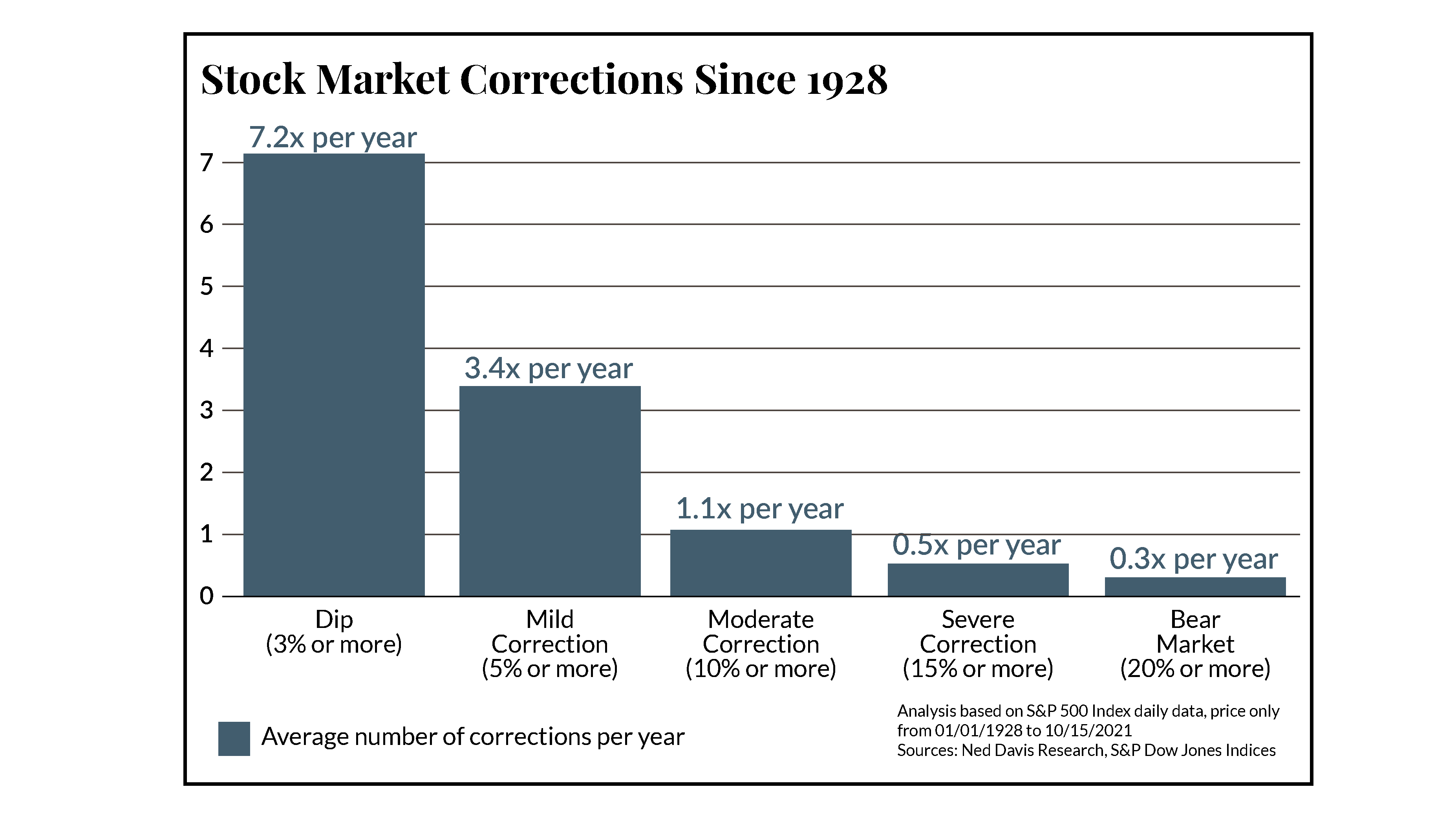

As the S&P 500 briefly dipped into bear market territory last week before rebounding, it became the last major index to breach the technical definition of a bear market, which is a fall of 20% or more from its all-time highs. Although not all markets move in unison, year-to-date returns still tell a mixed and primarily downbeat story: as of 5/20/22, global stock markets are lower by 17% (led to the downside by the S&P 500), and bonds are down 9%, while some of our preferred inflation hedges – gold and commodity producers – have produced positive returns. With bonds and stocks typically forming the foundation of most diversified portfolios, it has been a challenging year for investors who had started 2022 having just seen the S&P 500 rise 100% over the prior three calendar years.

Most of this year’s correction is due to falling valuation ratios, as opposed to declining earnings, which has given us a small measure of hope that companies may be better equipped than originally thought to navigate a plethora of “unprecedented” circumstances (e.g., inflation, war, supply chains, rising rates, etc.), so long as they don’t all pile on too quickly at once. The fresh worries fueling this year’s market slide is that as consumer demand starts to wane in the face of both a tightening central bank and higher inflation, corporate profit margins (which have remained near record levels) may start to falter. These fears are amplified in the absence of a safety net for investors, as abundant monetary and fiscal accommodation is being reversed, most evident in the rising interest rate structure underpinning this year’s bond market sell-off.

Presently, we are finding much better opportunities than we have in years with respect to valuations that sellers are willing to accept to part with assets that have long-term appeal. Case in point is that the S&P 500 is valued at 17X earnings, historically a good entry point, and international markets are much cheaper with price-to-earnings (P/E) ratios in the low teens. From an income perspective, many stocks offer 3%+ dividend yields, including most foreign developed and emerging markets, real estate investment trusts, select value stocks, and producers of natural resources including agricultural, energy, and metal products.

Amidst the carnage in fixed income markets, bond yields have largely doubled this year due to the falling prices, and offer much better entry points. Recent yield increases benefit long-term fixed income investors: the Bloomberg Barclays Aggregate Index now offers its second highest yield since 2012 at around 3.4%, and many corporate bonds are now yielding above 4%.

While it has been a difficult year for nearly all investors with few places to hide, we believe the JNBA Investment Committee’s decision this year to become a bit more defensive in January by reducing equity exposure, continuing to hold above-average levels of cash in portfolios, and focusing on broad diversification in areas out of favor (such as value and international stocks) have helped, and we are confident we have the flexibility to navigate any remaining turbulence this year.

As we have noted in our recent commentary, inflation may be in the process of peaking and is likely to decline over time given the strong dollar and central bank policy. We believe a sharp break in inflation could improve investor and consumer spirits, giving markets a respite from selling pressure. This would allow investor attention to shift back to attractive fundamentals including a healthy job market and higher quality earnings growth. With a valuation reset already having occurred in both stocks and bonds, it appears as though financial markets are penciling in a much higher probability of a recession, which creates opportunities for patient investors.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosure information at www.jnba.com/disclosure.