor market.

How this Impacts Portfolios Today

While the 12-month market outlook may be top of mind, understanding the impacts on long-term performance and the benefits of diversification to dampen volatility have proven valuable in 2025.

The diversification to have broader investment exposures while not relying too much on any one asset class could provide a needed, steadying influence amidst periods of heightened volatility. Staying flexible, having security to meet short-term needs, and remaining committed to a long-term strategy provides the best chances for success going forward.

As your financial advisory team, we are here to help navigate your portfolio through whatever the market brings. We remain focused on a long-term view to help keep you on the right path in achieving your goals.

As always, please reach out to your JNBA Advisory Team with any questions.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at jnba.com/disclosure