While global growth has somewhat subsided since the end of the year, the U.S. economy’s recovery remains on track, and expectations for another large U.S. spending bill have stoked anticipation for a strong rebound, lifting markets close to record levels. Importantly, corporate profit reports are coming in stronger than expected, and a second half economic recovery in the beleaguered services sector appears within sight now that vaccine distribution is steadily improving. With around 1.8 million shots administered each day and growing to help reduce hospitalizations and deaths from the virus, the JNBA Investment Committee expects the trend of vaccinations and infections to support employment and the economic recovery throughout 2021.

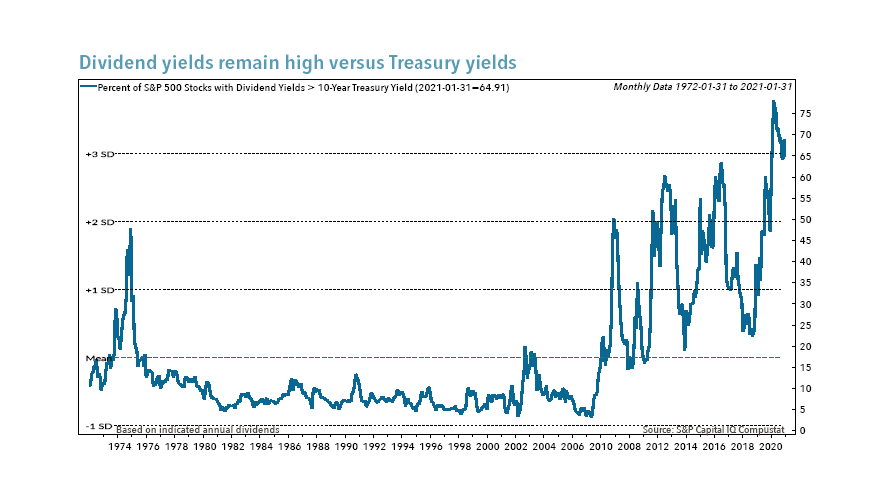

Given this backdrop, we believe a diversified approach to investing, combined with disciplined rebalancing to mitigate unintended risks, offers the best path to success in what has become a more challenging investment environment given stretched valuations. Though inflation remains low, we are concerned that bond investors have become too complacent; however, we are encouraged that rates have been rising over the last six months and now offer higher returns for investors. Given the scarcity of income, we would not be surprised to see dividends become more popular and a large driver of total returns over the next decade (see chart above).

While stocks appear to have priced in much of the good news with valuations at the high end of their historical range, the fundamentals in areas like value and international equities look appealing. Historically, cyclical value stocks have outperformed growth stocks coming out of a recession as economic activity accelerates and as the yield curve steepens, and we expect this time to be no different. International equities also often do well in cyclical upswings and receive support from a weakening U.S. dollar. Most commodities, such as oil, have recently performed well and many have recovered their losses of 2020, reflecting a rebound in demand in the face of lower inventories and supply constraints. While bond investors worry about rising inflation expectations, emerging markets and commodities should benefit from the reflation trade as we are big believers in their role in a diversified portfolio, both as a hedge and a way to make money.

So, while there are many things to worry about, including new strains of COVID-19 and potential vaccine-resistant mutations, rising interest rates, budgetary cuts at state and local governments, and bubble-like behavior among some new retail investors, markets have focused on profits and are performing about as expected. With ongoing progress in distributing the vaccine, we remain optimistic that earnings forecasts may be revised upward through 2021 as economic growth accelerates behind improving coronavirus case trends and additional fiscal stimulus. As the unemployment rate continues to tick lower and life “gets back to a new normal,” we would expect some of the high consumer savings rate to fuel future spending, including pent-up demand for travel and leisure as well as areas that are already doing well such as autos and housing. While this could lead to a buildup in inflationary pressures, we see this as temporary and are encouraged that global central banks are committed to following a “lower for longer” policy approach to managing interest rates until the labor market is back to pre-pandemic levels.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from JNBA Financial Advisors, LLC.

Please see important disclosures information at www.jnba.com/disclosure