Market Update: Lay of the Land

With the U.S. Congress passing legislation to lift the government’s debt ceiling this week, it appears a large overhang to recent months has been removed, and the markets have already been focusing on other things. The continued area of attention is the familiar debate on future rate hikes. Pundits have been talking about a “pause” […]

Q2 Market Podcast: Feeling Comfortably Uncomfortable

From turmoil with regional banks to bonds and treasury bills providing higher-yield competition for stocks, one way to describe how many investors are feeling right now is “comfortably uncomfortable.” Negative investor sentiment as we started 2023 set the bar relatively low, and both stocks and bonds are performing better than expected. But market volatility continues. […]

Market Update: The Big Picture

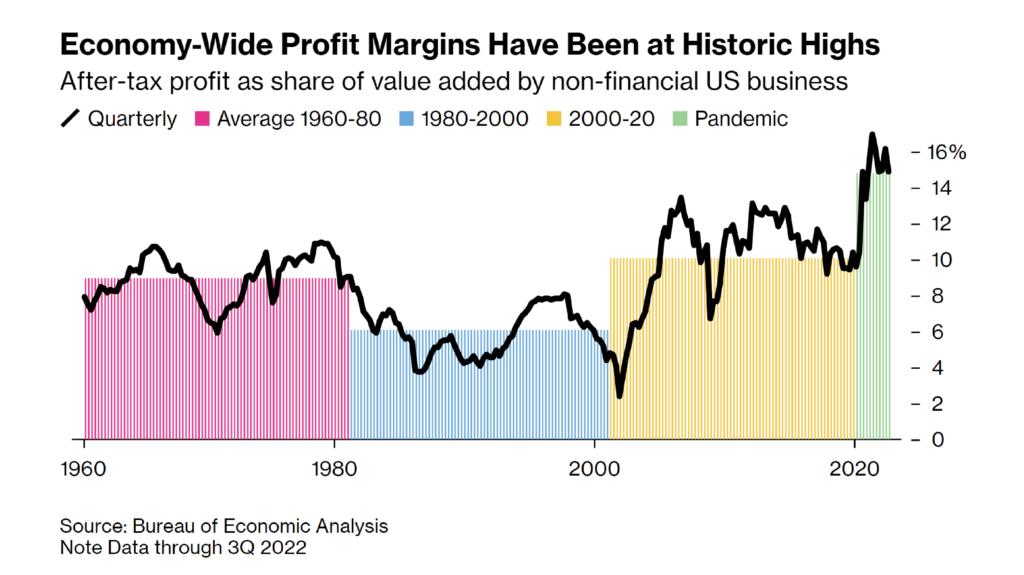

Over the last several years, the average investor has faced a historic wave of new factors to consider. The onset of the pandemic created constant ripples to monitor, from new case numbers, to mortality rates, quarantine lengths, government stimulus, vaccine developments and rates, consumer activity, wage growth, unemployment, inflation, Fed activity… the list goes on. […]

Market Update: Bank Failures in a Different Environment from 2008

Markets have been incredibly volatile recently with the Federal Reserve stepping in to protect both insured and uninsured depositors of Silicon Valley Bank and Signature Bank last weekend. With a duty to safeguard the stability of the banking system, the Fed took action to ensure depositors are made whole under the Federal Deposit Insurance Corporation […]

Q1 2023 Economic and Market Update

With stocks and bonds sputtering on the heels of a January that saw many financial assets claw back a large chunk of their 2022 losses, investors are starting to wonder about the speed with which inflation will subside and how Fed policy might alter the trajectory of economic growth. In recent weeks, investors have recalibrated […]

Podcast: Market Update: Out of the Woods?

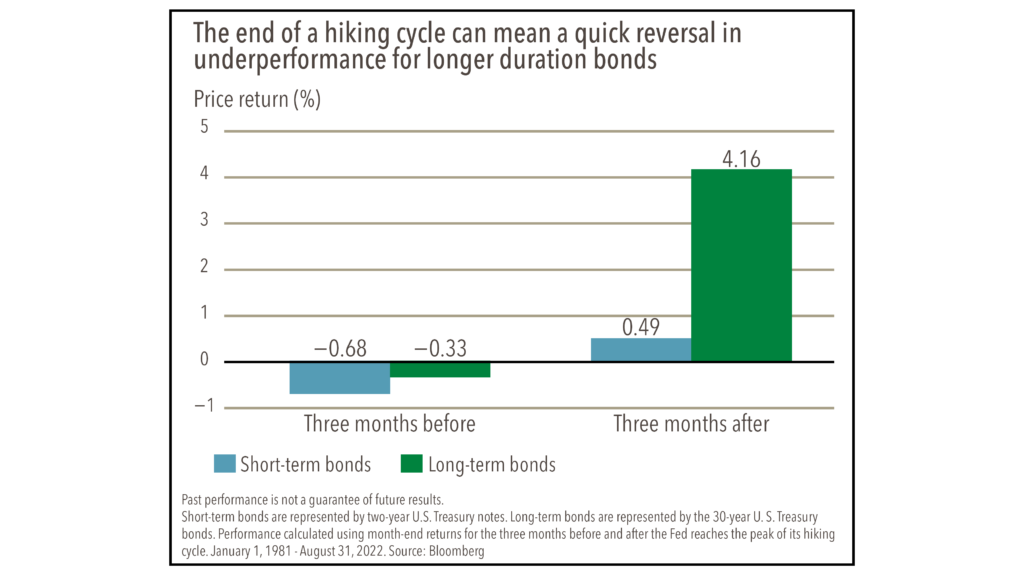

Just over a month into the new year, 2023 has provided investors with some long-sought good news. After a challenging 2022, both equities and bonds are off to a solid start, Europe and China are stimulating the global market, and the Fed may be coming close to the end of its tightening cycle. While this […]

The U.S. Debt Ceiling: What it Could Mean for the Markets

The Debt Ceiling is once again making front-page news, and investors are becoming increasingly anxious over what it means for their personal lives as well as their portfolios. In a nutshell, the JNBA Investment Committee believes the risk of the U.S. government defaulting on its debts is quite low. However, we acknowledge that the consequences of a […]

Investment Committee Video Discussion: What could 2022 mean for 2023 market performance?

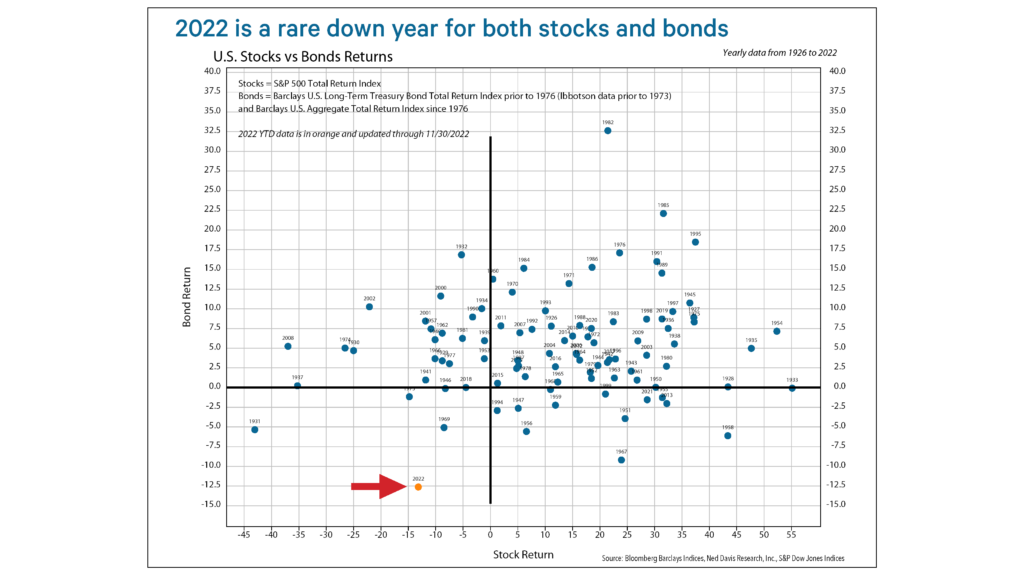

If we could summarize 2022’s market performance in one word, it would be “frustrating,” with negative returns across almost all asset classes, from equities to bonds. Inflation, relentless interest-rate hikes by the Fed, and supply chain distortions from the war in Ukraine and the pandemic all led to a perfect storm of uncertainty, volatility, and […]

How Interest Rate Increases in 2022 Could Set the Stage for 2023

In its eighth and final meeting of 2022 this week, the Federal Reserve increased rates by 50 basis points (bps). This deviates from four consecutive hikes of 75 bps thereby showing signs that moderating inflation has boosted confidence that higher interest rates are finally helping to slow global demand. In anticipation of more favorable news, […]

Q4 2022 Economic and Market Update

After investor pessimism reached extreme levels earlier this month and the market fell to a two-year low in intraday trading on October 12, equity sentiment has since reversed and stock markets have rallied rather sharply. At a high level, financial markets discount the future – and a lot of bad news had already been priced […]